Healthcare consumers are just as likely to factor in convenience as they do cost when deciding where to seek care and from whom, according to a new survey of 4,037 American adults about their attitudes and preferences as patients.

The survey, conducted from April 19-28 by JLL, in many ways confirms the obvious: that older generations seek preventive care more often than younger generations; that insurance coverage is a primary driver for choosing a provider or hospital; and that the quality of service affects the patient experience.

Nearly eight of 10 of the survey’s respondents had received at least one type of non-dental care in the last year. Women, who accounted for 51% of the survey’s respondents, are more likely to receive care overall, but men are more likely to receive emergency care.

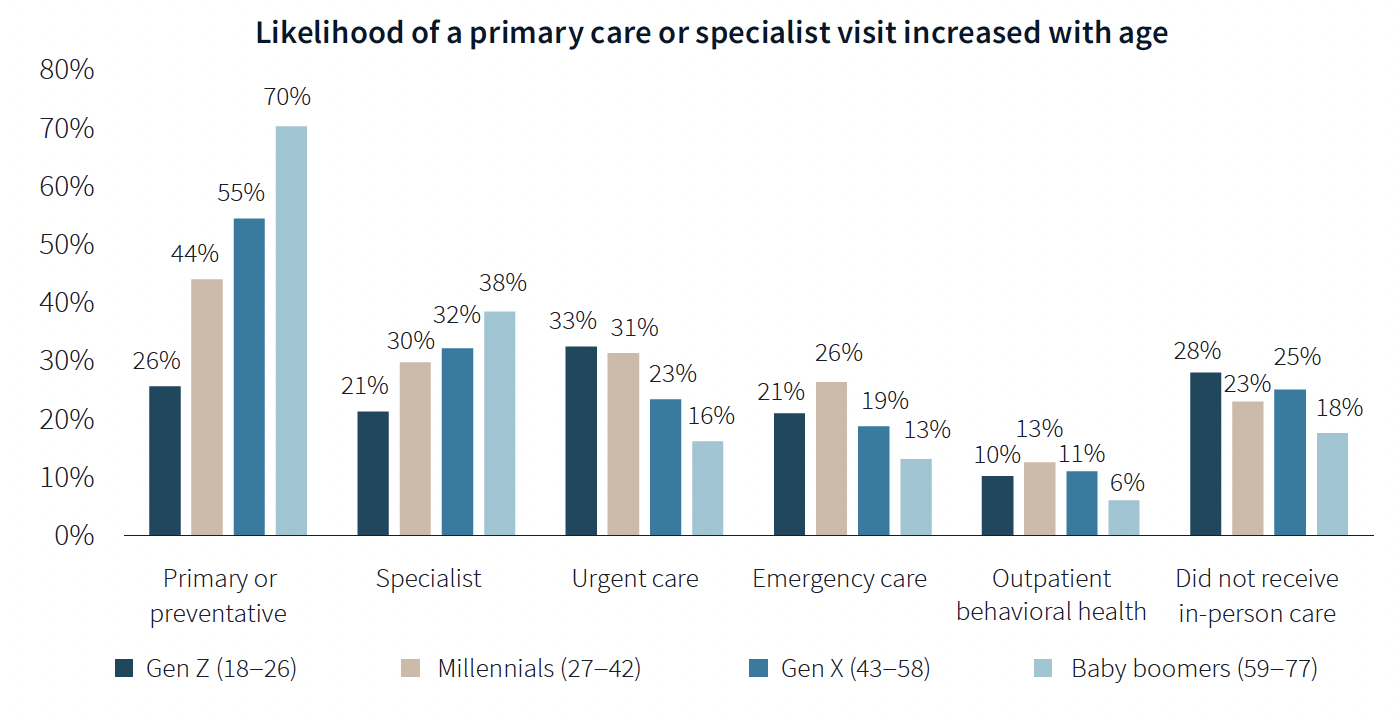

The likelihood of a primary care or specialist visit increases with age: 80% of adults 65 years or older have two or more chronic conditions that require continuous care. More than 70% of Baby Boomers (who accounted for 29% of the survey’s respondents) had received primary or preventive care within the last year, compared to only 26% of Generation Z.

Younger generations are more reactive than preventive in their healthcare decisions, borne out by the survey’s finding that Millennials and Gen Zs (43% of the survey's respondents) are more likely to receive urgent care, emergency care, and outpatient behavioral healthcare than older adults.

Proximity to patients counts

When care is urgently needed, “decision factors are simplified,” the survey states, and location and proximity of care are ranked higher as decision-making factors. But even outside of emergencies, convenience ranks high among factors for patients seeking care.

There’s no denying that cost is always in the background of any healthcare decision. “Accept my insurance” was the most common factor for choosing a provider among the survey’s respondents. (82% of participants has private insurance, and 81% has public insurance.)

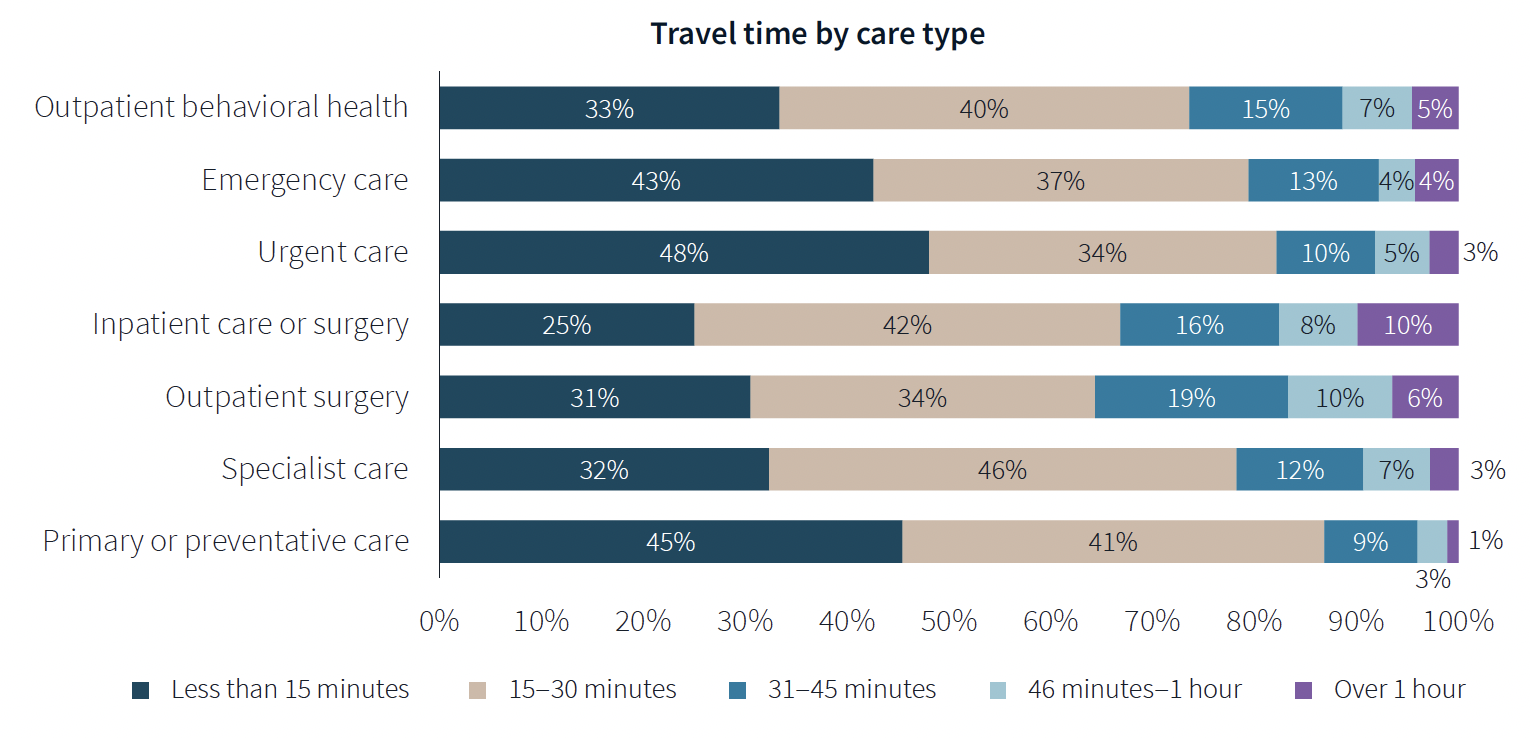

Two-fifths of respondents said they travel less than 15 minutes to receive care, and nearly eight of 10 respondents travel less than 30 minutes. Among those with appointments in standalone medical offices, 85% ranked location as convenience, which the survey suggested indicates the advantages of a dispersed location strategy.

“A strong location strategy can improve reach for health systems and physician practices and potentially improve care outcomes,” JLL writes. “But there is a balance between convenience and cost—health systems need to balance the benefits of being close to their target population with the cost of a new facility or doctors’ time in transit from a local clinic to the hospital.”

Convenience is also key both in location and in being able to navigate to care. Patients want to get to care quickly and get on with their day. Ease of parking and ability to navigate the facility also affected a facility’s net positive score in the survey.

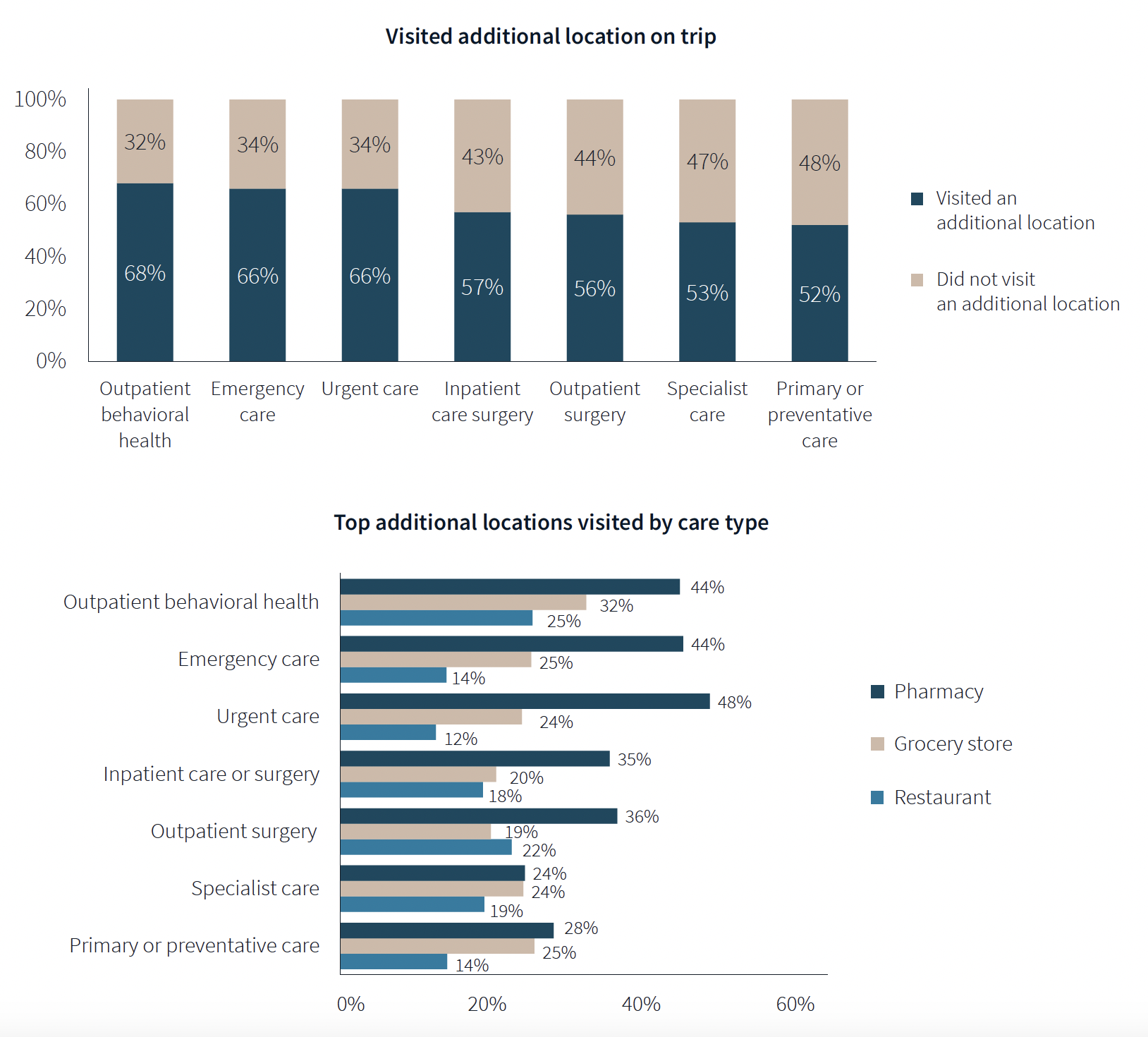

One of the survey’s more revealing findings is that nearly three-fifths of respondents—58%—went to another location—such as a pharmacy, or an urgent clinic—as part of their trip for healthcare.

Word of mouth often defines quality of care

Patients seem to be open to diverse care choices. For example, 29% said they have visited a retail clinic, such as a CVS, and would do so again. Gen Z and Millennials are more likely to frequent retail clinics for their convenient appointment schedules and shorter wait times.

More than two-fifths of respondents—42%—had a telehealth appointment within the last year, which was slightly down from the 45% in JLL’s 2022 survey. This year’s poll also found that 29% of telehealth appointments led to an in-person visit.

More than 40% of respondents ranked “reputation of quality” among the top five factors for choosing care. But where they get their impressions about quality varies.

Referrals play a larger role in specialist, outpatient surgery and inpatient care. Recommendations from friends ranked most highly for behavioral health, given the personal nature of such care, and was ranked in the top five by 31% of respondents. Younger patients, who “have yet to develop brand loyalty,” according to the survey, are more likely to rely on word-of-mouth recommendations than older patients for whom hospital systems’ reps matter more.

Outpatient surgery and primary care ranked highest for provider satisfaction; emergency care ranked lowest. Participants ranked their experiences on 12 aspects of care, and the biggest gap between “promoters” and “detractors” was for the service level of providers. Primary care had the highest net provider score, with 86% of respondents ranking its care as “attentive.”

Some amenities draw patients

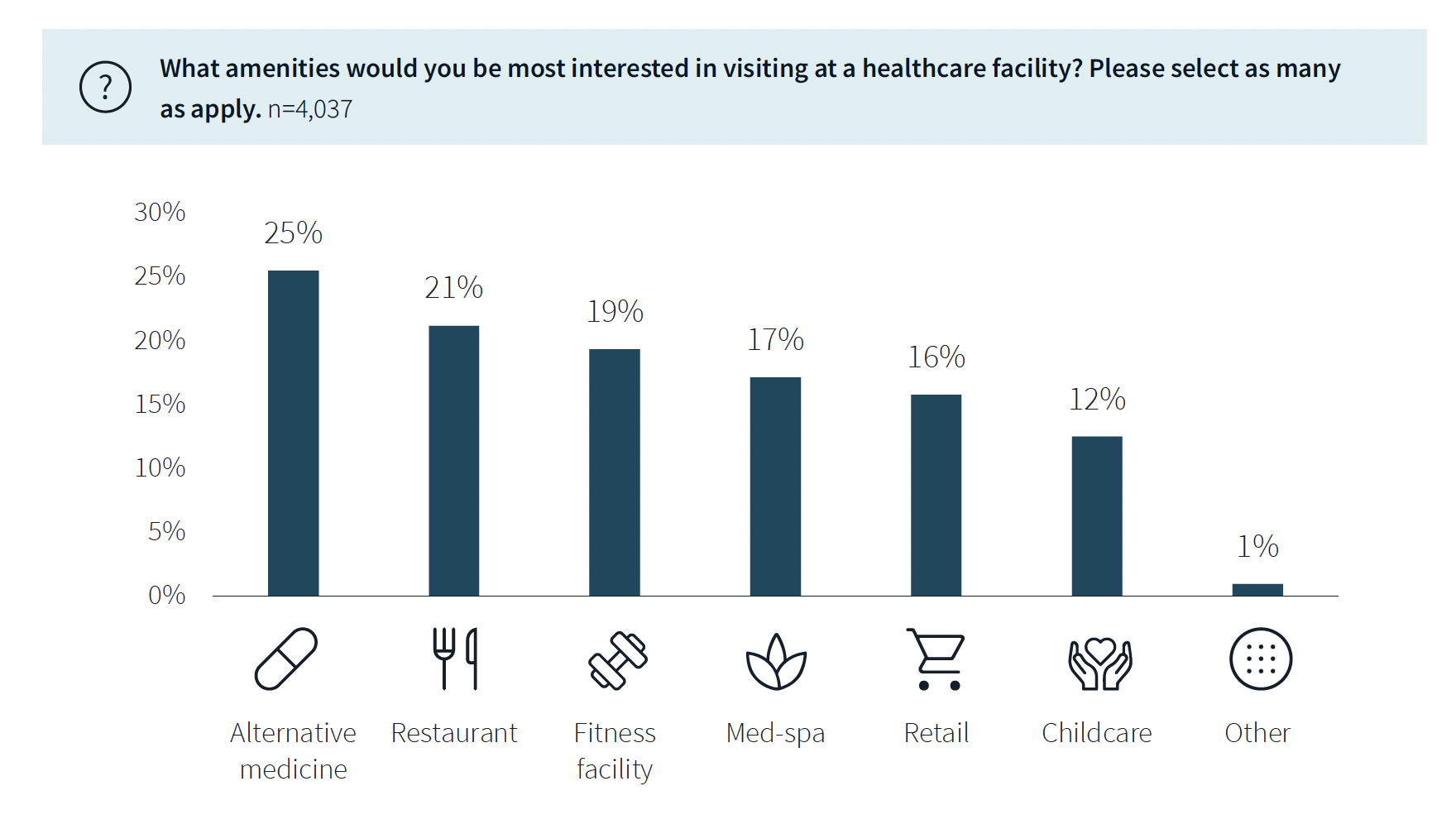

While not a decision-making factor, amenities do attract some patients. Among the survey’s respondents, 63% said they would be interested in visiting a healthcare facility with an additional amenity, such as alternative medicine, a restaurant, fitness center, or spa. (This inclination was more evident among younger respondents.)

The overall quality of facilities, including the comfort of their waiting rooms, can impact a patient’s choice, especially for inpatient, urgent, and emergency care. The survey also found that urban locations have lower favorability rankings for their facilities, signaling room for improvement. (Just under half—48%—of respondents live in the suburbs.)

Related Stories

| Jan 30, 2014

The evolving workplace: One designer's inspiration board

"Open office" has been a major buzzword for decades, and like any buzzword, some of the novelty has worn off. I don't believe we will abandon the open office, but I do think we need to focus on providing a dynamic mix of open and closed spaces.

| Jan 30, 2014

What's in store for healthcare capital markets in 2014?

Despite the shake up stemming from the Affordable Care Act, 2014 will be an active year in healthcare capital markets, according to real estate experts from CBRE Healthcare.

| Jan 28, 2014

16 awe-inspiring interior designs from around the world [slideshow]

The International Interior Design Association released the winners of its 4th Annual Global Excellence Awards. Here's a recap of the winning projects.

| Jan 13, 2014

Custom exterior fabricator A. Zahner unveils free façade design software for architects

The web-based tool uses the company's factory floor like "a massive rapid prototype machine,” allowing designers to manipulate designs on the fly based on cost and other factors, according to CEO/President Bill Zahner.

| Jan 11, 2014

Getting to net-zero energy with brick masonry construction [AIA course]

When targeting net-zero energy performance, AEC professionals are advised to tackle energy demand first. This AIA course covers brick masonry's role in reducing energy consumption in buildings.

| Jan 9, 2014

Harley Ellis Devereaux, BFHL Architects announce merger

Effective January 1, 2014, Ralph Lotito and Brett Paloutzian have merged BFHL, comprising 15 healthcare architects, with Harley Ellis Devereaux. A national architecture and engineering firm in practice since 1908, Harley Ellis Devereaux has offices in Chicago, Detroit, Los Angeles, San Diego and San Francisco, CA.

Smart Buildings | Jan 7, 2014

9 mega redevelopments poised to transform the urban landscape

Slowed by the recession—and often by protracted negotiations—some big redevelopment plans are now moving ahead. Here’s a sampling of nine major mixed-use projects throughout the country.

| Dec 20, 2013

Top healthcare sector trends for 2014 (and beyond)

Despite the lack of clarity regarding many elements of healthcare reform, there are several core tenets that will likely continue to drive transition within the healthcare industry.

| Dec 17, 2013

IBM's five tech-driven innovation predictions for the next five years [infographics]

Smart classrooms, DNA-based medical care, and wired cities are among the technology-related innovations identified by IBM researchers for the company's 5 in 5 report.

| Dec 17, 2013

CBRE's Chris Bodnar and Lee Asher named Healthcare Real Estate Executives of the Year

CBRE Group, Inc. announced today that two of its senior executives, Chris Bodnar and Lee Asher, have been named Healthcare Real Estate Executives of the Year by Healthcare Real Estate Insights.