The construction industry continues to tackle the challenges of rising construction materials costs, a skilled labor shortage and overall lack of productivity improvements, offering an expansive opportunity for disruption. According to the newly released JLL research report, “The State of Construction Technology,” Silicon Valley investors are stepping in to seize that opportunity. Venture capital funds are funneling unprecedented levels of cash into Construction Technology startups’ pockets.

In the first half of 2018, venture capital firms invested $1.05 billion in global construction tech startups, setting a record high. The 2018 investment volume is already up nearly 30 percent over the 2017 total, with six months still remaining in the year. To date, the Construction Technology sector has found three Unicorns—startups valued at more than $1 billion—in Katerra, Procore and Uptake.

“The construction sector is on the verge of major disruption as tech start-ups tackle head-on the industry’s biggest pressure points,” says Todd Burns, President, Project and Development Services, JLL. “These startups can provide technology that helps deliver projects faster, cheaper and with fewer resources than ever before, effectively addressing the existing challenges in the industry.”

Emerging technology is opening a significant opportunity for venture capitalists and construction executives. JLL recognized this opportunity early, and last year brought on two Silicon Valley veterans to launch JLL Spark, a global business that identifies and delivers new technology-driven real estate service offerings, including a $100 million global venture fund.

JLL’s research uncovered three primary focus areas of construction tech startups:

1. Collaboration software. Considering that dozens of professionals can be working on a given construction project at the same time, leveraging cloud-based software to optimize the workflow could profoundly improve collaboration and impact the bottom line. Front-runners such as Procore Technologies, PlanGrid, Clarizen and Flux Factory are utilizing cloud capabilities, mobile platforms and dedicated design software to enable collaboration.

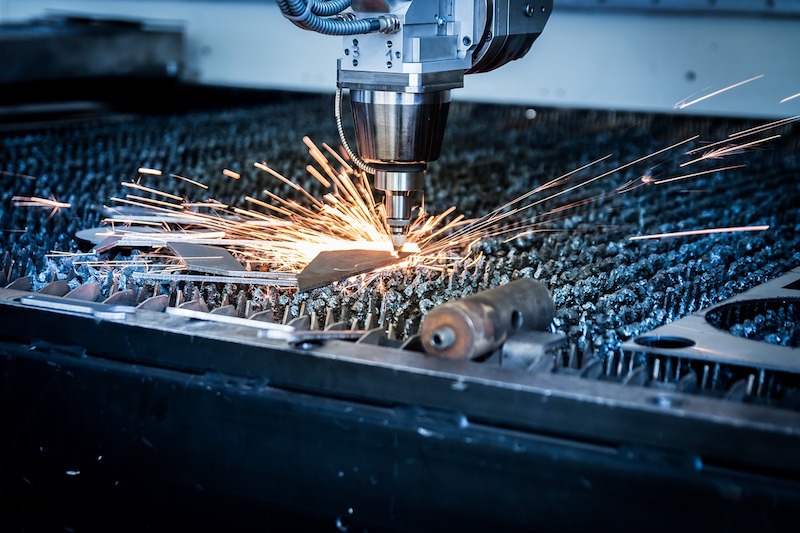

2. Offsite construction. As skilled construction labor becomes harder to find and general competition for construction inputs heats up, offsite construction startups are championing a different approach to how buildings are built: building component manufacturing. Offsite manufacturing and delivery of finalized components to the construction site equals shorter assembly time and more centralized production to help offset the labor pinch and rising costs. Industry leaders include Katerra, Blu Homes and Project Frog.

3. Big data and artificial intelligence (AI). From materials delivery to equipment maintenance, predictive data and automation tools can collect data on nearly every aspect of a construction project, resulting in data pools at risk of going to waste. Armed with big data and AI software, construction teams can make more informed business decisions to save time and money by extending the life of expensive equipment, reducing worksite risk and automating simple business processes. Top startups in this area include Uptake Technologies, Flux Factory and SmartEquip.

Since 2009, investors have closed 478 Construction Technology funding deals totaling $4.34 billion, underscoring the continued volume of construction projects and the recent urgency to innovate and offset industry costs. The huge bump in Construction Technology investment in 2018 is hopeful proof of an impending surge of technology and hardware marvels, promising to optimize the industry.

Related Stories

| Jan 9, 2015

Santiago Calatrava talks with BBC about St. Nicholas Church on Ground Zero

Calatrava reveals that he wanted to retain the “tiny home” feel of the original church building that was destroyed with the twin towers on 9/11.

Smart Buildings | Jan 7, 2015

NIBS report: Small commercial buildings offer huge energy efficiency retrofit opportunities

The report identifies several barriers to investment in such retrofits, such as the costs and complexity associated with relatively small loan sizes, and issues many small-building owners have in understanding and trusting predicted retrofit outcomes.

| Jan 7, 2015

University of Chicago releases proposed sites for Obama library bid

There are two proposed sites for the plan, both owned by the Chicago Park District in Chicago’s South Side, near the university’s campus in Hyde Park, according to the Chicago Sun-Times.

| Jan 7, 2015

4 audacious projects that could transform Houston

Converting the Astrodome to an urban farm and public park is one of the proposals on the table in Houston, according to news site Houston CultureMap.

| Jan 6, 2015

Snøhetta unveils design proposal of the Barack Obama Presidential Center Library for the University of Hawaii

The plan by Snøhetta and WCIT Architecture features a building that appears square from the outside, but opens at one corner into a rounded courtyard with a pool, Dezeen reports.

| Jan 2, 2015

S&ME to acquire Littlejohn

Companies plan to join forces, combining their strengths to create a leading engineering, design, planning, environmental and construction services firm.

| Dec 19, 2014

Zaha Hadid unveils dune-shaped HQ for Emirati environmental management company

Zaha Hadid Architects released designs for the new headquarters of Emirati environmental management company Bee’ah, revealing a structure that references the shape and motion of a sand dune.

| Dec 18, 2014

International Parking Institute and Green Parking Council collaborate with GBCI

The new collaboration recognizes importance of sustainable parking facility design and management to the built environment.

| Dec 17, 2014

USGBC announces 2014 Best of Green Schools honorees

Houston's Monarch School was named the K-12 school of the year, and Western Michigan University was honored as the top higher-ed institution, based on environmental programs and education efforts.

| Dec 17, 2014

ULI report looks at growing appeal of micro unit apartments

New research from the Urban Land Institute suggests that micro units have staying power as a housing type that appeals to urban dwellers in high-cost markets who are willing to trade space for improved affordability and proximity to downtown neighborhoods.