Construction spending declined for the fourth consecutive month in June as decreases in single-family, highway and educational projects outweighed increases in several private nonresidential categories, according to an analysis by the Associated General Contractors of America of government data released today. As state and local government face budget deficits, association officials cautioned that investments in infrastructure and other construction projects are likely to continue falling unless Congress and the Trump administration provide additional, targeted and dedicated infrastructure funding.

“Regrettably, the overall downward trend in spending is likely to continue and to spread to more project types as work that began before the pandemic hit finishes up,” said Ken Simonson, the association’s chief economist. “Unless the federal government invests heavily—and promptly—in infrastructure projects, both public and private nonresidential investment are likely to shrink further.”

Construction spending in June totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 0.7% from May and the lowest total in a year. After reaching a record high in February of $1.44 trillion, total spending has slumped by 6.0%, the steepest four-month contraction in a decade, the economist noted.

Public construction spending decreased by 0.7% in June, dragged down by a 1.7% drop in highway and street construction spending and a 2.7% decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 0.6%.

Private nonresidential construction spending inched up 0.2% from May to June, led by a gain of 0.7% in the largest segment, power construction. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 1.3%, while manufacturing construction rose 1.7% and office construction edged up 0.3%.

Private residential construction spending shrank by 1.5% in June as spending on single-family homebuilding plunged 3.6% to its lowest level since late 2016. In contrast, new multifamily construction spending climbed for the third month in a row, posting a 3.0% increase from May.

Association officials said that state and local budgets are getting hammered by declining economic activity related to the ongoing pandemic. They urged Congress and the administration to quickly pass new infrastructure and recovery measures to help reverse the declines in public spending. They added that those new investments would help put many people back to work in good-paying construction careers.

“It will be hard to rebuild the economy if state and local governments lack the resources needed to improve roads, retrofit schools and keep drinking water safe,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of letting people languish in unemployment, Washington can put people back to work simply by boosting investments in needed infrastructure and other construction projects.”

Related Stories

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

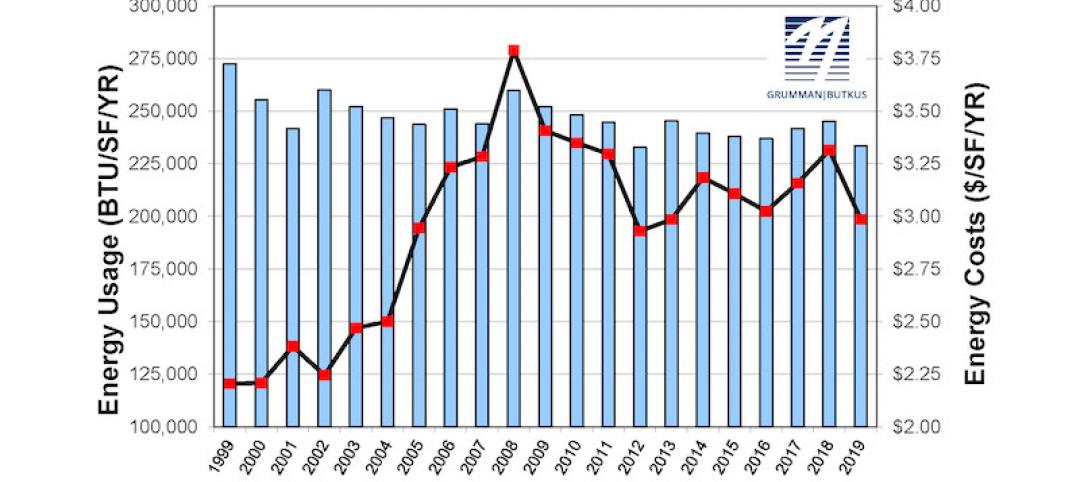

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

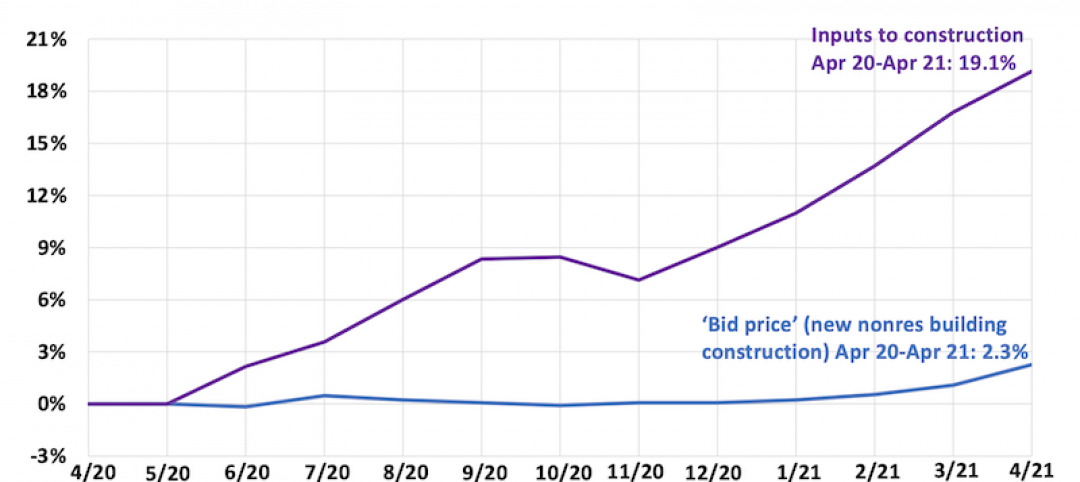

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.

Market Data | May 4, 2021

Nonresidential construction outlays drop in March for fourth-straight month

Weak demand, supply-chain woes make further declines likely.

Market Data | May 3, 2021

Nonresidential construction spending decreases 1.1% in March

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories.

Market Data | Apr 30, 2021

New York City market continues to lead the U.S. Construction Pipeline

New York City has the greatest number of projects under construction with 110 projects/19,457 rooms.

Market Data | Apr 29, 2021

U.S. Hotel Construction pipeline beings 2021 with 4,967 projects/622,218 rooms at Q1 close

Although hotel development may still be tepid in Q1, continued government support and the extension of programs has aided many businesses to get back on their feet as more and more are working to re-staff and re-open.

Market Data | Apr 28, 2021

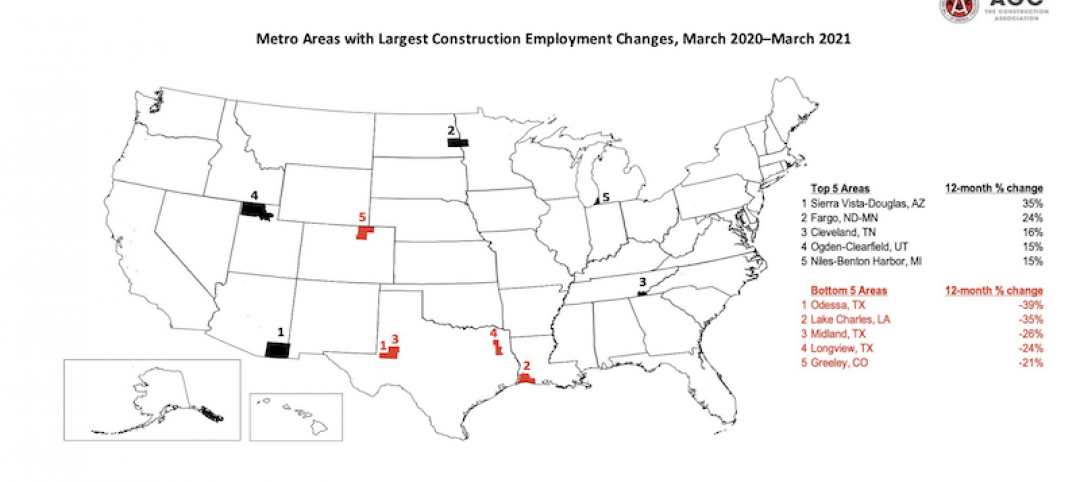

Construction employment declines in 203 metro areas from March 2020 to March 2021

The decline occurs despite homebuilding boom and improving economy.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.