The U.S. Green Building Council (USGBC) announced today that Fannie Mae will reward multifamily properties with a green building certification, such as LEED, with a lower interest rate. USGBC’s LEED green building rating system is one of several recognized certifications including Energy Star and Enterprise’s Green Communities Criteria.

For these certified properties, Fannie Mae is now granting a 10 basis point reduction in the interest rate of a multifamily refinance, acquisition or supplemental mortgage loan. For example, if the market interest rate is 4% on the multifamily loan, the new rate is 3.9% with this pricing break. On a $10 million dollar loan amortizing over 30 years, the owner would save $95,000 in interest payments over a 10-year term.

All loans financed under this lower interest rate will be also securitized as a Green MBS, growing the total volume of Green Bonds in the market for socially responsible investors to include in their portfolios. Fannie Mae is the leading provider of multifamily financing in the U.S., with a portfolio valued at more than $200 billion.

“This is a great demonstration of leadership from Fannie Mae, and the partnership between the multifamily finance industry and the green building industry,” said Rick Fedrizzi, CEO and founding chair, USGBC. “This is real money and an incentive to not only build green but also for existing buildings to achieve certification. For the first time, Fannie Mae multifamily lenders will be able to reward building owners for their better buildings.”

"Fannie Mae is leading the way in financing by offering new lower interest rates for green building certified multifamily properties,” says Jeffery Hayward, executive vice president for multifamily, Fannie Mae. “We clearly see the value in the triple-bottom line of certified green buildings: financial benefits of lower operating costs for owners and tenants; social benefits of better quality housing for renters; and environmental benefits for everyone. Our lenders are ready with financing solutions to help multifamily owners make their properties more energy and water efficient for today and for the future."

LEED buildings have been proven to have lower monthly energy and water costs, leaving more disposable income for families and creating healthier and more comfortable indoor environments for occupants. In a study from the U.S. Department of Energy it was reported that LEED buildings are estimated to consume 25% less energy and 11% less water, have 19 percent lower maintenance costs, 27 percent higher occupant satisfaction and 34 percent lower greenhouse gas emissions.

For more information on Fannie Mae’s Multifamily Green Initiative, please see www.fanniemaegreeninitiative.com.

Related Stories

Multifamily Housing | Jun 25, 2019

Historic New York hospital becomes multifamily development

CetraRuddy designed the project and Delshah Capital is the developer.

Multifamily Housing | Jun 25, 2019

New Joint Center housing report foresees steady rental demand over the next decade

However, supply shortages, especially on the affordable end, are likely to push rents even higher.

Multifamily Housing | Jun 17, 2019

Boston multifamily development combines a historic warehouse with a new, modern addition

The Architectural Team designed the project.

Multifamily Housing | Jun 4, 2019

New Silver Spring apartment community includes over 5,000 sf of amenity space

Design Collective is the project’s architect.

Multifamily Housing | Jun 3, 2019

11 trends in senior living

Style, flexibility, and fun highlight the latest design trends for the 55+ market.

Multifamily Housing | May 29, 2019

Grilled to order: The art of outdoor kitchens

Seven tips for ensuring outdoor kitchens deliver safe, memorable experiences for residents and guests.

Multifamily Housing | May 17, 2019

At last, downtown Dallas tower to get $450 million redo

The landmark tower has been vacant for a decade.

Multifamily Housing | May 8, 2019

Multifamily visionary: AvalonBay’s relentless attention to detail

The nation's fourth-largest owner of apartments holds more than 85,000 apartments in 291 communities.

| Apr 28, 2019

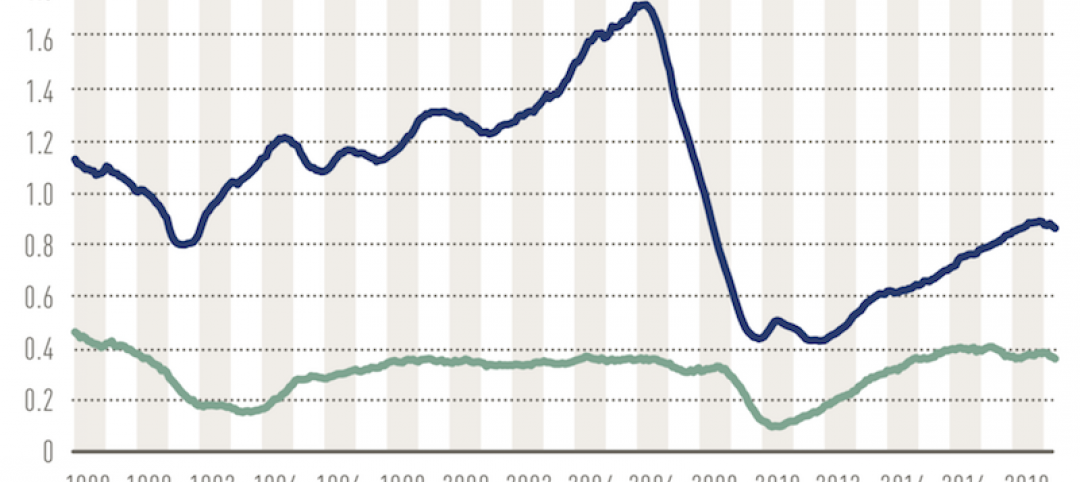

New York Is NOT Most Expensive City for Apartment Sales Transactions

Data from Marcus & Millichap 2019 U.S. Multifamily Investment Forecast on Average Price/Dwelling Unit in apartment transactions.