A small increase in total construction spending in September masked a widening gap between declines in most nonresidential segments and robust gains in residential construction, according to an analysis by the Associated General Contractors of America of government data released today. Association officials warned nonresidential construction is headed for an even steeper slump unless officials in Washington enact relief promptly, noting that their latest industry survey found three out of four respondents had experienced a postponed or cancelled project since the start of the pandemic.

“The September spending report shows the gulf between housing and nonresidential markets is growing steadily wider,” said Ken Simonson, the association’s chief economist. “In our October survey, 75% of respondents reported a postponed or cancelled project, up from 60% in August and 32% in June.”

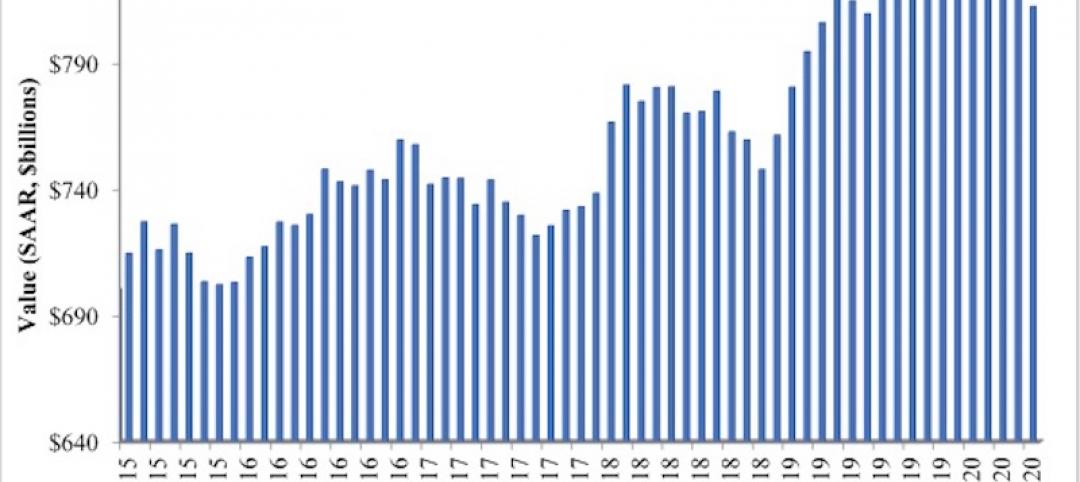

Construction spending in September totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 0.3% from the pace in August and 1.5% higher than in September 2019. Private and public nonresidential spending slumped by a combined 1.6% since August and 4.4% from a year earlier, while private residential spending climbed by 2.8% for the month and 9.9% year-over-year.

Private nonresidential construction spending declined for the third consecutive month, falling 1.5% from August to September, with decreases in nine out of 11 categories. The largest private nonresidential segment, power construction, declined 2.2% for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slid 1.9%, manufacturing construction declined 2.1%, and office construction rose 0.3%. Simonson noted that the office figure was likely inflated by inclusion of data centers, a segment that appears to have held up well.

Public construction spending fell 1.7% in September, the fourth monthly decline in a row. The largest public category, highway and street construction, tumbled 5.4% for the month. Among other large public segments, educational construction increased 2.0% for the month, while transportation construction dipped 0.3%.

Private residential construction spending increased for the fourth-straight month, rising 2.8% in September. Single-family homebuilding soared 5.7% for the month, while multifamily construction spending rose 1.2% and residential improvements declined 0.4%.

Association officials noted that the coronavirus was having a significant, negative impact on most commercial construction firms. In addition to widespread project delays and cancellations, the association’s recent survey found most contractors do not expect to expand their headcount during the next 12 months because of the pandemic. Many contractors report they are looking to Washington to enact new infrastructure investments and liability reforms to offset the ongoing impacts of the coronavirus.

“The pandemic is suppressing demand for new office buildings, hotels and shopping centers even while it inspires many people to build bigger homes,” said Stephen E. Sandherr, the association’s chief executive officer. “Without new federal investments in infrastructure and other needed relief measures, commercial firms will have a hard time retaining staff or investing in new equipment and supplies.”

Related Stories

Market Data | Jul 7, 2020

7 must reads for the AEC industry today: July 7, 2020

Construction industry adds 158,000 workers in June and mall owners open micro distribution hubs for e-commerce fulfillment.

Market Data | Jul 6, 2020

Nonresidential construction spending falls modestly in May

Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

Market Data | Jul 6, 2020

Construction industry adds 158,000 workers in June but infrastructure jobs decline

Gains in June are concentrated in homebuilding as state and local governments postpone or cancel roads and other projects in face of looming budget deficits.

Market Data | Jul 6, 2020

5 must reads for the AEC industry today: July 6, 2020

Demand growth for mass timber components and office demand has increased as workers return.

Market Data | Jul 2, 2020

Fall in US construction spending in May shows weakness of country’s construction industry, says GlobalData

Dariana Tani, Economist at GlobalData, a leading data and analytics company, offers her view on the situation

Market Data | Jul 2, 2020

6 must reads for the AEC industry today: July 2, 2020

Construction spending declines 2.1% in May and how physical spaces may adapt to a post-COVID world.

Market Data | Jul 1, 2020

Construction spending declines 2.1% in May as drop in private work outweighs public pickup

Federal infrastructure measure can help offset private-sector demand that is likely to remain below pre-coronavirus levels amid economic uncertainty.

Market Data | Jul 1, 2020

7 must reads for the AEC industry today: July 1, 2020

Facebook to build $800 million data center and 329 metro areas added construction jobs in May.

Market Data | Jun 30, 2020

AIA releases strategies and illustrations for reducing risk of COVID-19 in senior living communities

Resources were developed as part of AIA’s “Reopening America: Strategies for Safer Buildings” initiative.

Market Data | Jun 30, 2020

329 metro areas added construction jobs in May

Seattle-Bellevue-Everett, Wash. added the most construction jobs (28,600, 44%) in May.