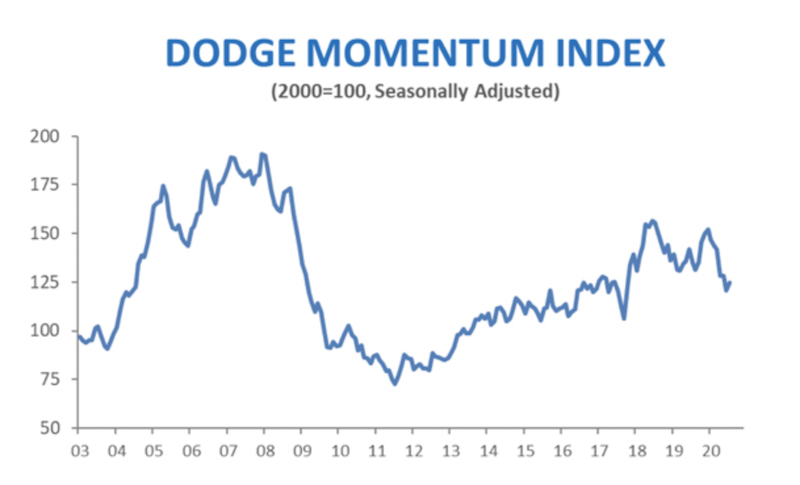

The Dodge Momentum Index moved 3.4% higher in July to 124.7 (2000=1000) from the revised June reading of 120.5. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. During the month, the commercial component increased 5.3% while the institutional component was unchanged.

This month’s increase in the Dodge Momentum Index was the first in all of 2020. Since December 2019, the Momentum Index has lost 18% with most of the decline coming in April when the COVID-19 pandemic led to numerous business shutdowns across the country. The pullback has largely come from institutional planning, rather than commercial plans. State and local government revenues have been squeezed as declines in economic activity have led to a drop in tax revenue just as costs related to the pandemic have skyrocketed. The institutional component is currently 28% below its December 2019 peak and 21% lower than its year ago level. Commercial planning is down 13% from its January 2020 peak, but is actually 1% higher than its year-ago level.

In July, 13 projects each with a value of $100 million or more entered planning. The leading commercial projects were the first two phases of the Centene Healthcare headquarters in Charlotte NC, with each phase valued at $500 million. The leading institutional projects were the $320 million Dignity Health Hospital in Elk Grove CA and the $155 million first phase of the West Henderson Hospital in Henderson NV.

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.