Overall expenses per multifamily unit rose to $8,950, a 7.1% increase year-over-year (YOY) as of January 2024, according to an examination of more than 20,000 properties analyzed by Yardi Matrix.

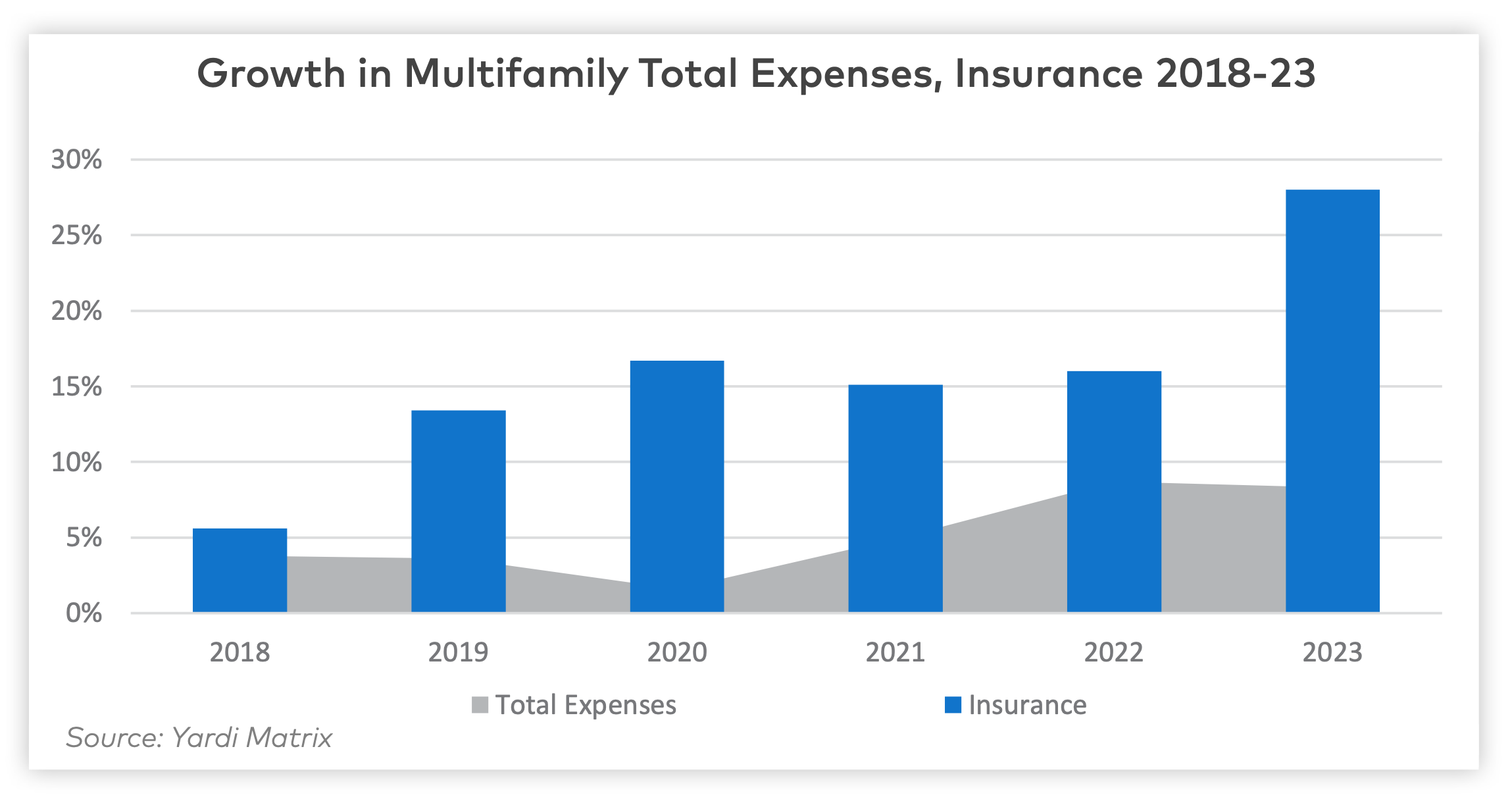

According to the March 2024 Matrix Research Bulletin for Multifamily Expenses, expense growth for multifamily properties was led by property insurance (up 27.7% YOY), marketing (12.3%), administrative costs (9.6%), and repairs and maintenance (8.8%).

Driven by inflationary pressures, total expenses at multifamily properties have “increased rapidly” in the past two years, peaking at 8.7% in 2022, the report states. This is compared to the average annual expense growth of 4.9% in 2021, 1.6% in 2020, 3.6% in 2019, and 3.8% in 2018.

Multifamily Expenses Rising, Led by Insurance

Insurance costs per unit continue to rise, and have increased 129% nationally since 2018. The current property insurance costs per unit are now at an average of $636.

While property insurance makes up just 7% of total expenses for properties, it's becoming a growing concern especially in the Southeast and other regions prone to severe weather events. In these high-risk areas prone to hurricanes, floods, and fires, obtaining insurance is becoming increasingly difficult.

The study showed that multifamily properties were still profitable in 2023, despite rising expenses. This is because income growth outpaced expenses. On average, gross income per unit increased by $1,056 nationally, while expenses only grew by $593, resulting in a $463 increase in net operating income (NOI).

Yardi Matrix forecasts that asking rents will increase by 1.8% during 2024, and we can expect renewal rent growth will continue to decelerate.