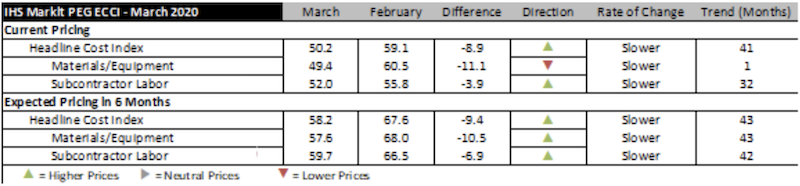

Construction costs increased once again in March, according to IHS Markit (NYSE: INFO) and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 50.2, a figure barely above the neutral mark. The last time the headline index registered an almost flat pricing was in November 2016. After 40 months, the materials and equipment index came in at 49.4, indicating falling prices. The sub-contractor labor index showed continued price increases, with an index reading of 52.0.

Survey respondents reported falling prices for five out of the 12 components within the materials and equipment sub-index. These included ocean freight (Asia to U.S. and Europe to U.S.), fabricated structural steel, carbon steel pipe, copper-based wire and cable. Prices for five categories rose while prices for two categories (alloy steel pipe and exchangers) remained the same. Index figures for all categories dropped relative to February, indicating that a greater proportion of the respondents are observing lower prices. The sharpest drops were reported for ocean freight.

“Ocean freight has taken a notable hit with the onset of coronavirus,” said Deni Koenhemsi, senior economist with IHS Markit. “As China tried to contain COVID-19, industrial production contracted substantially, and the transportation of goods nearly came to a halt. In the first two months of 2020, U.S. imports from Asia dropped 6.2 percent year-over-year, and imports from China were down 15.5 percent. Although the number of blank sailings is beginning to taper off-meaning we will see higher imports from China to United States-the rapid spread of the virus in Europe and North America could cause the downward trend to continue.”

The sub-index for current subcontractor labor costs came in at 52.0 for March. For the United States, labor cost remained flat in the Northeast, Midwest and West, but increased in the South. For Canada, the labor cost index was flat in western Canada but rose for eastern Canada.

The six-month headline expectations for future construction costs index reflected increasing prices for the 43rd consecutive month, registering 58.2, a sharp decline from February’s reading of 67.6. The six-month materials and equipment expectations index came in at 57.6 this month, down from 68.0 last month. Prices for all materials, equipment and freight are expected to rise with the exception of carbon steel pipe and exchangers, which are expected to see flat pricing. Expectations for sub-contractor labor slipped to 59.7 in March. All regions of the U.S. are expected to see higher labor costs; labor costs in Canada are expected to stay flat.

In the survey comments, respondents noted lower demand conditions due to the coronavirus.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

Related Stories

Market Data | Jun 16, 2021

Construction input prices rise 4.6% in May; softwood lumber prices up 154% from a year ago

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span.

Market Data | Jun 16, 2021

Producer prices for construction materials and services jump 24% over 12 months

The 24.3% increase in prices for materials used in construction from May 2020 to last month was nearly twice as great as in any previous year

Market Data | Jun 15, 2021

ABC’s Construction Backlog inches higher in May

Materials and labor shortages suppress contractor confidence.

Market Data | Jun 11, 2021

The countries with the most green buildings

As the country that set up the LEED initiative, the US is a natural leader in constructing green buildings.

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.