Construction spending in February inched up 0.1% from January and increased 3.0% from the February 2017 level, according to an analysis of new government data by the Associated General Contractors of America. Association officials noted that public construction dropped sharply in February and urged federal agencies to move promptly to invest recently approved funding for a variety of construction categories.

"Construction spending in February was marked by healthy gains in most private categories but a widespread and steep downturn in public construction," said Ken Simonson, the association's chief economist. "Year-over-year trends suggest overall expansion, but public investment will depend on how quickly federal agencies follow up on the spending that Congress has authorized."

Construction spending in February increased 0.1% from January to a record level of $1.273 trillion at a seasonally adjusted annual rate. The February total exceeded the year-earlier level by 3.0%. For the month, private nonresidential construction spending rose 1.5%, private residential spending edged up 0.1%, but public construction spending declined by 2.1%. On a year-over-year basis, private residential construction spending increased 5.5%, private nonresidential spending added 1.1%, and public construction spending grew by 1.6%.

"All but one of the 13 public construction categories declined for the month," Simonson pointed out. "In particular, the largest public segment—highway and street construction—decreased 0.2% from January and 5.1% compared with the year-ago level. In contrast, new single- and multifamily construction increased for the month and year-over-year, as did most private nonresidential categories."

Association officials called on federal agencies to act promptly to distribute or spend the construction funds that Congress approved last month as part of an appropriations bill that keeps the government open through September. Officials noted that programs covering highways, other transportation, water and wastewater state revolving funds, and direct federal construction received funding increases after years of spending freezes or cuts, but these authorizations in some cases will expire in less than six months.

"Federal, state and local officials should act quickly to put the newly enacted federal funding to work improving infrastructure," said Stephen E. Sandherr, the association's chief executive officer. "It would be a shame to let an entire construction season pass before putting these new dollars to work improving the nation's public works."

Related Stories

Market Data | Jul 19, 2021

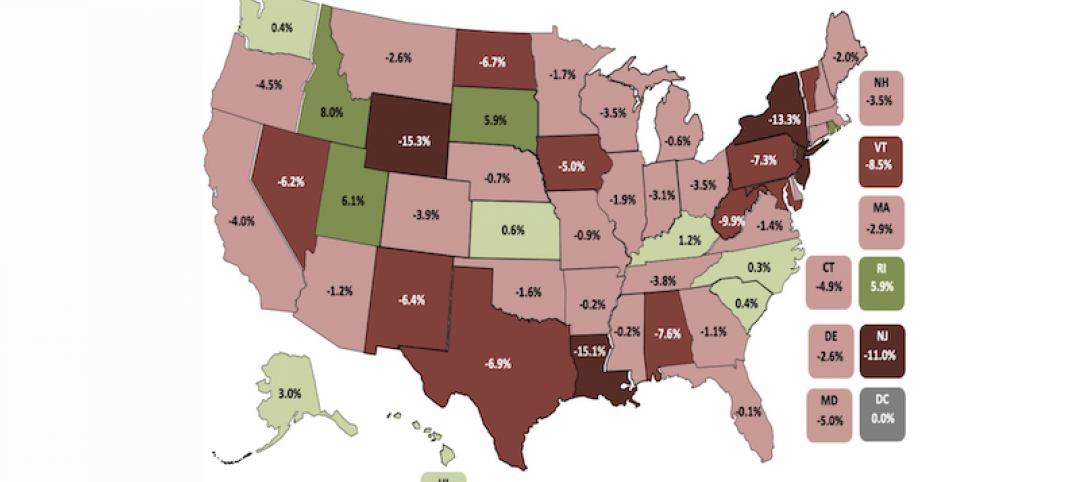

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

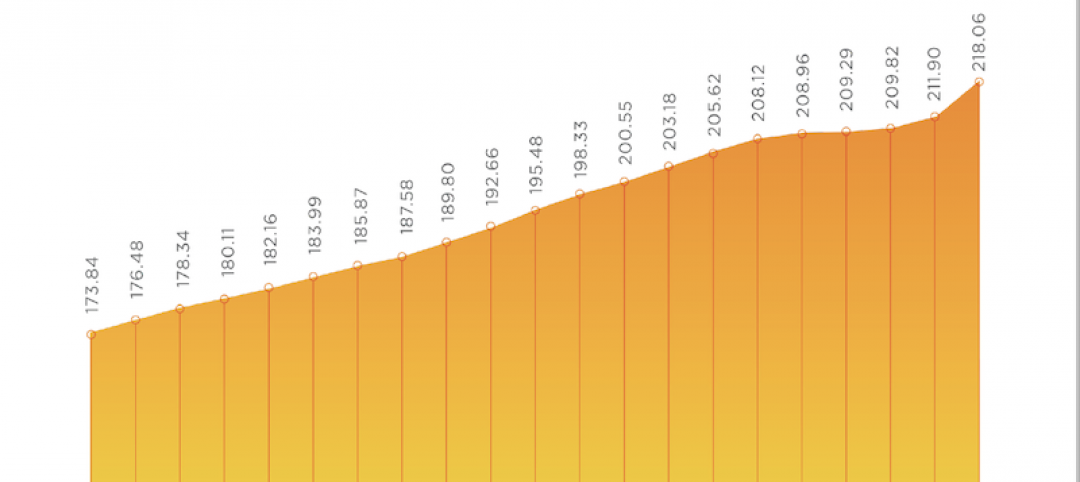

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

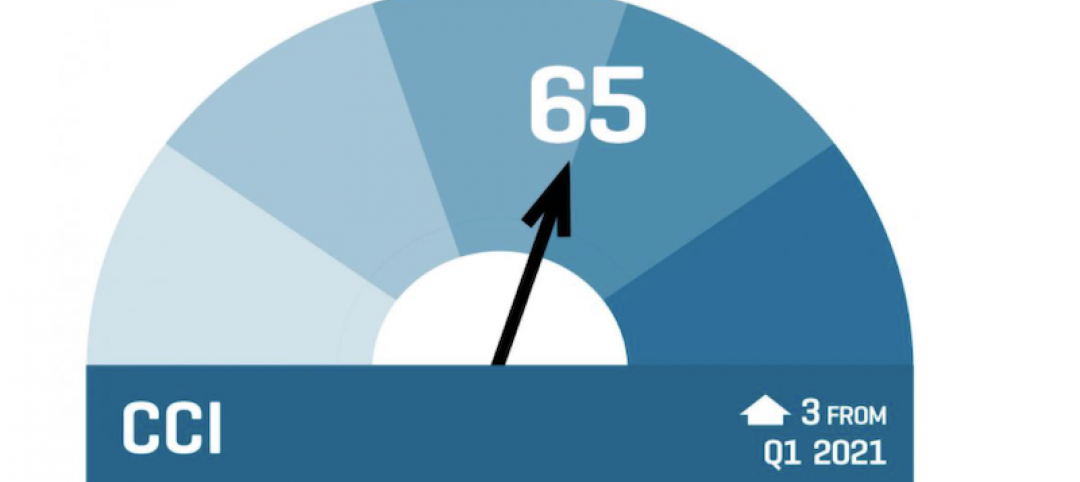

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.