Healthcare consumers are just as likely to factor in convenience as they do cost when deciding where to seek care and from whom, according to a new survey of 4,037 American adults about their attitudes and preferences as patients.

The survey, conducted from April 19-28 by JLL, in many ways confirms the obvious: that older generations seek preventive care more often than younger generations; that insurance coverage is a primary driver for choosing a provider or hospital; and that the quality of service affects the patient experience.

Nearly eight of 10 of the survey’s respondents had received at least one type of non-dental care in the last year. Women, who accounted for 51% of the survey’s respondents, are more likely to receive care overall, but men are more likely to receive emergency care.

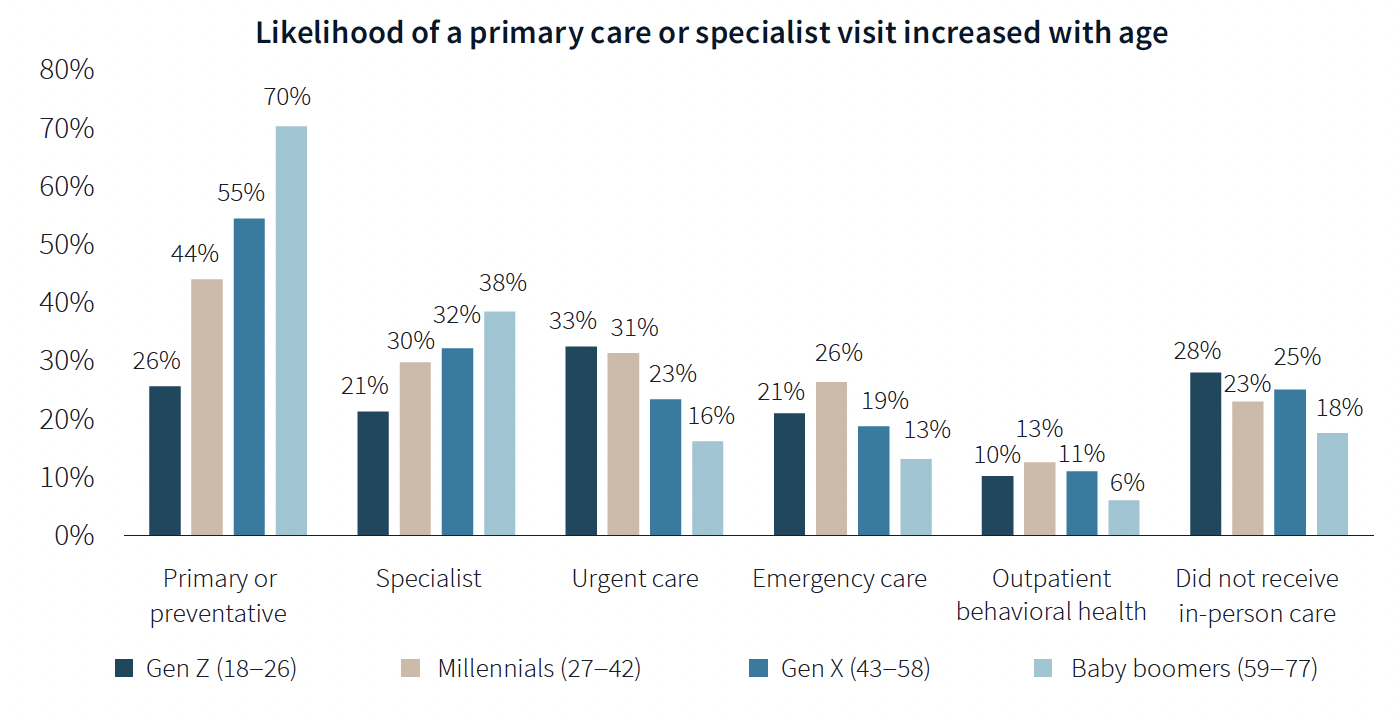

The likelihood of a primary care or specialist visit increases with age: 80% of adults 65 years or older have two or more chronic conditions that require continuous care. More than 70% of Baby Boomers (who accounted for 29% of the survey’s respondents) had received primary or preventive care within the last year, compared to only 26% of Generation Z.

Younger generations are more reactive than preventive in their healthcare decisions, borne out by the survey’s finding that Millennials and Gen Zs (43% of the survey's respondents) are more likely to receive urgent care, emergency care, and outpatient behavioral healthcare than older adults.

Proximity to patients counts

When care is urgently needed, “decision factors are simplified,” the survey states, and location and proximity of care are ranked higher as decision-making factors. But even outside of emergencies, convenience ranks high among factors for patients seeking care.

There’s no denying that cost is always in the background of any healthcare decision. “Accept my insurance” was the most common factor for choosing a provider among the survey’s respondents. (82% of participants has private insurance, and 81% has public insurance.)

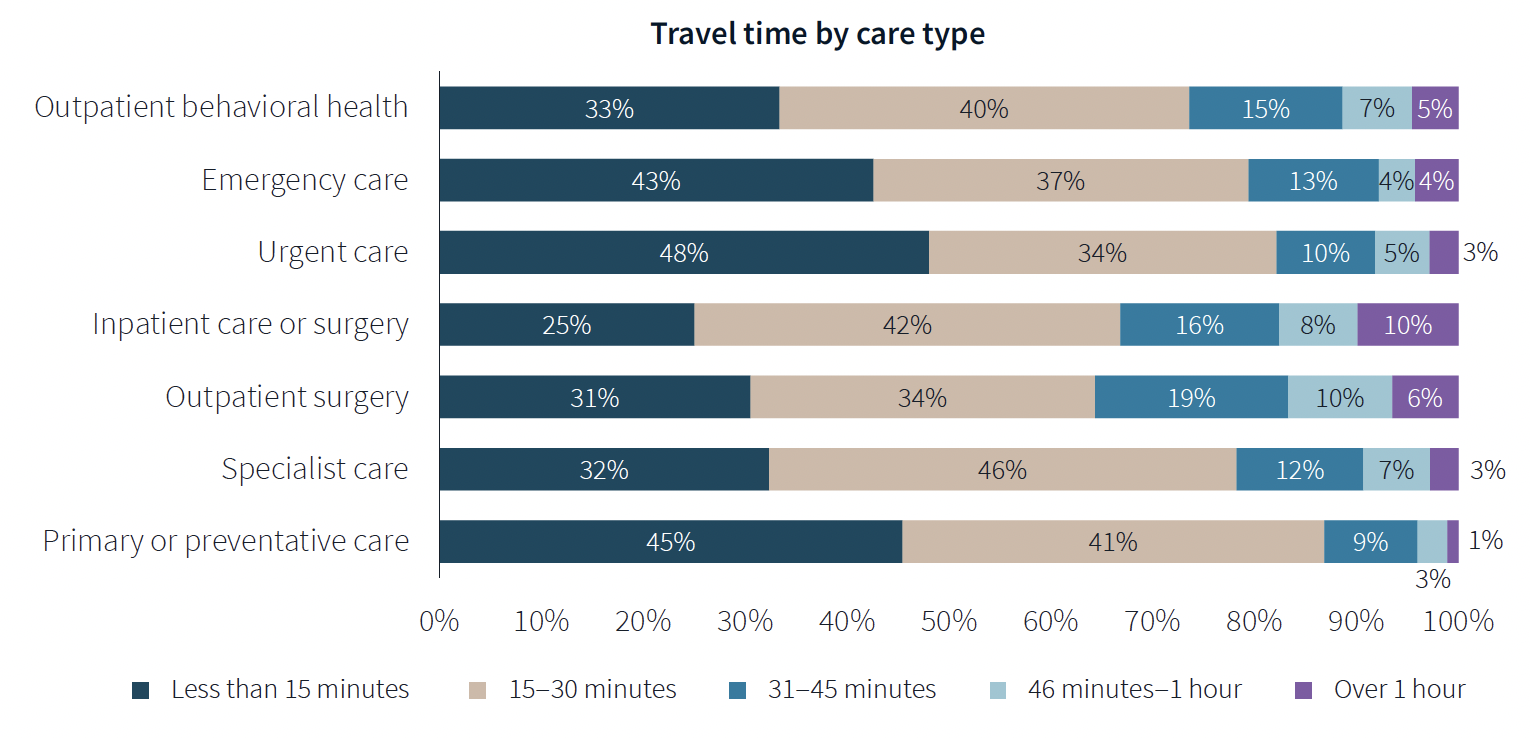

Two-fifths of respondents said they travel less than 15 minutes to receive care, and nearly eight of 10 respondents travel less than 30 minutes. Among those with appointments in standalone medical offices, 85% ranked location as convenience, which the survey suggested indicates the advantages of a dispersed location strategy.

“A strong location strategy can improve reach for health systems and physician practices and potentially improve care outcomes,” JLL writes. “But there is a balance between convenience and cost—health systems need to balance the benefits of being close to their target population with the cost of a new facility or doctors’ time in transit from a local clinic to the hospital.”

Convenience is also key both in location and in being able to navigate to care. Patients want to get to care quickly and get on with their day. Ease of parking and ability to navigate the facility also affected a facility’s net positive score in the survey.

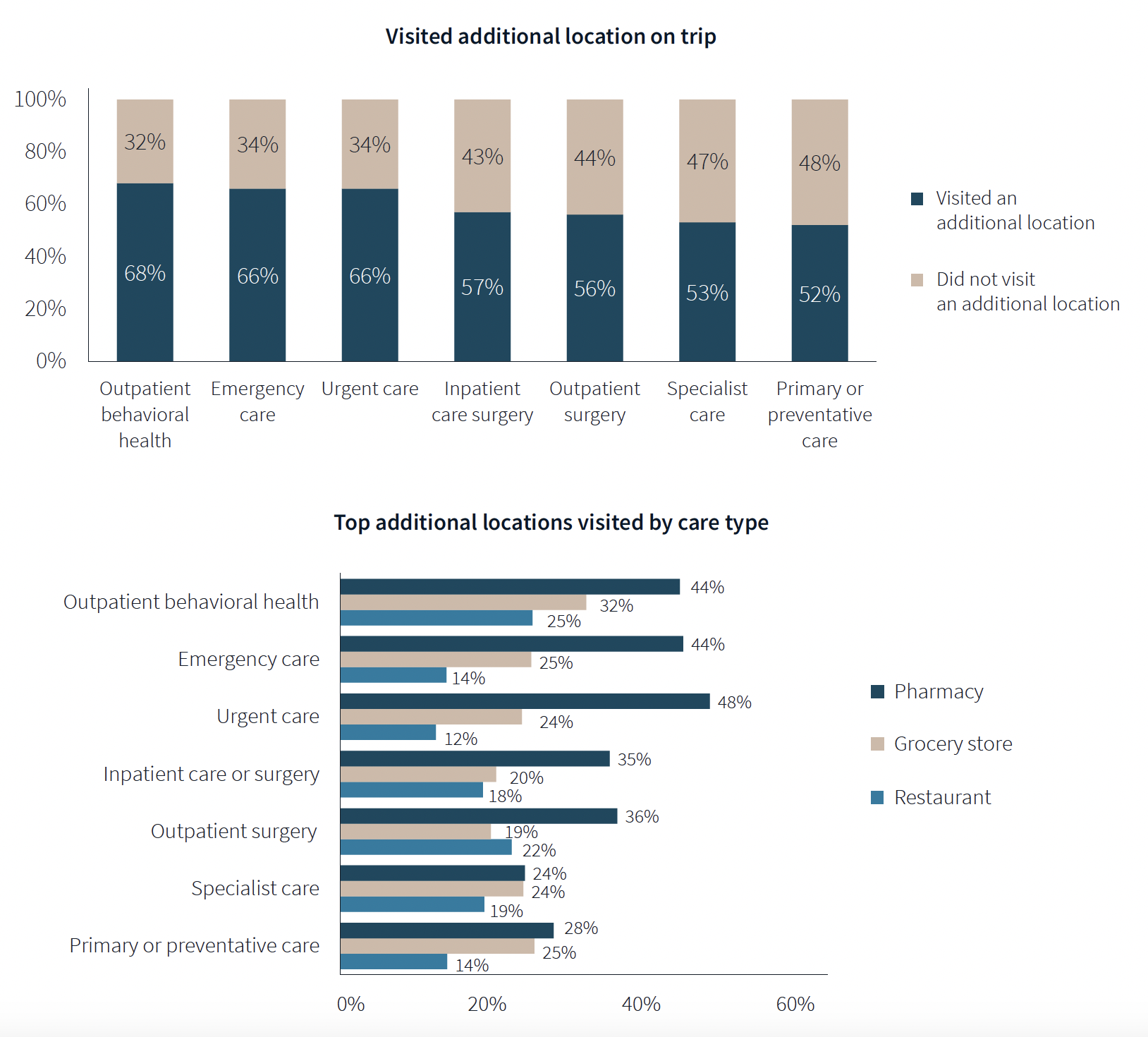

One of the survey’s more revealing findings is that nearly three-fifths of respondents—58%—went to another location—such as a pharmacy, or an urgent clinic—as part of their trip for healthcare.

Word of mouth often defines quality of care

Patients seem to be open to diverse care choices. For example, 29% said they have visited a retail clinic, such as a CVS, and would do so again. Gen Z and Millennials are more likely to frequent retail clinics for their convenient appointment schedules and shorter wait times.

More than two-fifths of respondents—42%—had a telehealth appointment within the last year, which was slightly down from the 45% in JLL’s 2022 survey. This year’s poll also found that 29% of telehealth appointments led to an in-person visit.

More than 40% of respondents ranked “reputation of quality” among the top five factors for choosing care. But where they get their impressions about quality varies.

Referrals play a larger role in specialist, outpatient surgery and inpatient care. Recommendations from friends ranked most highly for behavioral health, given the personal nature of such care, and was ranked in the top five by 31% of respondents. Younger patients, who “have yet to develop brand loyalty,” according to the survey, are more likely to rely on word-of-mouth recommendations than older patients for whom hospital systems’ reps matter more.

Outpatient surgery and primary care ranked highest for provider satisfaction; emergency care ranked lowest. Participants ranked their experiences on 12 aspects of care, and the biggest gap between “promoters” and “detractors” was for the service level of providers. Primary care had the highest net provider score, with 86% of respondents ranking its care as “attentive.”

Some amenities draw patients

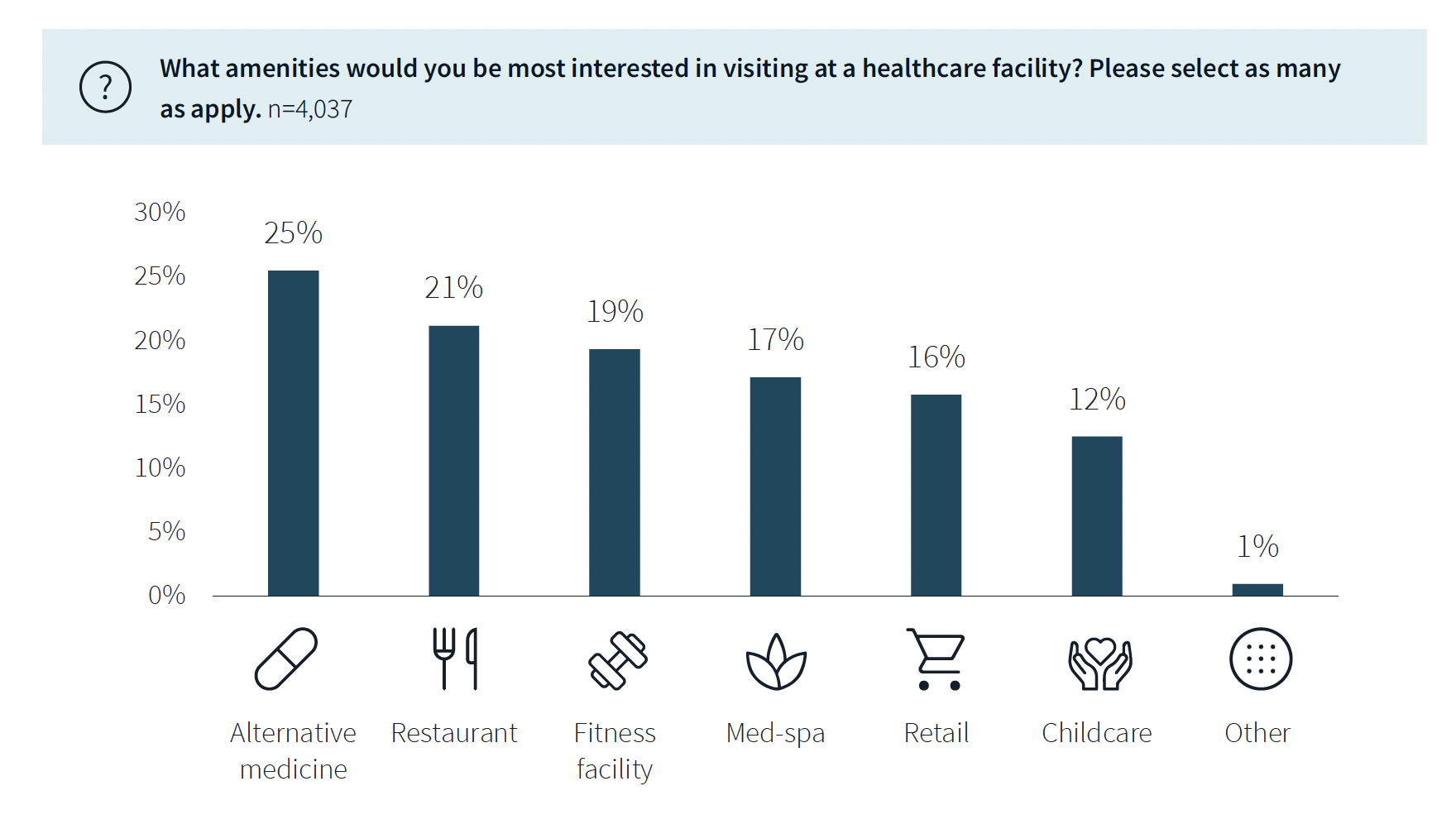

While not a decision-making factor, amenities do attract some patients. Among the survey’s respondents, 63% said they would be interested in visiting a healthcare facility with an additional amenity, such as alternative medicine, a restaurant, fitness center, or spa. (This inclination was more evident among younger respondents.)

The overall quality of facilities, including the comfort of their waiting rooms, can impact a patient’s choice, especially for inpatient, urgent, and emergency care. The survey also found that urban locations have lower favorability rankings for their facilities, signaling room for improvement. (Just under half—48%—of respondents live in the suburbs.)

Related Stories

| Feb 28, 2012

Griffin Electric completes Medical University of South Carolina project

The 210,000-sf complex is comprised of two buildings, and houses research, teaching and office areas, plus conference spaces for the University.

| Feb 22, 2012

CISCO recognizes Gilbane for quality construction, design, and safety

The project employed more than 2,000 tradespeople for a total of 2.1 million hours worked – all without a single lost-time accident.

| Feb 14, 2012

The Jackson Laboratory announces Gilbane Building Co. as program manager for Connecticut facility

Gilbane to manage program for new genomic medicine facility that will create 300 jobs in Connecticut.

| Feb 13, 2012

WHR Architects renovation of Morristown Memorial Hospital Simon Level 5 awarded LEED Gold

Located in the Simon Building, which serves as the main entrance leading into the Morristown Memorial Hospital campus, the project comprises three patient room wings connected by a centralized nursing station and elevator lobby.

| Feb 13, 2012

New medical city unveiled in Abu Dhabi

SOM’s design for the 838-bed, three-million-square foot complex creates a new standard for medical care in the region.

| Feb 10, 2012

Mortenson Construction research identifies healthcare industry and facility design trends

The 2012 Mortenson Construction Healthcare Industry Study includes insights and perspectives regarding government program concerns, the importance of lean operations, flexible facility design, project delivery trends, improving patient experience, and evidence-based design.

| Jan 31, 2012

Fusion Facilities: 8 reasons to consolidate multiple functions under one roof

‘Fusing’ multiple functions into a single building can make it greater than the sum of its parts. The first in a series on the design and construction of university facilities.

| Jan 31, 2012

Suffolk Construction to manage Lawrence & Memorial Hospital Cancer Center project in Waterford, Conn.

Leading construction management firm overseeing one of first healthcare projects in the country to utilize innovative IPD process.

| Jan 16, 2012

Suffolk completes construction on progressive operating suite

5,700 square-foot operating suite to be test bed for next generation of imaged-guided operating techniques.

| Jan 4, 2012

HDR to design North America’s first fully digital hospital

Humber River is the first hospital in North America to fully integrate and automate all of its processes; everything is done digitally.