Construction spending decreased 0.2 percent from November to December as declines in public and private nonresidential projects outweighed a large rise in single-family homebuilding, according to a new analysis of federal data released today by the Associated General Contractors of America. Association officials noted that its recent survey found widespread optimism about prospects for projects available to bid on in 2020 but they urged officials in Washington to follow through on announced plans for infrastructure spending increases.

“Both the actual spending totals for December and our members’ expectations for 2020 point to a positive year for all major categories of construction,” said Ken Simonson, the association’s chief economist. “Continuing job gains throughout the nation, along with low interest rates, make a good year for residential construction especially likely, while spending many nonresidential categories should match or exceed 2019 levels.”

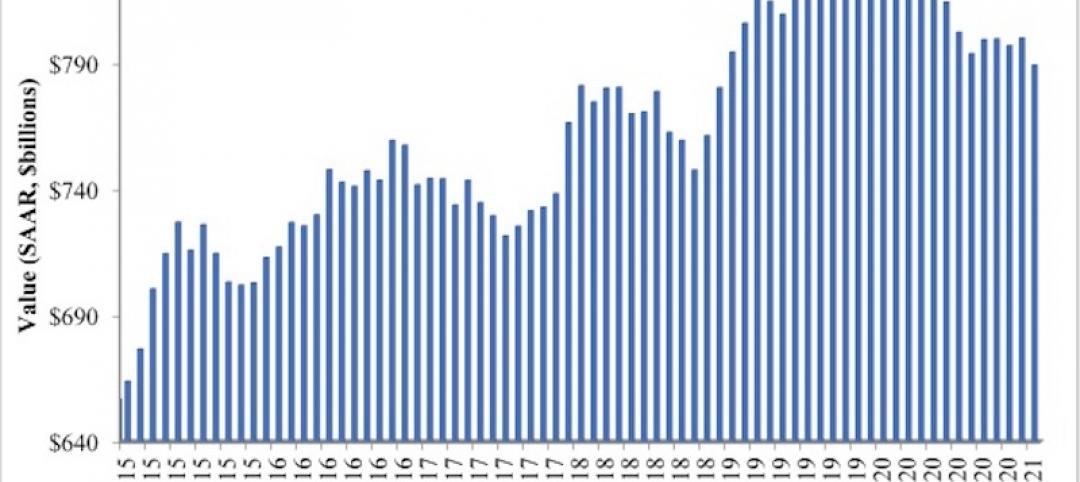

Construction spending totaled $1.328 trillion at a seasonally adjusted annual rate in December, a decrease of 0.2 percent from November but a gain of 5.0 percent from December 2018, according to estimates the U.S. Census Bureau released today. Private residential spending increased 1.4 percent for the month, led by a 2.7 percent increase in single-family homebuilding. Private nonresidential spending declined 1.8 percent for the month and 0.1 percent compared to December 2018. Public construction spending slipped 0.4 percent from November but jumped 11.5 percent from a year earlier.

For 2019 as a whole, spending totaled $1.303 trillion, a dip of 0.3 percent from the 2018 total. Private residential spending declined 4.7 percent for the year, private nonresidential spending was flat, and public construction spending increased 7.1 percent.

The new spending data comes as the association’s 2020 Construction Outlook survey found that for each of 13 project types, more contractors expect an increase in 2020 than a decrease in the dollar value of projects they compete for. On balance, the 956 respondents were most optimistic about water and sewer construction, followed by highway and bridge projects, transportation structures (including airports, transit, rail and port facilities), schools, and hospitals.

Association officials said continued growth in highway and other transportation construction depends in part on timely action by Congress and the President to approve new infrastructure spending plans. The officials noted that the current highway and transit funding legislation expires in less than eight months, and they urged policy makers to reach agreement swiftly on how to boost funding for all types of infrastructure.

“Expanding and modernizing the transportation infrastructure is essential for continued economic health,” said Stephen E. Sandherr, the association’s chief executive officer. “That is why Congress and the Trump administration must act quickly to boost investments in all modes of transportation.”

View the 2020 Construction Outlook Survey.

Related Stories

Market Data | Apr 20, 2021

Demand for design services continues to rapidly escalate

AIA’s ABI score for March rose to 55.6 compared to 53.3 in February.

Market Data | Apr 16, 2021

Construction employment in March trails March 2020 mark in 35 states

Nonresidential projects lag despite hot homebuilding market.

Market Data | Apr 13, 2021

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

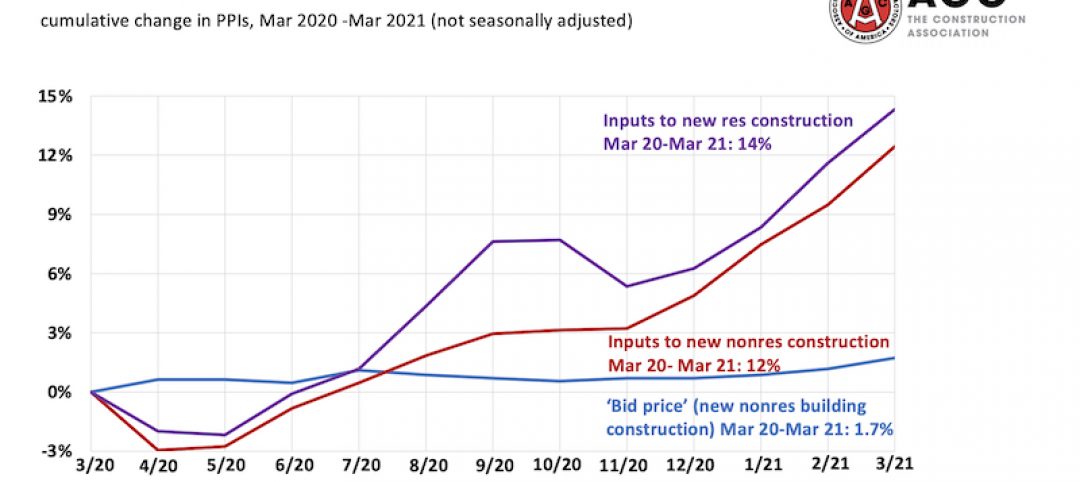

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.