Construction spending increased by 1.4% in August as strong gains in residential construction outweighed decreases in most private nonresidential segments and many public categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that nonresidential construction demand will likely continue to stagnate without new federal measures to offset the economic impacts from the coronavirus.

“The August spending report shows a stark divide between housing and nonresidential markets that appears likely to widen over the coming months,” said Ken Simonson, the association’s chief economist. “With steadily rising business closures and worker layoffs, and growing budget gaps for state and local governments, project cancellations are likely to mount and new starts will dwindle.”

Construction spending in August totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 1.4% from July’s upwardly revised total. Residential spending jumped by 3.7%, while private and public nonresidential spending inched down by a combined 0.1%.

Private nonresidential construction spending contracted by 0.3% from July to August, with decreases in nine out of 11 categories. The two largest private nonresidential segments, power construction and commercial construction—comprising retail, warehouse and farm structures—each shrank by 1.1%. Among other large segments, manufacturing construction rose 2.2% and office construction slipped 0.3%.

Public construction spending edged up 0.1% in August but eight of 13 categories declined. Despite the increase in August, public construction spending has trended down by 2.5% from its high point in March.

Private residential construction spending increased by 3.7% in August, powered by a 5.5% jump in single-family homebuilding and a 3.0% gain in residential improvements. In contrast, new multifamily construction spending dipped by 0.1% from July.

Association officials noted that demand for nonresidential construction was being impacted by broader economic challenges brought about by the coronavirus. These challenges are impacting demand for many commercial projects while also impacting state and local construction budgets. The construction officials urged Congress and the White House to work together to enact new recovery measures to help boost economic activity and demand for construction.

“One of the biggest challenges facing the construction industry is the lack of demand for many new types of commercial and local infrastructure projects, especially after the current crop of projects is completed,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can give a needed boost to construction demand and employment by boosting infrastructure and putting in place liability protections for firms that are protecting workers from the coronavirus.”

Related Stories

Market Data | Jul 18, 2019

Construction contractors remain confident as summer begins

Contractors were slightly less upbeat regarding profit margins and staffing levels compared to April.

Market Data | Jul 17, 2019

Design services demand stalled in June

Project inquiry gains hit a 10-year low.

Market Data | Jul 16, 2019

ABC’s Construction Backlog Indicator increases modestly in May

The Construction Backlog Indicator expanded to 8.9 months in May 2019.

K-12 Schools | Jul 15, 2019

Summer assignments: 2019 K-12 school construction costs

Using RSMeans data from Gordian, here are the most recent costs per square foot for K-12 school buildings in 10 cities across the U.S.

Market Data | Jul 12, 2019

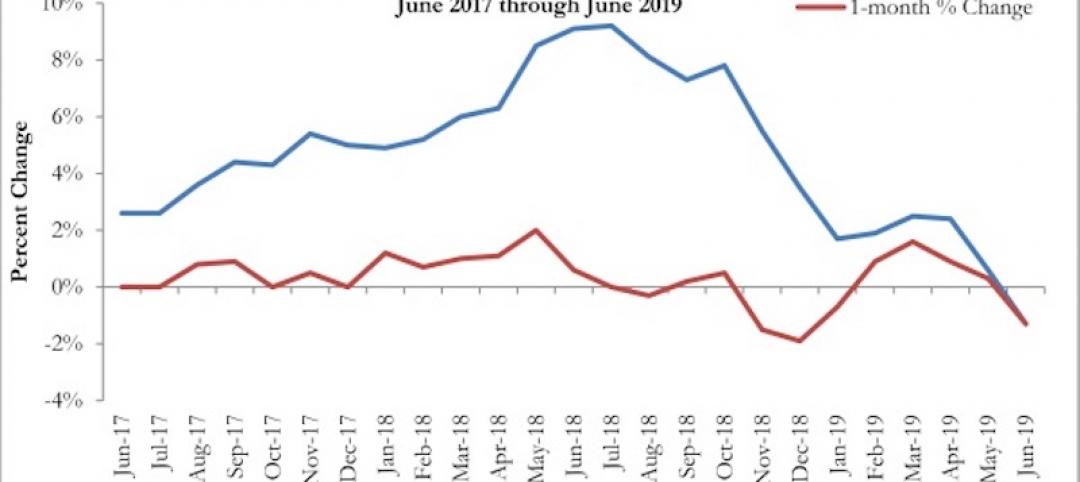

Construction input prices plummet in June

This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Market Data | Jul 1, 2019

Nonresidential construction spending slips modestly in May

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, five experienced increases in monthly spending.

Market Data | Jul 1, 2019

Almost 60% of the U.S. construction project pipeline value is concentrated in 10 major states

With a total of 1,302 projects worth $524.6 billion, California has both the largest number and value of projects in the U.S. construction project pipeline.

Market Data | Jun 21, 2019

Architecture billings remain flat

AIA’s Architecture Billings Index (ABI) score for May showed a small increase in design services at 50.2.

Market Data | Jun 19, 2019

Number of U.S. architects continues to rise

New data from NCARB reveals that the number of architects continues to increase.

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.