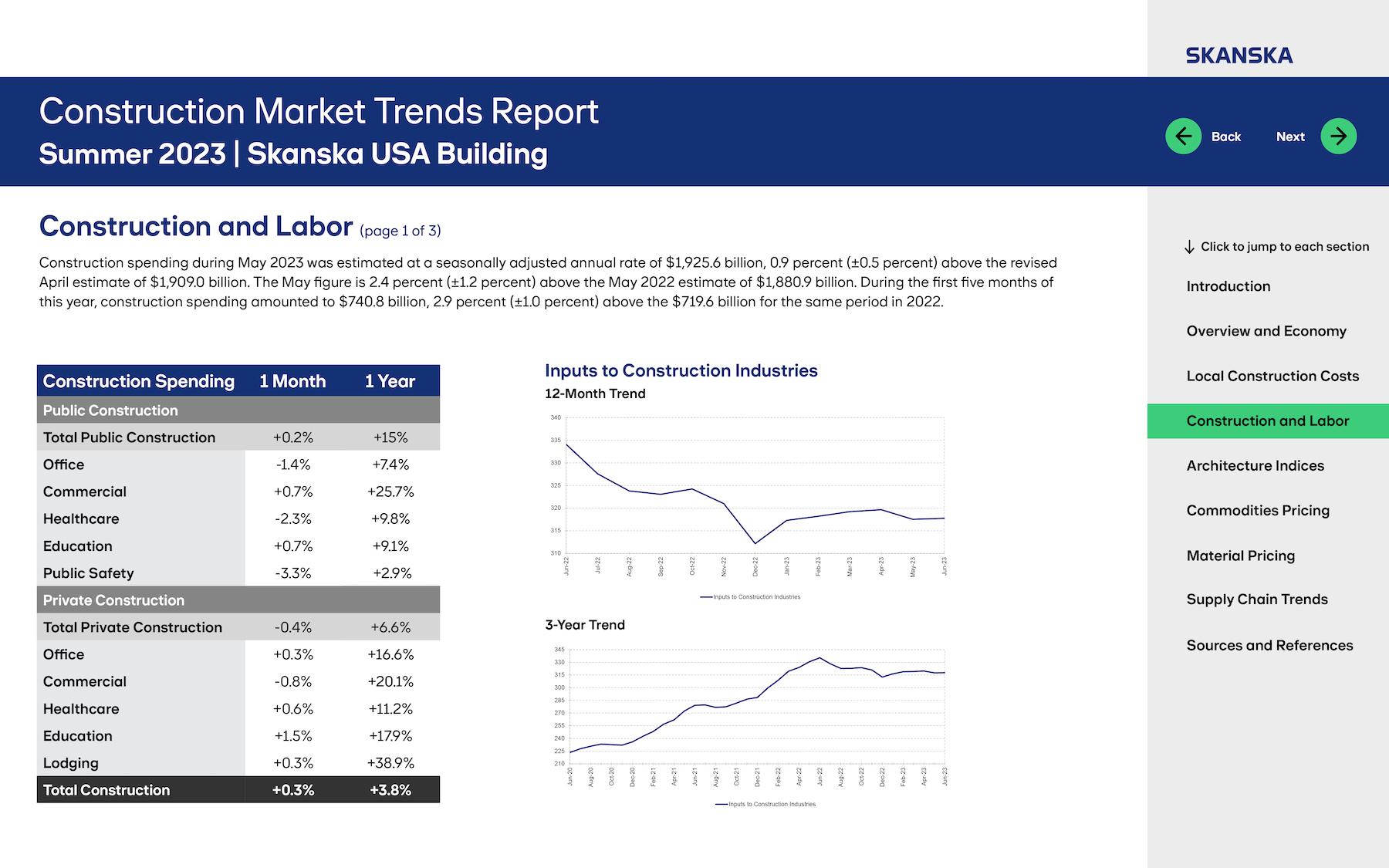

While materials and labor price hikes continue to create havoc, they don’t seem to be shackling demand or activity for nonresidential construction, according to Skanska’s Summer 2023 Construction Market Trends Report, which looks at pricing and supply-chain trends for 14 product groups, and forecasts local construction costs for 21 markets across the U.S.

“Despite being the most expensive construction environment we have ever experienced … the health of the construction industry remains quite strong,” wrote Steve Stouthamer, Executive Vice President, Project Planning, Skanska USA Building, and one of the Skanska executives who produced this 43-page report. Stouthamer added that commercial office development and residential markets remain the most challenged by interest rate pressures, and offices are still contending with high vacancy rates.

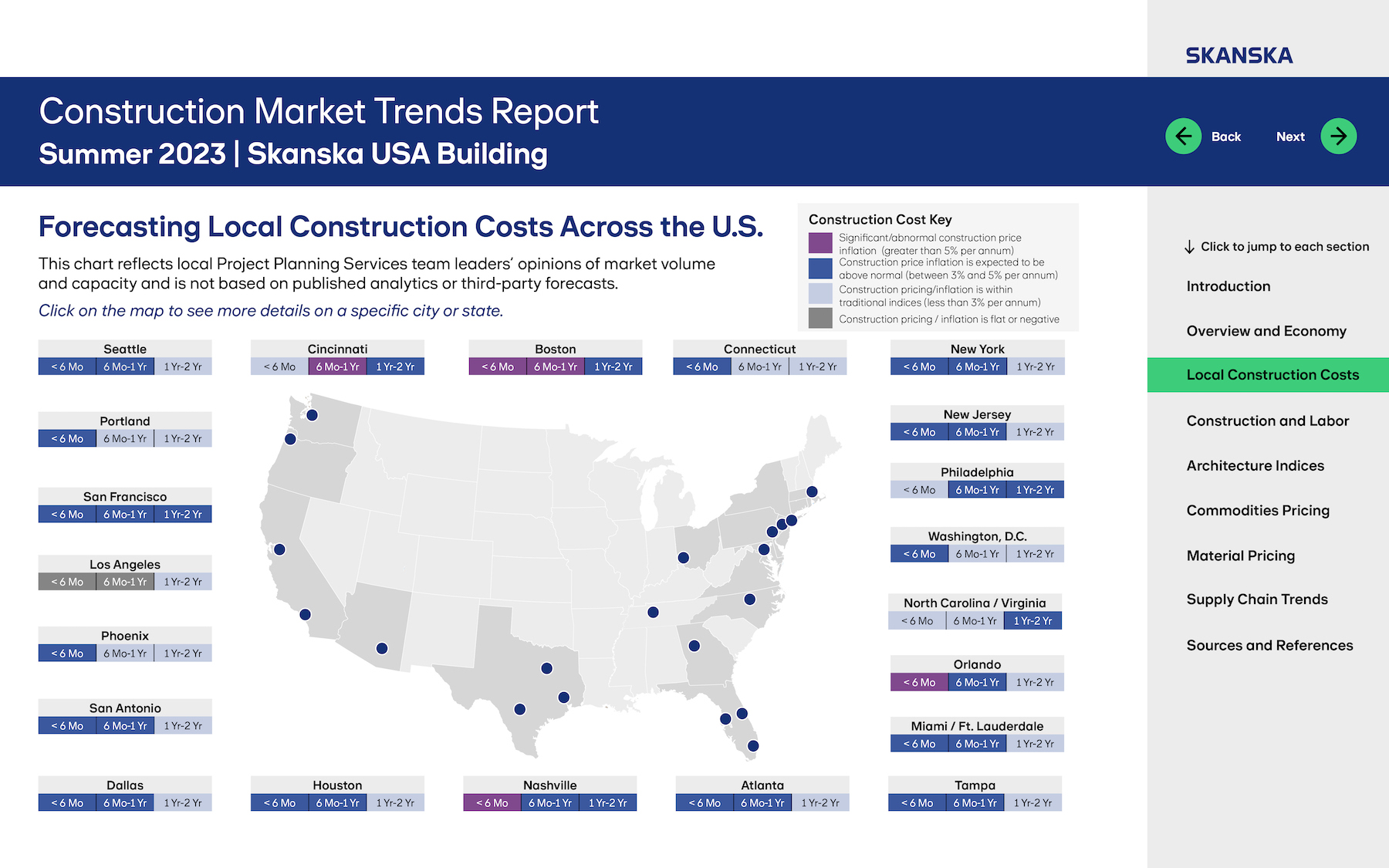

Skanska anticipates significant or abnormal construction price inflation (greater than 5 percent per year) over the next six to 12 months in Nashville, Boston, Cincinnati, and Orlando. Indeed, with the exception of Los Angeles and the North Carolina/Virginia region, the other markets that Skanksa’s report tracks are expected to experience at least above-normal (3-5% per annum) construction price inflation over the next six to 24 months.

Different sectors driving local economies

Skanska evaluated business conditions and prospects for each of the markets it tracked.

Take Seattle, for example: New labor agreements, coupled with manpower shortages and the availability of materials and equipment, are pushing construction prices up. But much-needed tourism is returning there, re-energizing the retail, hospitality, and aviation sectors. And outside of the downtown core, Skanska saw “plenty of opportunities for new projects,” notably in K-12, mass transit, and aviation.

In Philadelphia, the same inflation dynamic exists. But that hasn’t stopped Philly’s healthcare sector from gaining momentum, and life sciences continues to be vibrant, “with new capital projects and office as clients realize the importance of new amenity space to bring staff back to work.” Skanska also foresees a laggard Higher Ed sector in recovery, with several new projects under consideration for this year and next.

Skanska’s report cited the Architecture Billings Index in June as another barometer of construction demand, and the news was mixed. While business conditions have improved for architecture firms in all regions except the West, the pace of growth inquiries since March has slowed, and the value of new design contracts has declined.

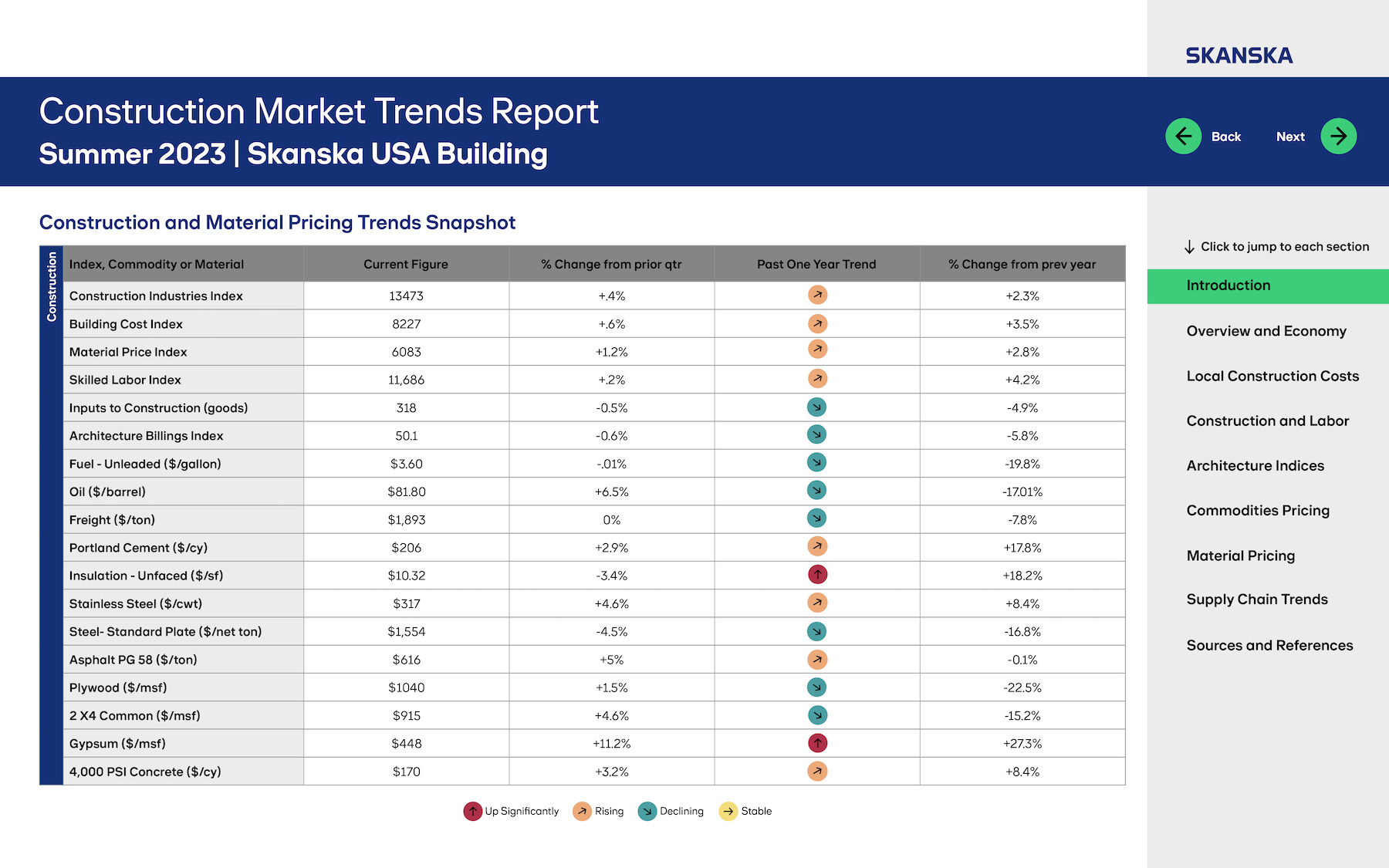

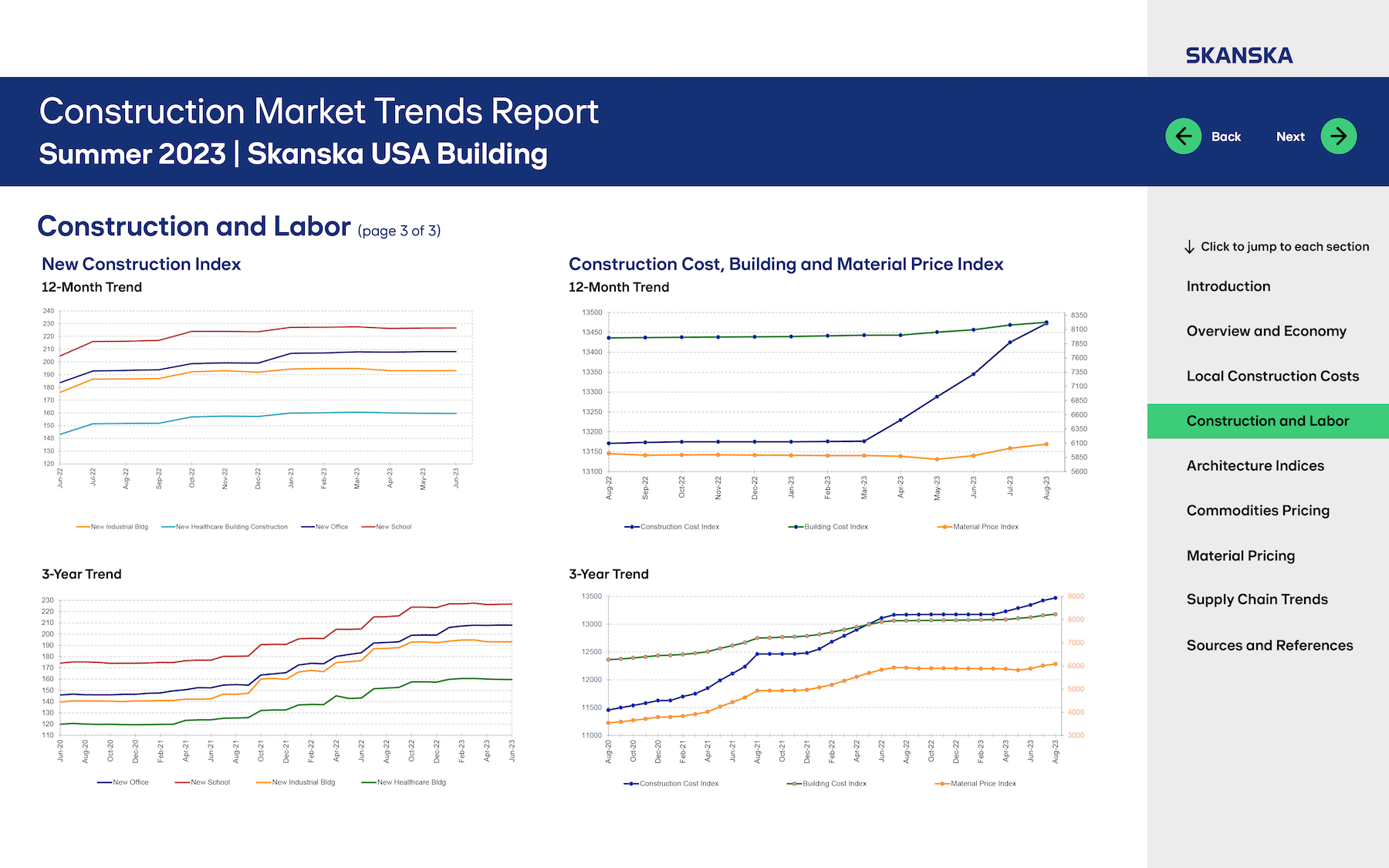

An uncertain stability for construction costs

Every metro market tracked in Skanska’s report has had to cope with rising costs for materials and labor, which Skanska estimates rose nationally by 4.2% and 2.8% respectively, compared to the same period a year ago. But only two product categories—unfaced insulation and 4,000-psi gypsum—were up significantly: by 18.2% and 27.3%, respectively. Conversely, the costs of three product groups tracked–-standard plate steel, plywood, and 2x4s—were trending downward. Skanska also reported declines in the cost of fuel, oil, and freight, though the firm expected fuel costs to remain “elevated” through the rest of this year.

Softness in asphalt pricing is tied to lower seasonal demand, and Skanska expects prices for this material to increase again based on infrastructure work. Cement and concrete prices continued to improve early this year, but could increase dramatically as the weather got warmer. The pricing for structural steel has also stabilized, but Skanska expects a slight uptick in the future. Pricing for aluminum and copper, despite moderate declines, remain high compared to historical levels, as demand is strong.

As for product availability, Skanska said that over the previous quarter, the construction supply chain has continued to improve, “most notably around raw material prices for PVC resins, steel, copper, and lumber.” The supply chain for roofing products “has fully recovered.” Inventory for plumbing and fixtures appears to be healthy.

The challenges lie with HVAC and electrical gear availability. though several HVAC equipment manufacturers have reported improvements in their backlogs of orders due to increased factory capacity. (The one glaring exception is chillers that still have lead times of between 45 and 65 weeks.)

Skanska predicted that the construction industry’s lean toward electrification, as well as investment in data centers, will likely last for several more years. Investment in production capacity for electrical equipment products should allow manufacturers to be able to keep up with “persistent demand.”

Regional takes on construction costs

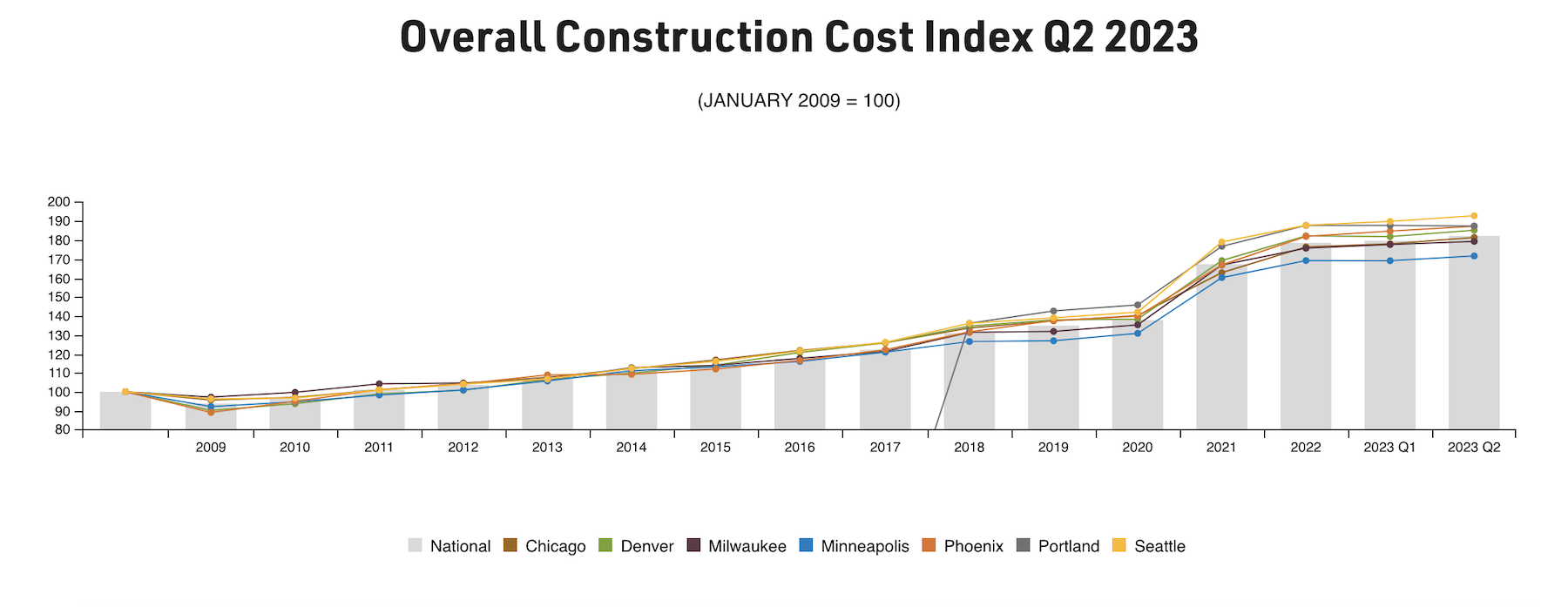

Looking at market conditions from a slightly narrower perspective, Mortenson’s just-released nonresidential Construction Cost Index, which tracks quarterly spending and inflation trends in seven markets—Seattle, Portland, Denver, Phoenix, Milwaukee, Chicago, and Minneapolis—stood at 182 nationally in the second quarter of 2023, or 8.72% higher than for all of 2021. Within that time frame, Phoenix saw the biggest increase in its index (12.22% to 187.3), and Portland the smallest (6.06% to 187.4).

“Our construction cost index shows a continued flattening of material costs, suggesting pandemic, supply-chain, and inflation-related increases experienced over the last two years have largely abated,” states Mortenson. Nationally, nonresidential construction costs during Q223 increased year over year by 2.94%. Mortenson’s overall outlook for nonresidential construction remains optimistic but also cautious, primarily because increasing labor costs “are beginning to offset the stabilization.”

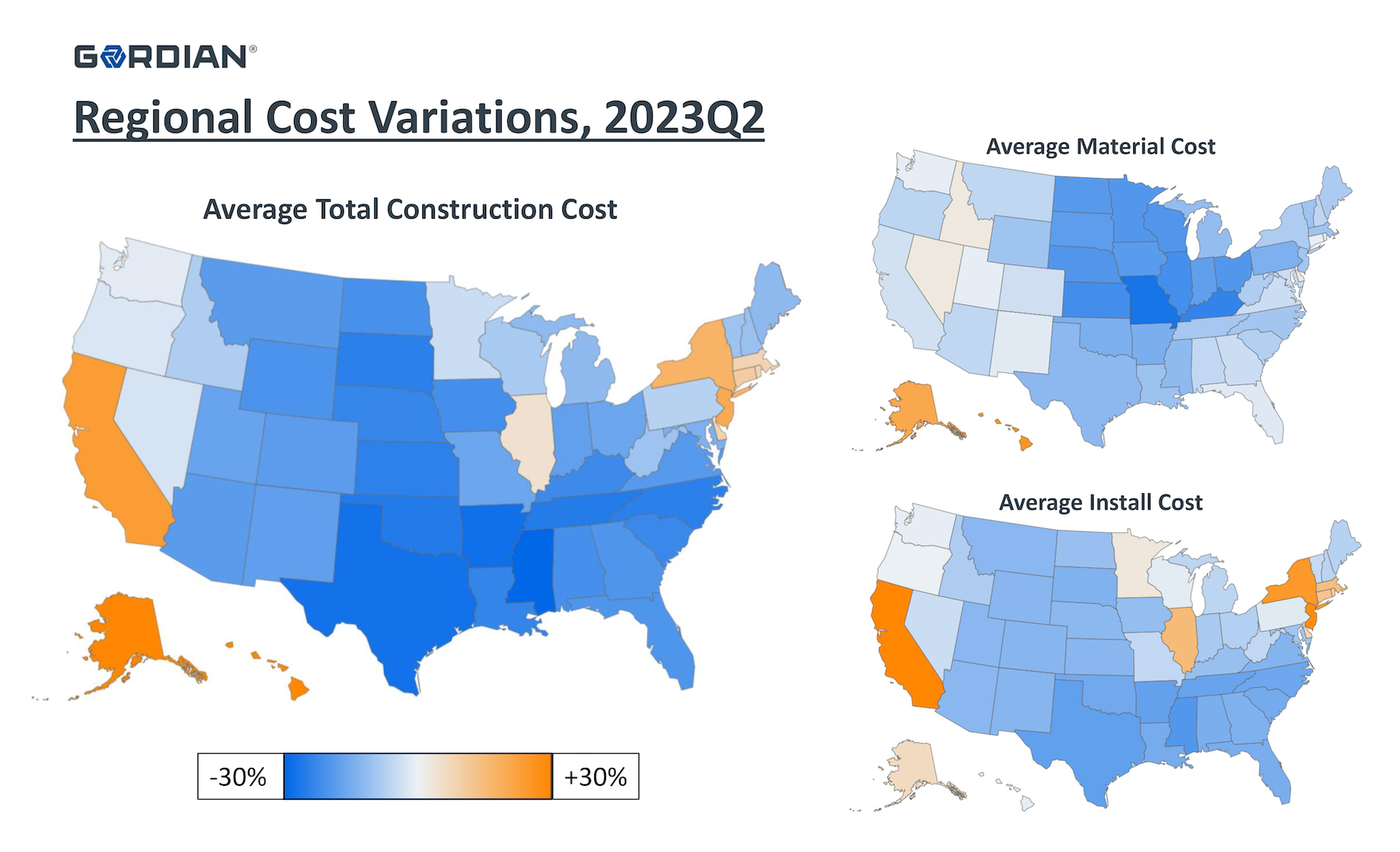

Data from Gordian’s RSMeans City Cost Index illustrates how dramatically costs differ by region, and how doing business in coastal markets is more expensive.

The City Cost Index takes into account the costs of labor, materials, and equipment, and compares that aggregate number to a national average of 30 major U.S. cities. The cost model encompasses 66 materials, 21 trades, and six pieces of equipment (plus fuel and maintenance costs).

The map above illustrates regional cost differences during the second quarter of 2023. Here are some takeaways:

•The average costs of construction are highest across California, Hawaii, and Alaska; and lowest across Mississippi;

•Materials costs are highest as you move farther east and west from the Mississippi River;

•Costs for installation (labor and equipment) are highest in the West and Northeast.

Related Stories

Market Data | Nov 2, 2018

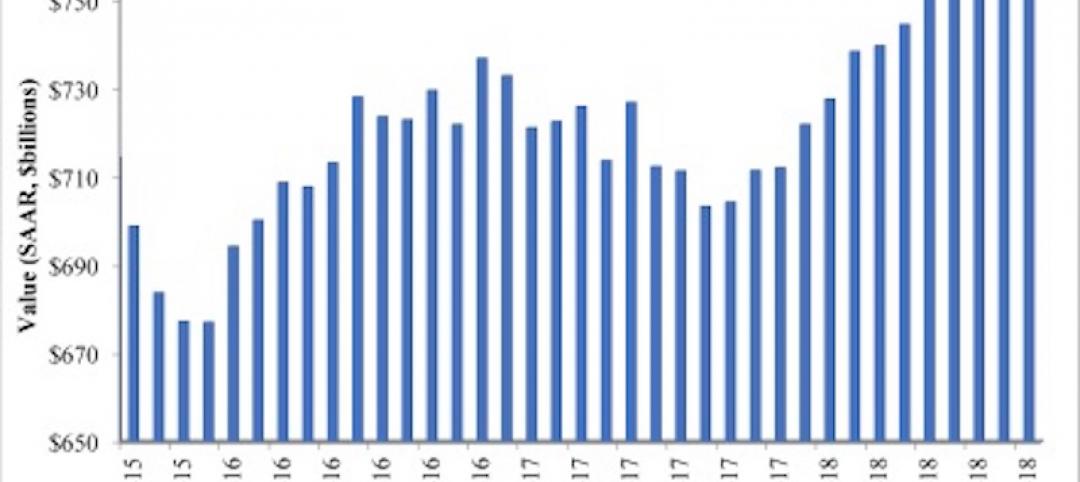

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

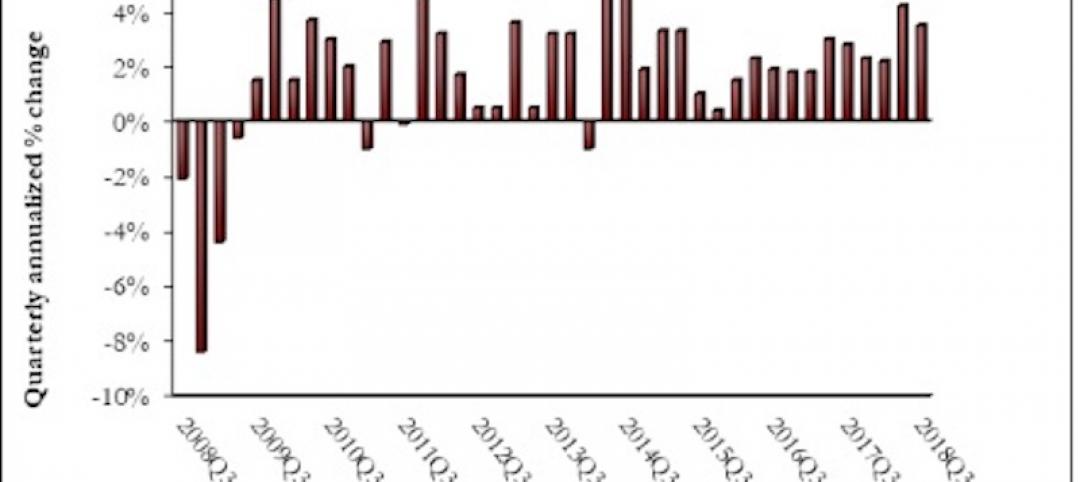

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

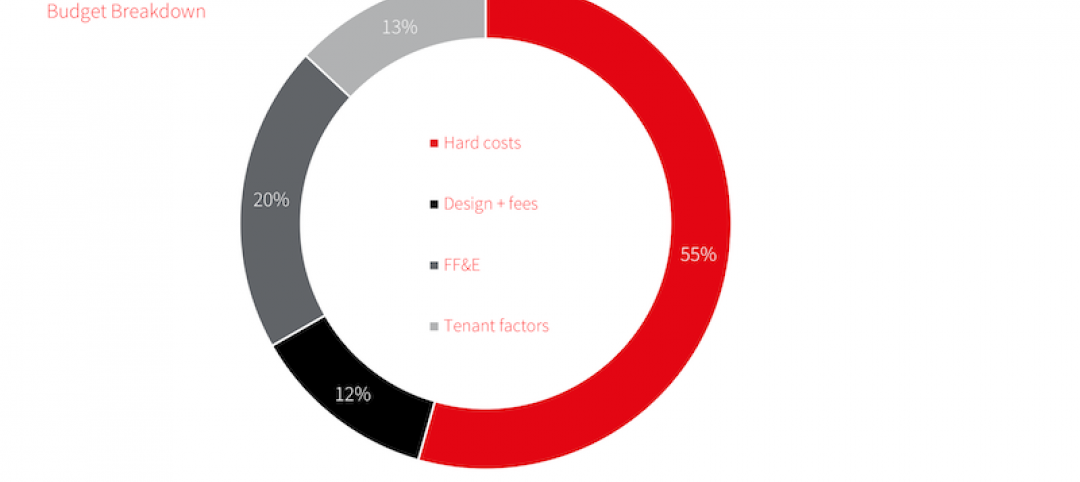

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.