Nonresidential construction spending, which rose by 3.5% in the second half of 2019, is expected to increase in 2020, albeit at a modest 2% clip, with demand projected to weaken as the year goes on.

In its Construction Outlook for the U.S. 2020, JLL attributed last year’s performance mostly to the 10.1% rise in public spending. Construction employment was up 2.1% to 6.44 million, and construction unemployment dipped to 4.5%. Indexed building costs increased 1.5% year-over-year.

In 2020, the dollar value of construction starts (according to Dodge Data & Analytics) is expected to decline by nearly 5%. And JLL expects the disparity between public and private nonres construction spending to continue.

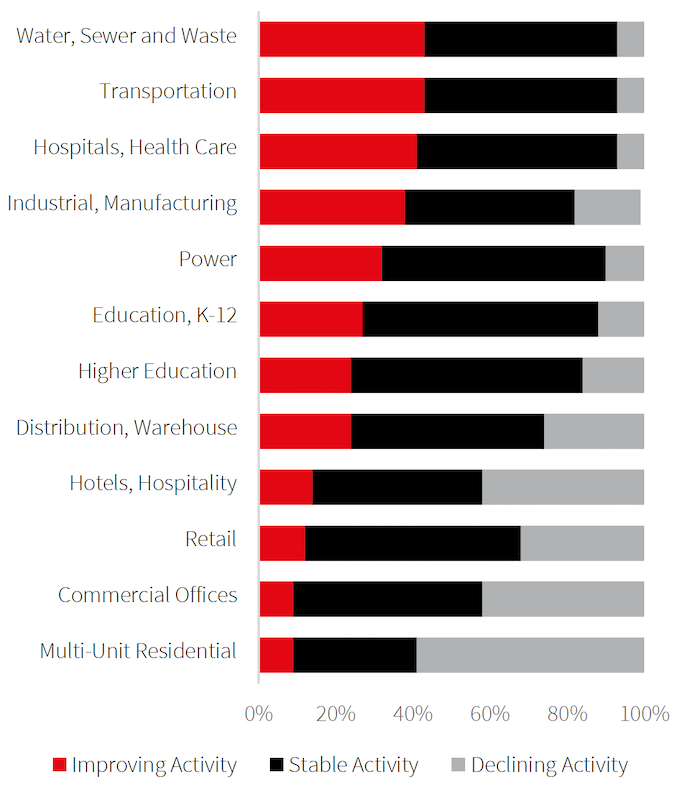

With nearly all growth in construction spending coming from public dollars, the sectors expected to do well this year will be those with the most public investment, such as transportation, education, healthcare and public safety. The reverse will be true about multifamily residential, commercial office, hotels, and retail.

JLL forecasts construction inflation to fall somewhere between 1% and 3%, and by a bit higher percentages on the labor side.

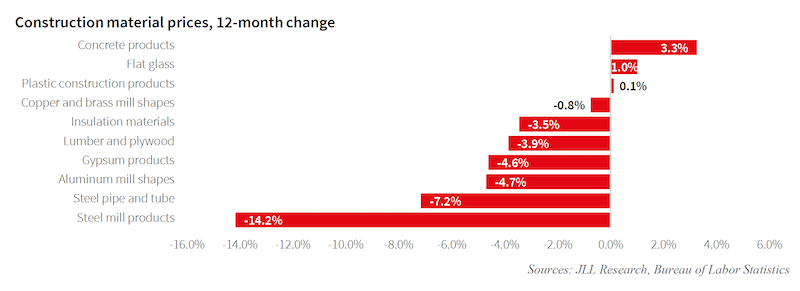

Inflation in the cost of construction materials has been held in check.

JLL was reluctant to speculate on the impact of the coronavirus on construction. But it did note that roughly between one-quarter and one-third of all construction products in the U.S. are sourced from China, so any sustained slowdown in Chinese production due to the spread of COVID 19 may cause material shortages in the U.S.

The Outlook’s projections about the U.S. economy—that it would remain strong enough in 2020 to keep the construction industry on track overall, but would not provide the private investment fuel that would be necessary for robust growth—were made before the economy appeared to be sinking into recession in mid March.

On the plus side, the Outlook points out that the ratified U.S.-Mexico-Canada Agreement is on track to be fully implemented in 2020. “The agreement brings stability to critical material markets for the construction industry, particularly for lumber, steel and aluminum,” JLL posited. Across the Pacific, the U.S. and China signed a Phase One agreement to roll back a very small portion of the tariffs that were imposed between the two countries over the past few years. Phase One represents the first time under the Trump administration that average tariff rates on Chinese imports have declined.

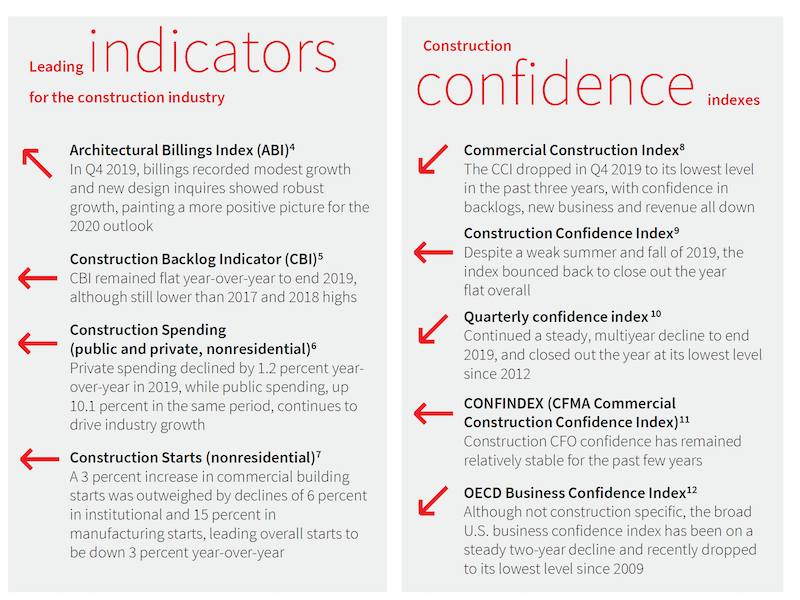

Construction confidence was flat to down in 2019, according to several measurements.

Much of the Outlook was actually devoted to recounting key metrics from last year. It points out, for example, that construction confidence was flat in 2019, while the Commercial Construction Index, as aggregated by the U.S. Chamber of Commerce and USG, dropped in the fourth quarter to its lower level in three years.

Last year, the rate of increase for construction materials eased a bit, to 3%, with most of that increase occurring in the first half of the year. Steel-mill products, in fact, experienced a 14.2% decrease over the 12-month period.

The most expensive cities with more than 150,000 people to build in last year were the usual suspects: New York, San Francisco, Chicago, Honolulu, and Fairbanks, Alaska. The least expensive were Knoxville, Tenn., Austin, Amarillo, Texas, Little Rock, Ark., and El Paso, Texas.

JLL’s Outlook also provides regional comparisons for the years 2008 through 2019. In that context, for example, warehouses were the strongest construction sector in the Midwest and Northeast, Amusement & Recreation in the West, and Auto Service/Parts in the South. The sectors with the greatest decline over that decade were bank and financial offices (Northeast and South), Multiretail (West), and houses of worship (Midwest).

As for overall growth during this 10-year period. the Northeast, West, and Midwest fell short of the national average in terms of construction backlog, while the South outperformed the country as a whole.

Related Stories

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.

Market Data | Oct 15, 2020

6 must reads for the AEC industry today: October 15, 2020

Chicago's Bank of America Tower opens and altering facilities for a post-COVID-19 world.

Market Data | Oct 14, 2020

6 must reads for the AEC industry today: October 14, 2020

Thailand's new Elephant Museum and the Art Gallery of New South Wales receives an expansion.

Market Data | Oct 13, 2020

5 must reads for the AEC industry today: October 13, 2020

Miami Beach Convention Center renovation completes and guidance offered for K-12 schools to support students with asthma.

Market Data | Oct 12, 2020

Majority of contractors fear long-term business implications of COVID-19, according to Construction Executive survey

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning.

Market Data | Oct 12, 2020

6 must reads for the AEC industry today: October 12, 2020

4 challenges of realizing BIM's value for an owner and Florida office property is designed for a post-Covid world.

Market Data | Oct 8, 2020

6 must reads for the AEC industry today: October 8, 2020

The first rendering of the National Medal of Honor Museum is unveiled and seven urgent changes needed to fix senior living.

Market Data | Oct 7, 2020

6 must reads for the AEC industry today: October 7, 2020

Water-filled windows' effect on energy and construction begins on PGA of America HQ.

Market Data | Oct 6, 2020

Construction sector adds 26,000 workers in September but nonresidential jobs stall

Many commercial firms experience project cancellations.

Market Data | Oct 6, 2020

6 must reads for the AEC industry today: October 6, 2020

Construction rises 1.4% in August while nonresidential construction spending falls slightly.