Construction employment increased by 26,000 jobs in September to a total of 7,245,000, but the gains were concentrated in housing, while employment in the infrastructure and nonresidential building construction sector remained little changed, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the pandemic was prompting strong demand for new housing as more Americans work from home, while undermining private-sector development of office, retail and other types of projects and forcing many local and state governments to cut construction budgets.

“Construction is becoming steadily more split between a robust residential component and generally stagnant private nonresidential and public construction activity,” said Ken Simonson, the association’s chief economist, noting that in the three months since June, residential construction employment has increased nearly 3 percent while nonresidential employment has slipped 0.2 percent. “As project cancellations mount, so too will job losses on the nonresidential side unless the federal government provides funding for infrastructure and relief for contractors.”

The AGC of America-Autodesk Workforce Survey, released last month, found that 38 percent of respondents—whose firms perform all types of nonresidential construction--expect it will take more than six months for their firm’s volume of business to return to normal, relative to a year earlier. That percentage topped the 29 percent who reported business was already at or above year-ago levels.

A likely reason for the more pessimistic outlook is the rapid increase in postponed or canceled projects, the economist said. He noted that the latest survey found 60 percent of firms report a scheduled project has been postponed or canceled, compared to 12 percent that had won new or additional work as a result of the pandemic.

The employment pickup in September was mainly in homebuilding, home improvement and a portion of nonresidential construction, Simonson noted. There was a rise of 22,100 jobs in residential construction employment, comprising residential building (6,600) and residential specialty trade contractors (15,500). There was a gain of 4,000 jobs in nonresidential construction employment, covering nonresidential building (5,300), specialty trades (2,100) and heavy and civil engineering construction (-3,400).

The industry’s unemployment rate in September was 7.1 percent, with 700,000 former construction workers idled. These figures were more than double the September 2019 figures of 3.2 percent and 319,000 workers, respectively.

Association officials said that nonresidential construction was likely to continue to stagnate while the pandemic persists without new additional federal coronavirus recovery measures. Those recovery measures must include liability protections for businesses that are protecting workers from the coronavirus, new infrastructure investments and funding for depleted state and local construction budgets, they added.

“Until businesses are confident enough to invest in new development projects and state and local governments are able to invest in public works, the commercial construction sector will not be able to fully recover,” said Stephen E. Sandherr, the association’s chief executive officer. “Protecting honest employers, improving our infrastructure and helping state and local officials fix schools and improve other public facilities will create the jobs people need and the momentum our economy requires.”

Related Stories

Market Data | Jul 5, 2023

Nonresidential construction spending decreased in May, its first drop in nearly a year

National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.06 trillion.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Industry Research | Jun 13, 2023

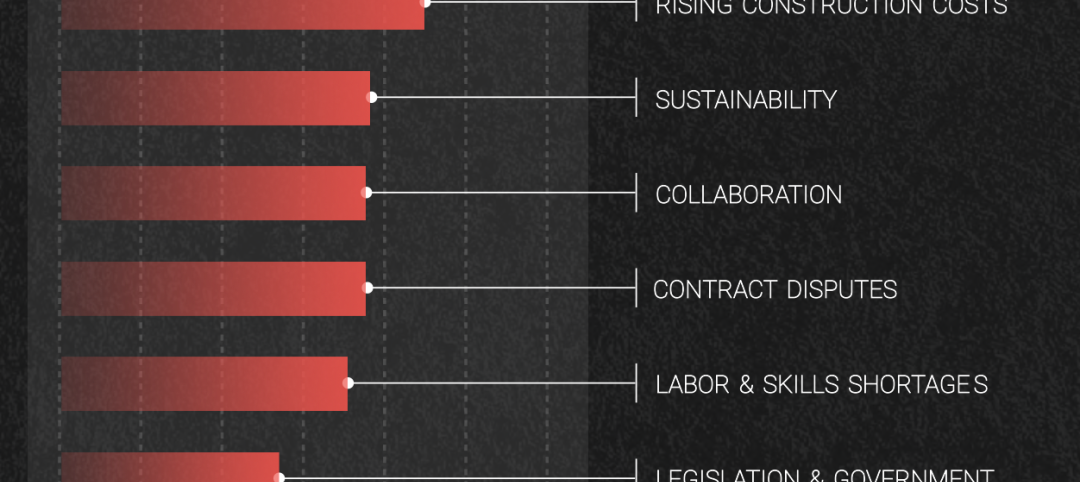

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.

| Jun 5, 2023

Communication is the key to AEC firms’ mental health programs and training

The core of recent awareness efforts—and their greatest challenge—is getting workers to come forward and share stories.

Contractors | May 24, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of April 2023

Contractor backlogs climbed slightly in April, from a seven-month low the previous month, according to Associated Builders and Contractors.

Multifamily Housing | May 23, 2023

One out of three office buildings in largest U.S. cities are suitable for residential conversion

Roughly one in three office buildings in the largest U.S. cities are well suited to be converted to multifamily residential properties, according to a study by global real estate firm Avison Young. Some 6,206 buildings across 10 U.S. cities present viable opportunities for conversion to residential use.

Industry Research | May 22, 2023

2023 High Growth Study shares tips for finding success in uncertain times

Lee Frederiksen, Managing Partner, Hinge, reveals key takeaways from the firm's recent High Growth study.

Multifamily Housing | May 8, 2023

The average multifamily rent was $1,709 in April 2023, up for the second straight month

Despite economic headwinds, the multifamily housing market continues to demonstrate resilience, according to a new Yardi Matrix report.