The U.S. Green Building Council (USGBC) announced today that Fannie Mae will reward multifamily properties with a green building certification, such as LEED, with a lower interest rate. USGBC’s LEED green building rating system is one of several recognized certifications including Energy Star and Enterprise’s Green Communities Criteria.

For these certified properties, Fannie Mae is now granting a 10 basis point reduction in the interest rate of a multifamily refinance, acquisition or supplemental mortgage loan. For example, if the market interest rate is 4% on the multifamily loan, the new rate is 3.9% with this pricing break. On a $10 million dollar loan amortizing over 30 years, the owner would save $95,000 in interest payments over a 10-year term.

All loans financed under this lower interest rate will be also securitized as a Green MBS, growing the total volume of Green Bonds in the market for socially responsible investors to include in their portfolios. Fannie Mae is the leading provider of multifamily financing in the U.S., with a portfolio valued at more than $200 billion.

“This is a great demonstration of leadership from Fannie Mae, and the partnership between the multifamily finance industry and the green building industry,” said Rick Fedrizzi, CEO and founding chair, USGBC. “This is real money and an incentive to not only build green but also for existing buildings to achieve certification. For the first time, Fannie Mae multifamily lenders will be able to reward building owners for their better buildings.”

"Fannie Mae is leading the way in financing by offering new lower interest rates for green building certified multifamily properties,” says Jeffery Hayward, executive vice president for multifamily, Fannie Mae. “We clearly see the value in the triple-bottom line of certified green buildings: financial benefits of lower operating costs for owners and tenants; social benefits of better quality housing for renters; and environmental benefits for everyone. Our lenders are ready with financing solutions to help multifamily owners make their properties more energy and water efficient for today and for the future."

LEED buildings have been proven to have lower monthly energy and water costs, leaving more disposable income for families and creating healthier and more comfortable indoor environments for occupants. In a study from the U.S. Department of Energy it was reported that LEED buildings are estimated to consume 25% less energy and 11% less water, have 19 percent lower maintenance costs, 27 percent higher occupant satisfaction and 34 percent lower greenhouse gas emissions.

For more information on Fannie Mae’s Multifamily Green Initiative, please see www.fanniemaegreeninitiative.com.

Related Stories

Multifamily Housing | Jul 31, 2017

Chicago’s Ukrainian Village neighborhood adds new co-living space

The new building offers 12 bedrooms across four floors of living space.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Multifamily Housing | Jul 27, 2017

Game rooms and game simulators popular amenities in multifamily developments

The number of developments providing space for physical therapy was somewhat surprising, according to a new survey.

Multifamily Housing | Jul 25, 2017

Co-living arrives in Queens: Common adds two new co-living homes

Common adds a new coliving home in Brooklyn and its first offering in Queens with Common Lincoln and Common Cornelia.

Multifamily Housing | Jul 19, 2017

Student housing trends: The transformation of co-living in college

The Student Hotel is representative of a new model for delivering housing solutions for students globally.

Multifamily Housing | Jul 19, 2017

KTGY-designed Elan Menlo Park nears completion

The 146-unit apartment community was designed as a series of six interactively connected garden-style apartments.

Multifamily Housing | Jul 12, 2017

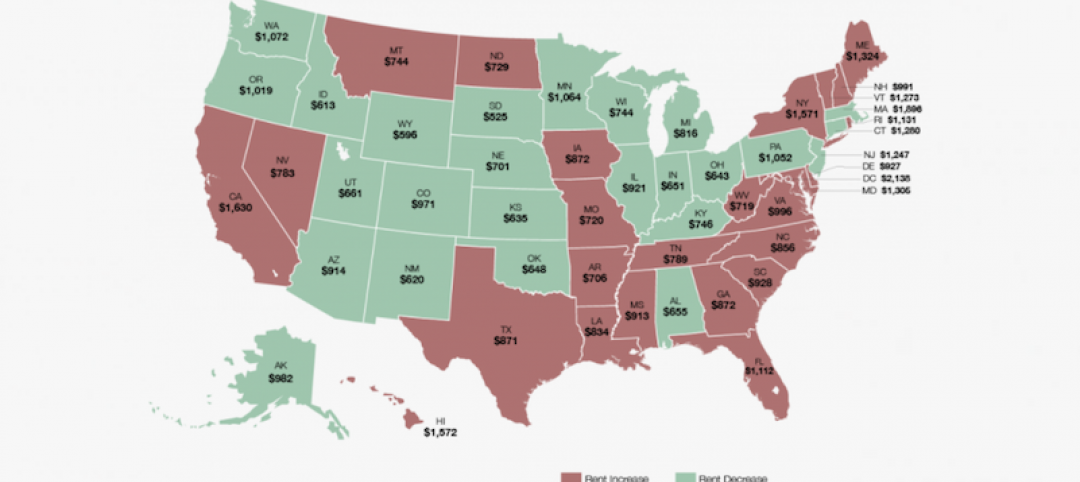

Midyear Rent Report: 26 states saw rental price increases in first half of 2017

The most notable rental increases are in growing markets in the South and Southwest: New Orleans, Glendale, Ariz., Houston, Reno, N.V., and Atlanta.

Multifamily Housing | Jul 12, 2017

7 noteworthy multifamily projects: posh amenities, healthy living, plugged-in lifestyle

Zen meditation gardens, bocce courts, saltwater pools, and free drinks highlight the niceties at these new multifamily developments.

Mixed-Use | Jul 7, 2017

ZHA’s Mandarin Oriental hotel and residences employs ‘stacked vases’ design approach

The mixed-use tower will rise 185 meters and be located in Melbourne's Central Business District.