Gilbane Building Company today announces the publication of the Spring 2013 edition of Construction Economics – Market Conditions in Construction. Based on an array of economic data, construction starts, and material cost trends, the data is the most positive the company has seen in recent years.

“We are in a growth period that by all leading indicators seems here to stay. From 2006 to 2010, as work declined, we saw the largest decline of margins in recent history. In 2011 that trend began to reverse slightly” says Ed Zarenski, the report’s author and a 40-year veteran of the construction industry. “I expect the positive growth to continue.”

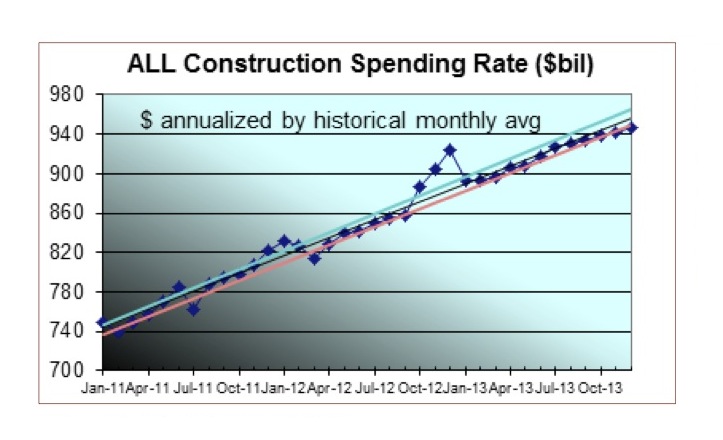

According to the report, the monthly rate of construction spending is up 20% in 24 months and increased in 18 of the last 24 months, which is a good leading indicator for new construction work in Q3-Q4 2013.

Other highlights include:

- Residential spending will take the lead in 2013, nonresidential spending will lag.

- Public spending will decline. Private spending will lead the charge in 2013.

- As spending continues to increase, even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

- Predicted spending growth of 8.2% for Commercial markets, 5.2% for Office and 2.3% for Healthcare.

Construction jobs grew by 150,000 in the last five months. Just to meet the needs of the predicted residential building expansion, the workforce needs to grow by 750,000 jobs in the next two years, faster than the entire construction workforce has ever grown in history.

Future escalation, in order to support labor growth, materials demand and to capture increasing margins, will be higher than normal labor/material cost growth. Lagging regions may take longer to experience high escalation. Residential escalation will be near the upper end of the range.

This free report and its executive summary are available for download at http://www.gilbaneco.com/economic-report.

About Gilbane, Inc.

Gilbane provides a full slate of construction and facilities-related services – from pre-construction planning and integrated consulting capabilities to comprehensive construction management, close-out and facility management services – for clients across various markets. Marking its 140th year in operation and still a privately held, family-run company, Gilbane has more than 60 office locations around the world. To find out what the next 140 years have in store, visit www.gilbaneco.com.

Related Stories

Cultural Facilities | Nov 21, 2023

Arizona’s Water Education Center will teach visitors about water conservation and reuse strategies

Phoenix-based architecture firm Jones Studio will design the Water Education Center for Central Arizona Project (CAP)—a 336-mile aqueduct system that delivers Colorado River water to almost 6 million people, more than 80% of the state’s population. The Center will allow the public to explore CAP’s history, operations, and impact on Arizona.

MFPRO+ New Projects | Nov 21, 2023

An 'eco-obsessed' multifamily housing project takes advantage of downtown Austin’s small lots

In downtown Austin, Tex., architecture firm McKinney York says it built Capitol Quarters to be “eco-obsessed, not just eco-minded.” With airtight walls, better insulation, and super-efficient VRF (variable refrigerant flow) systems, Capitol Quarters uses 30% less energy than other living spaces in Austin, according to a statement from McKinney York.

MFPRO+ News | Nov 21, 2023

California building electrification laws could prompt more evictions and rent increases

California laws requiring apartment owners to ditch appliances that use fossil fuels could prompt more evictions and rent increases in the state, according to a report from the nonprofit Strategic Actions for a Just Economy. The law could spur more evictions if landlords undertake major renovations to comply with the electrification rule.

Codes and Standards | Nov 21, 2023

Austin becomes largest U.S. city to waive minimum parking requirements

Austin, Texas recently became the largest city in the United States to stop requiring new developments to set a minimum amount of parking. The Austin City Council voted 8-2 earlier this month to eliminate parking requirements in an effort to fight climate change and spur more housing construction as Texas’s capitol grapples with a housing affordability crisis.

MFPRO+ News | Nov 21, 2023

Underused strip malls offer great potential for conversions to residential use

Replacing moribund strip malls with multifamily housing could make a notable dent in the housing shortage and revitalize under-used properties across the country, according to a report from housing nonprofit Enterprise Community Partners.

Giants 400 | Nov 16, 2023

Top 100 Science + Technology Facility Architecture Firms for 2023

Gensler, HDR, Page Southerland Page, Flad Architects, and DGA top BD+C's ranking of the nation's largest science and technology (S+T) facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking factors revenue from all science and technology (S+T) buildings work, including laboratories, research buildings, technology/innovation buildings, pharmaceutical production facilities, and semiconductor production facilities.

Resiliency | Nov 16, 2023

How inclusive design supports resilience and climate preparedness

Gail Napell, AIA, LEED AP BD+C, shares five tips and examples of inclusive design across a variety of building sectors.

Retail Centers | Nov 15, 2023

Should retail developers avoid high crime areas?

For retailers resolute to operating in high crime areas, design elements exist to mitigate losses and potentially deter criminal behavior.

MFPRO+ News | Nov 15, 2023

Average U.S multifamily rents drop $3 to $1,718 in October 2023: Yardi Matrix

Multifamily fundamentals continued to soften and impact rents last month, according to the latest Yardi Matrix National Multifamily Report. The average U.S. asking rent dropped $3 to $1,718 in October, with year-over-year growth moderating to 0.4%, down 40 basis points from September. Occupancy slid to 94.9%, marking the first decline in four months.

MFPRO+ Special Reports | Nov 14, 2023

Register today! Key trends in the multifamily housing market for 2024 - BD+C Live Webinar

Join the BD+C and Multifamily Pro+ editorial team for this live webinar on key trends and innovations in the $110 billion U.S. multifamily housing market. A trio of multifamily design and construction experts will present their latest projects, trends, innovations, and data/research on the three primary multifamily sub-sectors: rental housing, senior living, and student housing.