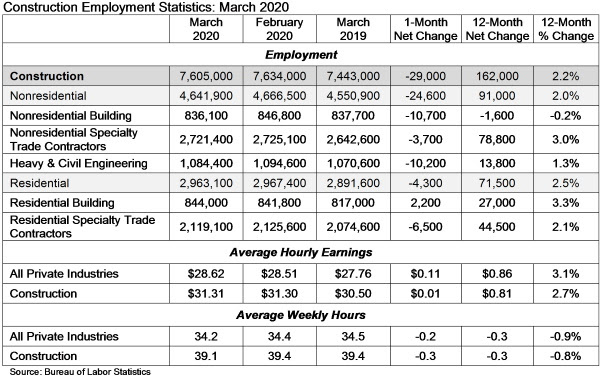

Construction industry employment declined by 29,000 in March, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Nonresidential construction employment declined by 24,600 in March.

All three nonresidential segments registered job losses, with the largest decrease experienced in nonresidential building (-10,700) followed closely by heavy and civil engineering (-10,200). Nonresidential specialty trade lost 3,700 jobs on net.

The construction unemployment rate was 6.9% in March, up 1.7 percentage points from the same time one year ago. Unemployment across all industries rose from 3.5% in February to 4.4% last month, a direct result of the global pandemic.

“So ends the lengthiest expansion in American economic history,” said ABC Chief Economist Anirban Basu. “The expansion was associated with dramatic asset price increases, multi-decade lows in unemployment, persistently low costs of capital and a thriving U.S. nonresidential construction sector. While the March jobs report is horrific, ending a 113-month streak of employment gains, it is clear that employment reports in future months are likely to be even worse.

“What remains unclear is the extent to which estimated construction employment declines are due to mandated suspension of projects in Massachusetts, Pennsylvania, California and elsewhere, and how much of this is due to the emergence of recessionary forces,” said Basu. “Generally, nonresidential construction is one of the last segments of the economy to enter recession as contractors continue to work down their collective backlog, which stood at 8.9 months in ABC’s Construction Backlog Indicator. The need for social distancing renders that statistic less pertinent, meaning that nonresidential construction is susceptible to large-scale job losses immediately.

“While the recently passed stimulus package is massive and helps support the payments side of the economy, economic recovery will remain elusive until the COVID-19-engendered crisis is behind us,” said Basu. “While that is obvious, many people are still looking to compare the current crisis to other episodes in American history, including the Great Recession. As a practical matter, this period defies comparison, and must be understood on its own. Based on what is known, the downturn will be vicious. The good news is that this crisis may finally induce policymakers to fashion and implement a long-awaited infrastructure stimulus package.”

Related Stories

K-12 Schools | Feb 29, 2024

Average age of U.S. school buildings is just under 50 years

The average age of a main instructional school building in the United States is 49 years, according to a survey by the National Center for Education Statistics (NCES). About 38% of schools were built before 1970. Roughly half of the schools surveyed have undergone a major building renovation or addition.

MFPRO+ Research | Feb 27, 2024

Most competitive rental markets of early 2024

The U.S. rental market in early 2024 is moderately competitive, with apartments taking an average of 41 days to find tenants, according to the latest RentCafe Market Competitivity Report.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

Student Housing | Feb 21, 2024

Student housing preleasing continues to grow at record pace

Student housing preleasing continues to be robust even as rent growth has decelerated, according to the latest Yardi Matrix National Student Housing Report.

Architects | Feb 21, 2024

Architecture Billings Index remains in 'declining billings' state in January 2024

Architecture firm billings remained soft entering into 2024, with an AIA/Deltek Architecture Billings Index (ABI) score of 46.2 in January. Any score below 50.0 indicates decreasing business conditions.

Multifamily Housing | Feb 14, 2024

Multifamily rent remains flat at $1,710 in January

The multifamily market was stable at the start of 2024, despite the pressure of a supply boom in some markets, according to the latest Yardi Matrix National Multifamily Report.

Student Housing | Feb 13, 2024

Student housing market expected to improve in 2024

The past year has brought tough times for student housing investment sales due to unfavorable debt markets. However, 2024 offers a brighter outlook if debt conditions improve as predicted.

Contractors | Feb 13, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of January 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator declined to 8.4 months in January, according to an ABC member survey conducted from Jan. 22 to Feb. 4. The reading is down 0.6 months from January 2023.

Industry Research | Feb 8, 2024

New multifamily development in 2023 exceeded expectations

Despite a problematic financing environment, 2023 multifamily construction starts held up “remarkably well” according to the latest Yardi Matrix report.

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.