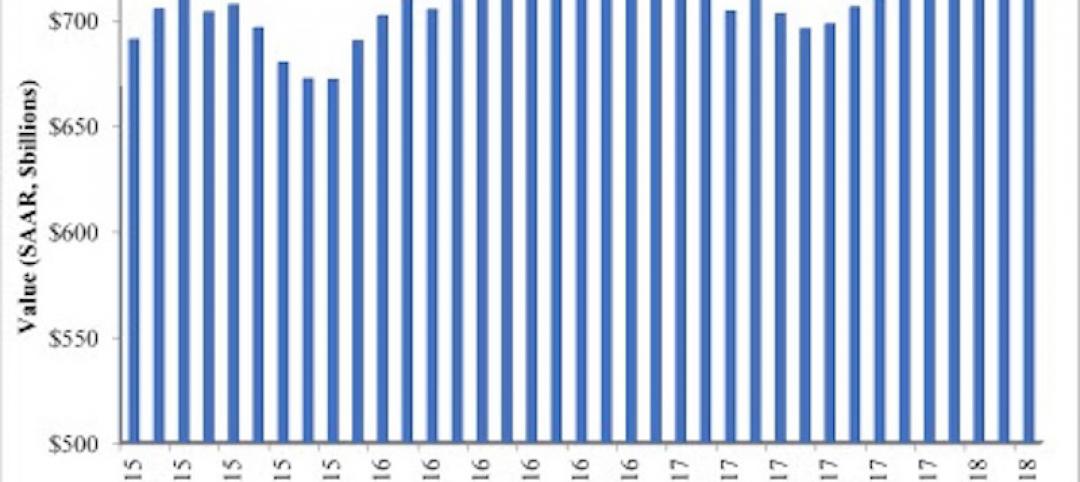

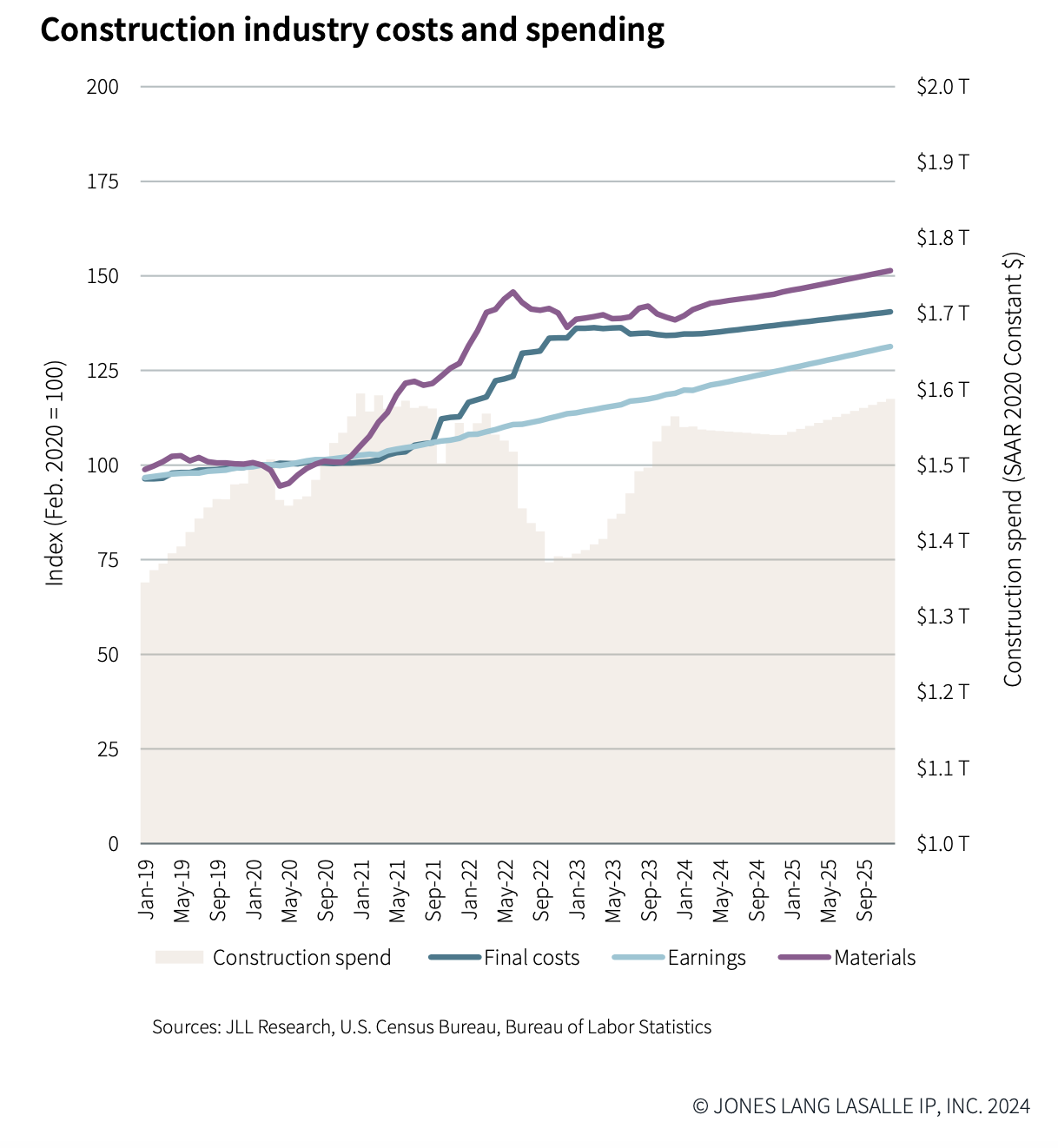

In the first half of 2024, construction costs stabilized. And through the remainder of this year, total cost growth is projected to be modest, and matched by an overall increase in construction spending.

That prediction can be found in JLL’s 2024 Midyear Construction Update and Reforecast, released today. JLL bases its market analyses on insights gleaned from its global team of more than 550 research professionals who track economic and property trends and forecast future conditions in over 60 countries.

The Update acknowledges that the industry has been adjusting to new patterns of demand, as not all sectors are performing equally well. Interest in projects in general has increased, lending regulations are not tightening, and spending is up more than originally anticipated.

Still, the trajectory of interest rates “continues to elude forecasters,” observes JLL, “making ‘higher for longer’ the correct operating paradigm.” Yet despite financial constraints, JLL expects cost growth and development to continue. Stakeholders need to account for maturing debt, lease expirations, and emerging global advantages as they navigate the realities of sustained higher interest rates and varied local outcomes.

One area of opportunity for AEC firms, under these circumstances, is resilient and sustainable design and construction, says JLL.

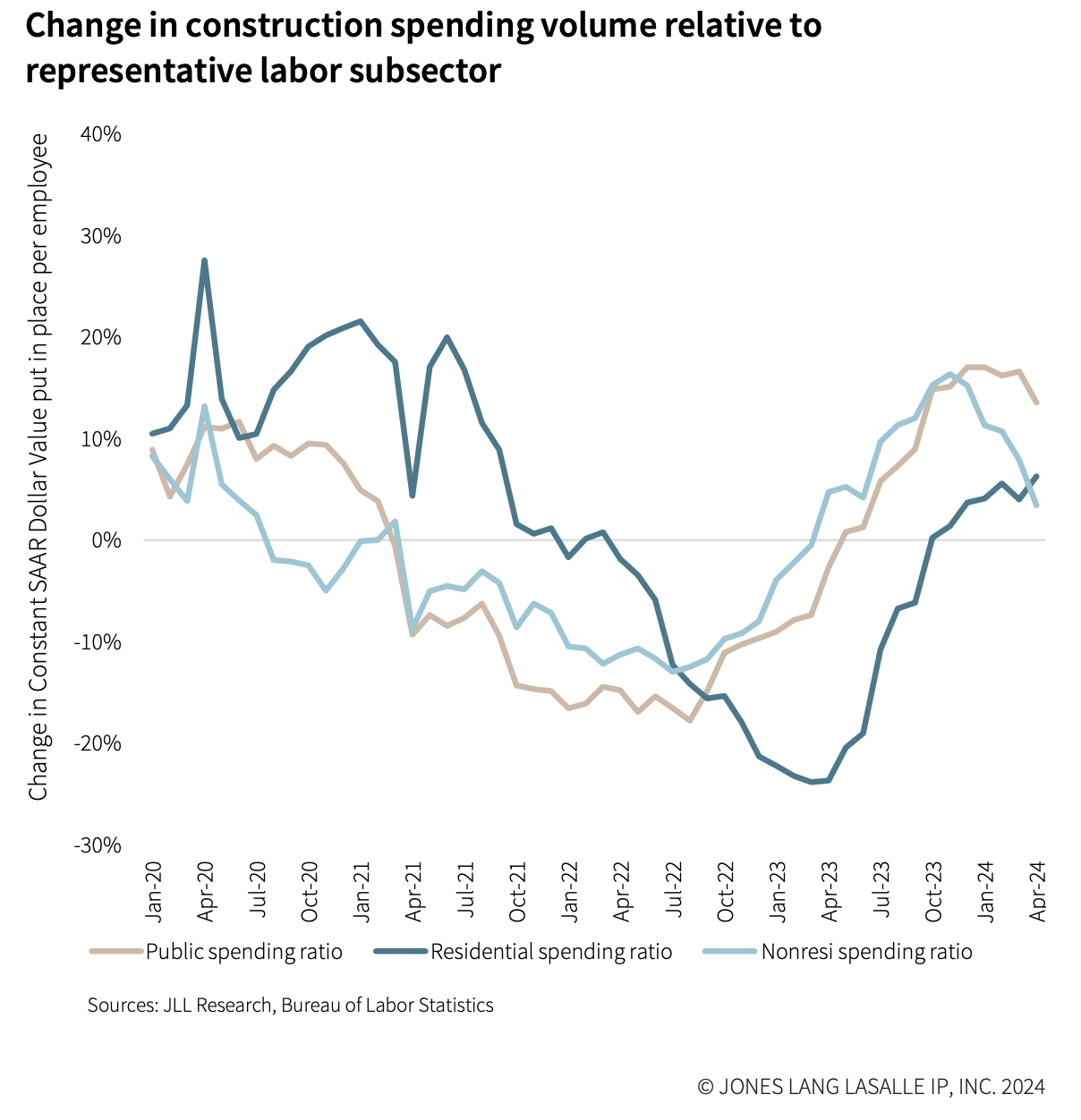

Spending is outpacing employment availability

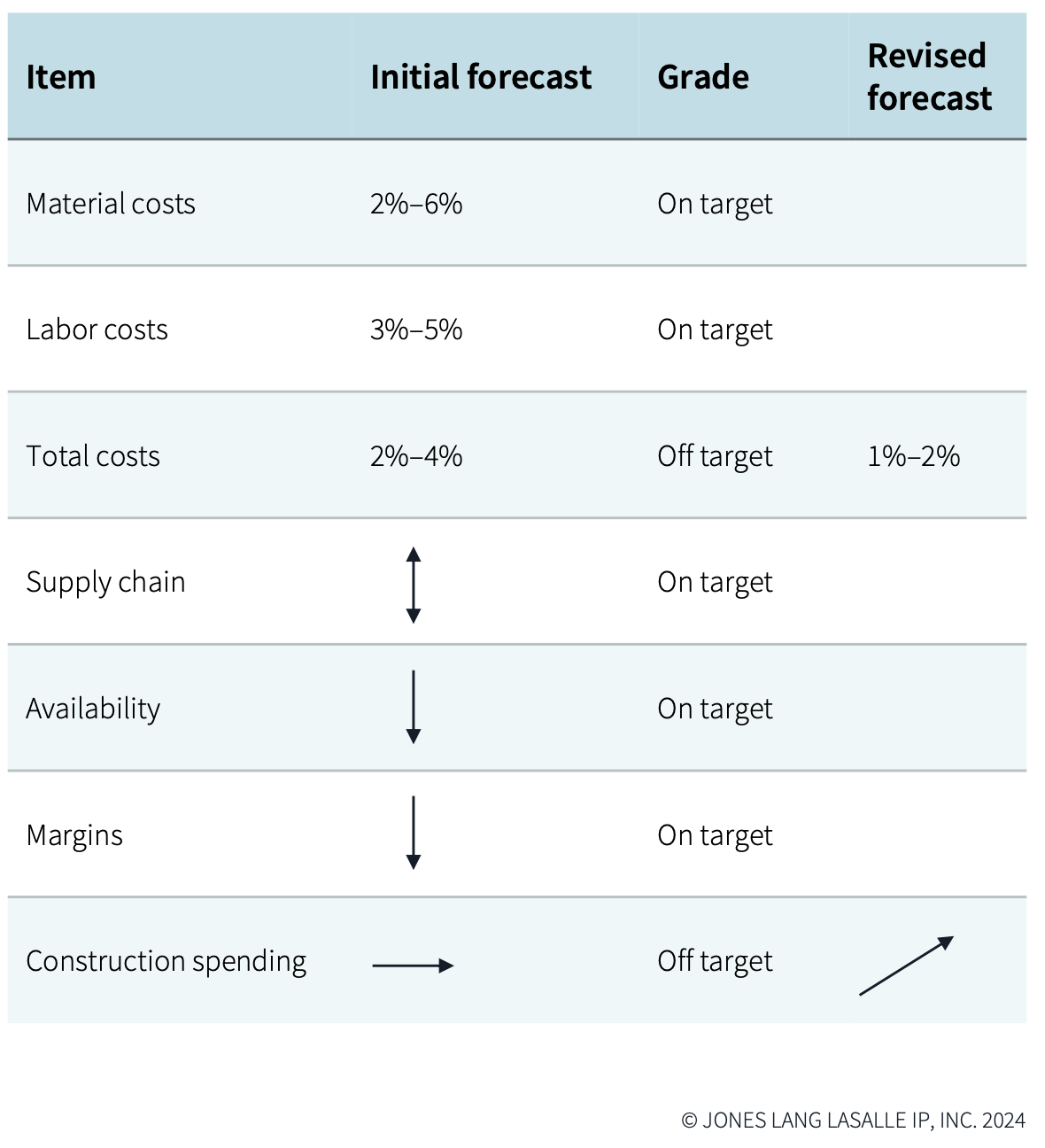

With these positive outlooks, construction employment has risen, along with compensation. Labor costs driven by limited availability continue to provide a growth floor for broader industry costs. JLL states that its predictions of wage growth at moderately higher than historical rates remain unchanged.

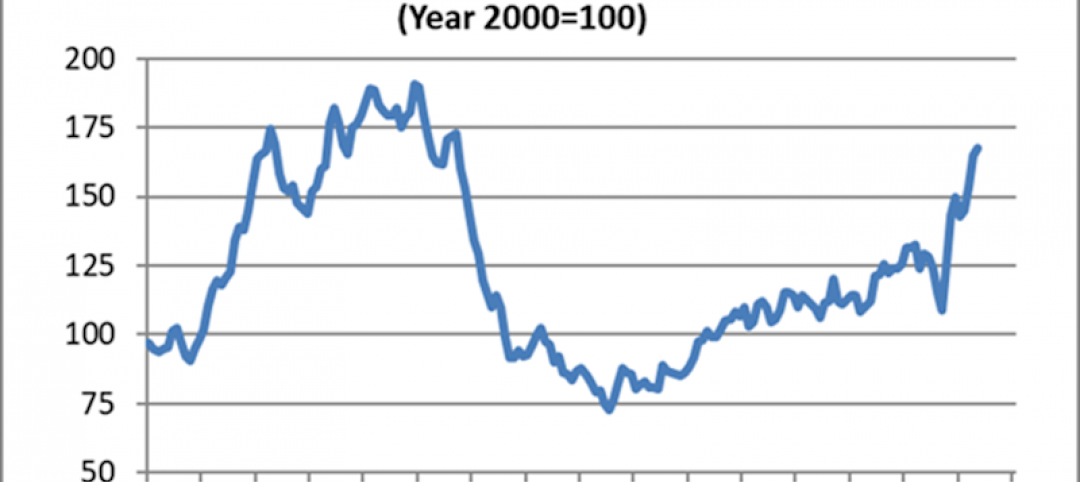

This is because construction spending has been outpacing employment. “Relative strain in production value required per employee is returning to pre-pandemic points [but] with a very different workforce, and remains heavily concentrated in select metros,” JLL states.

While overall growth has been restrained to average below expectations, volatility persists, notably on the cost of materials. Demand for finished goods remains high, especially for MEP products as more sectors electrify and upgrade their operating systems.

Staples of demand are changing and, with them, expectations for price moderation and normal market behavior. For example, bid prices for staple materials such as metals and concrete are at their lowest average monthly movement since 2020. JLL observes that price stability reflects efforts to develop backlogs and secure work and margins. But with global events being so unpredictable, this current period of price stability, says JLL, is transient “and likely short-lived.”

Big question: continued infrastructure investment

JLL believes that market participants, namely developers, suppliers, and AEC firms, are going to hold their current growth pace over the short term. Its Update advises stakeholders to engage the nuances of local markets and design demands “as early as possible” to determine market direction and to navigate disruptions.

So far, firms have been able to compress their margins, mainly because material costs have trended lower than expected, which in turn has allowed for higher-than-anticipated construction spending. But labor challenges continue unabated and are expected to exert pressure on costs into 2025 and beyond.

Consequently, JLL has revised some of its forecasts for the remainder of 2024, most prominently that total costs would increase just 1-2% for the year, and that construction spending (which JLL previously thought would be flat) will increase.

JLL notes, too, that aggregate materials, currently on the low end of price increases, might experience more volatility. JLL also states that anticipating spending increases—and the price floor that such demand would set—will depend on continued public investment in infrastructure and other construction projects.

Related Stories

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.

Market Data | May 30, 2018

Construction employment increases in 256 metro areas between April 2017 & 2018

Dallas-Plano-Irving and Midland, Texas experience largest year-over-year gains; St. Louis, Mo.-Ill. and Bloomington, Ill. have biggest annual declines in construction employment amid continuing demand.