Following the announcement by the US Bureau of Statistics that construction spending fell by 2.1% in May from a month earlier:

Dariana Tani, Economist at GlobalData, a leading data and analytics company, offers her view on the situation:

“May’s construction spending data shows the ongoing weakness in the US construction industry amid the COVID-19 pandemic. Overall, construction spending was driven down by a decline in spending on private construction projects offsetting an increase in spending on public projects.

“GlobalData expects the US construction industry to contract by -6.5% in 2020 and -2% in 2021, down from the previous growth forecast of 0.6% and 1.4% before the COVID-19 pandemic started. Sectors such as commercial, residential and industrial are anticipated to be the hardest hit amid the collapse in business and consumer confidence, while sectors such as institutional and infrastructure will also be affected although to a lesser extent.

“As Congress and the White House contemplate the next phase of yet another unprecedented government response to limit the economic impact of the COVID-19 outbreak, Democrats and President Donald Trump are increasingly raising the prospects of passing a multi-trillion dollar infrastructure plan that could generate millions of jobs and stimulate the economy and the construction industry. However, key risks remain. With the number of new COVID-19 cases surging across the country, as many states are reopening their economies, the construction industry is expected to continue to decline over the coming months.

“A second wave in the second half of 2020 and the potential increase of caseloads in underserved communities could put at risk the recovery of the labor market and increase the risk that the pandemic could result in long-lasting damage to the economy as new lockdown restrictions will have to be put in place again. Furthermore, heightening political uncertainty over the upcoming presidential election, lower oil prices, and financial volatility are other factors that could undermine confidence.”

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

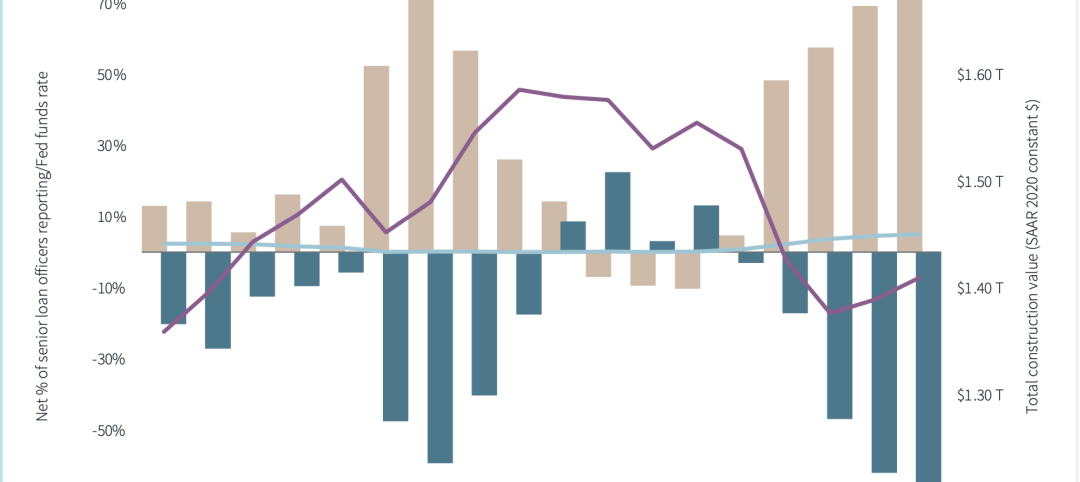

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.