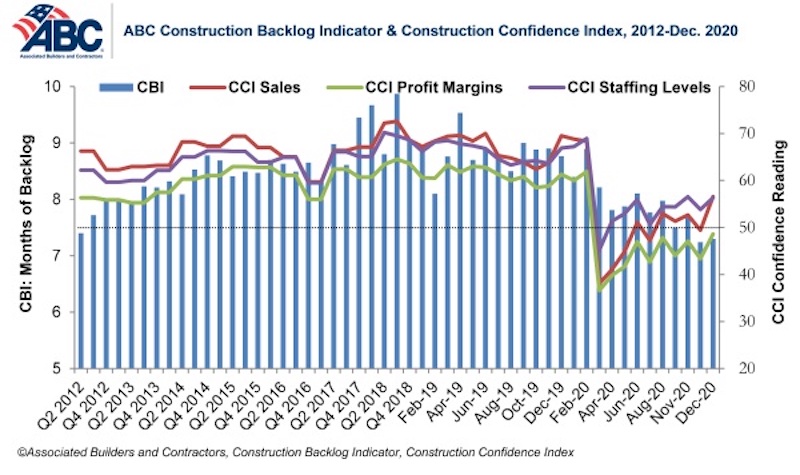

Associated Builders and Contractors reported today that its Construction Backlog Indicator rebounded modestly to 7.3 months in December, an increase of 0.1 months from November’s reading, according to an ABC member survey conducted from Dec. 18 to Jan. 5. Backlog is 1.5 months lower than in December 2019.

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December. The sales index climbed above the threshold of 50, indicating contractors expect to grow sales over the next six months. The index reading for profit margins remained below that threshold. The staffing level index increased to 56.3 but remains well below its December 2019 reading.

“While many contractors enter 2021 with significant trepidation, the most recent backlog and confidence readings suggest that the onset of vaccinations has generally led to more upbeat assessments regarding nonresidential construction’s future,” said ABC Chief Economist Anirban Basu. “Backlog is down substantially from its year-ago level and profit margins remain under pressure, yet many contractors expect to enjoy higher sales and to support more staff six months from now.

“The baseline expectation is that by the spring, the U.S. economy will blossom,” said Basu. “With many households sitting on mounds of savings and sustaining pent-up demand for many goods and services, the U.S. economy is set for rapid growth as it reopens more fully during mid to late 2021. While it will take time for that to fully translate into new construction projects, some that were postponed earlier during the pandemic are likely to come back to life over the next several months. That should help many contractors begin to rebuild backlog, and to eagerly await 2022.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Multifamily Housing | Aug 12, 2016

Apartment completions in largest metros on pace to increase by 50% in 2016

Texas is leading this multifamily construction boom, according to latest RENTCafé estimates.

Market Data | Jul 29, 2016

ABC: Output expands, but nonresidential fixed investment falters

Nonresidential fixed investment fell for a third consecutive quarter, as indicated by Bureau of Economic Analysis data.

Industry Research | Jul 26, 2016

AIA consensus forecast sees construction spending on rise through next year

But several factors could make the industry downshift.

Architects | Jul 20, 2016

AIA: Architecture Billings Index remains on solid footing

The June ABI score was down from May, but the figure was positive for the fifth consecutive month.

Market Data | Jul 7, 2016

Airbnb alleged to worsen housing crunch in New York City

Allegedly removing thousands of housing units from market, driving up rents.

Market Data | Jul 6, 2016

Construction spending falls 0.8% from April to May

The private and public sectors have a combined estimated seasonally adjusted annual rate of $1.14 trillion.

Market Data | Jul 6, 2016

A thriving economy and influx of businesses spur construction in downtown Seattle

Development investment is twice what it was five years ago.

Multifamily Housing | Jul 5, 2016

Apartments continue to shrink, rents continue to rise

Latest survey by RENTCafé tracks size changes in 95 metros.

Multifamily Housing | Jun 22, 2016

Can multifamily construction keep up with projected demand?

The Joint Center for Housing Studies’ latest disection of America’s housing market finds moderate- and low-priced rentals in short supply.

Contractors | Jun 21, 2016

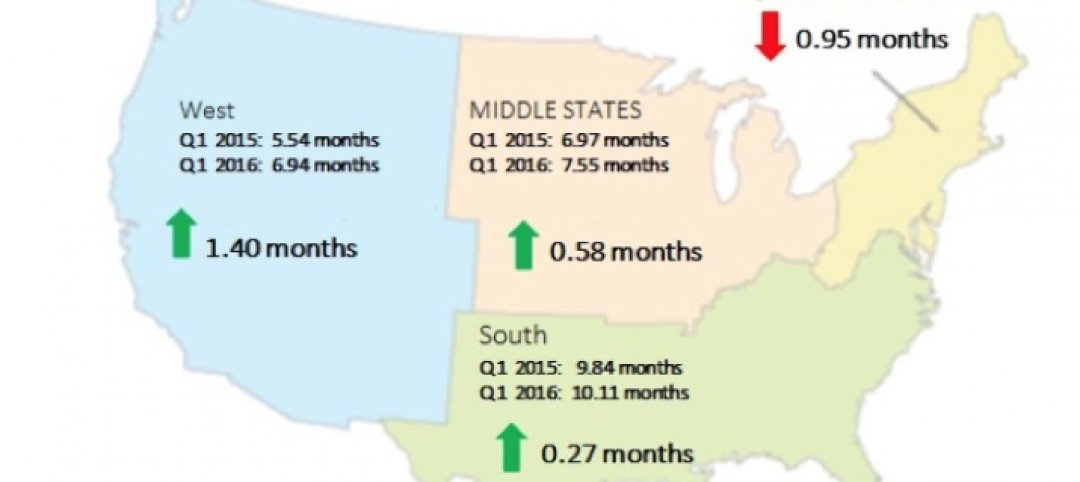

Bigness counts when it comes to construction backlogs

Large companies that can attract talent are better able to commit to more work, according to a national trade group for builders and contractors.