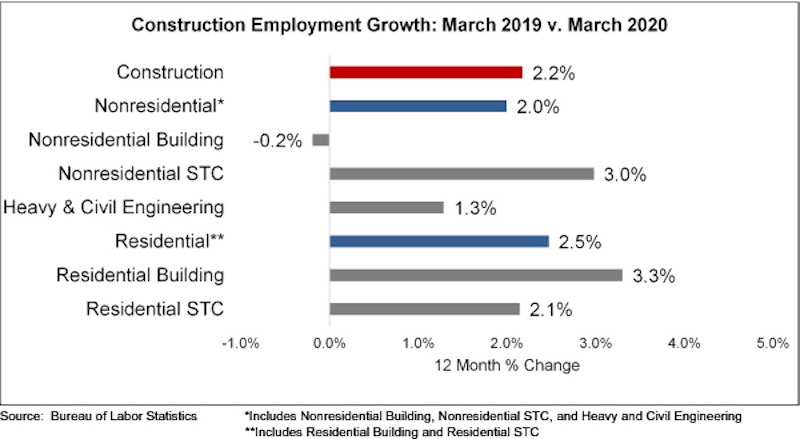

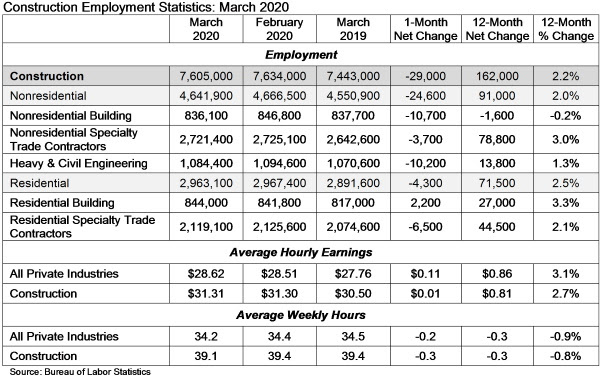

Construction industry employment declined by 29,000 in March, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Nonresidential construction employment declined by 24,600 in March.

All three nonresidential segments registered job losses, with the largest decrease experienced in nonresidential building (-10,700) followed closely by heavy and civil engineering (-10,200). Nonresidential specialty trade lost 3,700 jobs on net.

The construction unemployment rate was 6.9% in March, up 1.7 percentage points from the same time one year ago. Unemployment across all industries rose from 3.5% in February to 4.4% last month, a direct result of the global pandemic.

“So ends the lengthiest expansion in American economic history,” said ABC Chief Economist Anirban Basu. “The expansion was associated with dramatic asset price increases, multi-decade lows in unemployment, persistently low costs of capital and a thriving U.S. nonresidential construction sector. While the March jobs report is horrific, ending a 113-month streak of employment gains, it is clear that employment reports in future months are likely to be even worse.

“What remains unclear is the extent to which estimated construction employment declines are due to mandated suspension of projects in Massachusetts, Pennsylvania, California and elsewhere, and how much of this is due to the emergence of recessionary forces,” said Basu. “Generally, nonresidential construction is one of the last segments of the economy to enter recession as contractors continue to work down their collective backlog, which stood at 8.9 months in ABC’s Construction Backlog Indicator. The need for social distancing renders that statistic less pertinent, meaning that nonresidential construction is susceptible to large-scale job losses immediately.

“While the recently passed stimulus package is massive and helps support the payments side of the economy, economic recovery will remain elusive until the COVID-19-engendered crisis is behind us,” said Basu. “While that is obvious, many people are still looking to compare the current crisis to other episodes in American history, including the Great Recession. As a practical matter, this period defies comparison, and must be understood on its own. Based on what is known, the downturn will be vicious. The good news is that this crisis may finally induce policymakers to fashion and implement a long-awaited infrastructure stimulus package.”

Related Stories

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Market Data | Apr 1, 2024

Nonresidential construction spending dips 1.0% in February, reaches $1.179 trillion

National nonresidential construction spending declined 1.0% in February, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.179 trillion.

Market Data | Mar 26, 2024

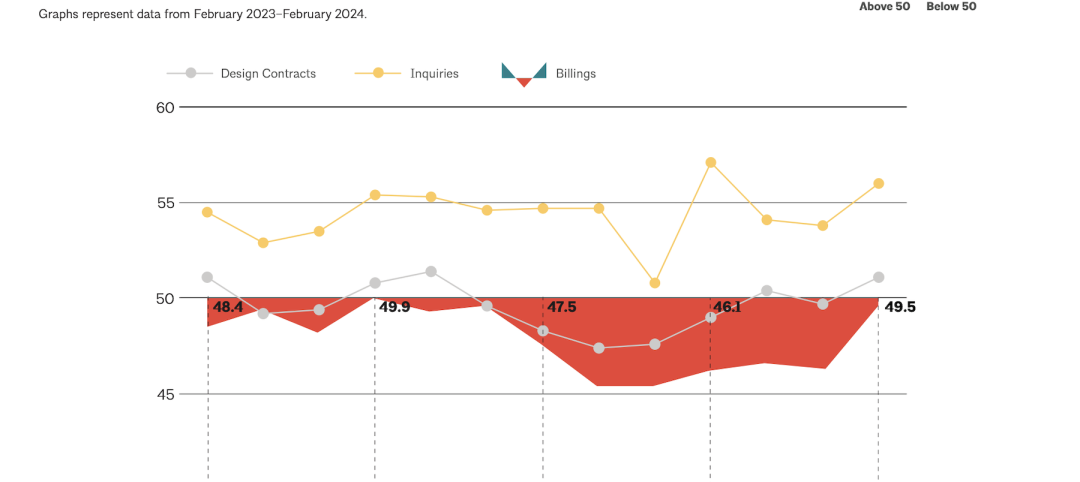

Architecture firm billings see modest easing in February

Architecture firm billings continued to decline in February, with an AIA/Deltek Architecture Billings Index (ABI) score of 49.5 for the month. However, February’s score marks the most modest easing in billings since July 2023 and suggests that the recent slowdown may be receding.

K-12 Schools | Mar 18, 2024

New study shows connections between K-12 school modernizations, improved test scores, graduation rates

Conducted by Drexel University in conjunction with Perkins Eastman, the research study reveals K-12 school modernizations significantly impact key educational indicators, including test scores, graduation rates, and enrollment over time.

MFPRO+ News | Mar 16, 2024

Multifamily rents stable heading into spring 2024

National asking multifamily rents posted their first increase in over seven months in February. The average U.S. asking rent rose $1 to $1,713 in February 2024, up 0.6% year-over-year.

Market Data | Mar 14, 2024

Download BD+C's March 2024 Market Intelligence Report

U.S. construction spending on buildings-related work rose 1.4% in January, but project teams continue to face headwinds related to inflation, interest rates, and supply chain issues, according to Building Design+Construction's March 2024 Market Intelligence Report (free PDF download).

Contractors | Mar 12, 2024

The average U.S. contractor has 8.1 months worth of construction work in the pipeline, as of February 2024

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Market Data | Mar 6, 2024

Nonresidential construction spending slips 0.4% in January

National nonresidential construction spending decreased 0.4% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.190 trillion.

Multifamily Housing | Mar 4, 2024

Single-family rentals continue to grow in BTR communities

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

MFPRO+ News | Mar 2, 2024

Job gains boost Yardi Matrix National Rent Forecast for 2024

Multifamily asking rents broke the five-month streak of sequential average declines in January, rising 0.07 percent, shows a new special report from Yardi Matrix.