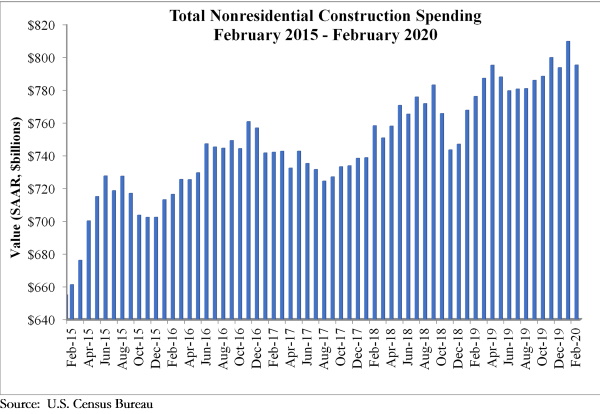

National nonresidential construction spending fell 1.8% in February, but is up 2.5% compared to the same time last year, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $795.1 billion for the month.

Private nonresidential spending declined 2% on a monthly basis and is down 0.7% compared to February 2019. Public nonresidential construction spending was down 1.5% for the month, but is up 7.2% on a year-over-year basis.

“Data characterizing the economy prior to the coronavirus outbreak continues to trickle in,” said ABC Chief Economist Anirban Basu. “While nonresidential construction spending declined in February, according to today’s data release, the decline was modest and overall performance was not substantially different from prior months.

“However, with communities in Massachusetts, Pennsylvania, California and elsewhere recently shutting down certain construction projects in an effort to better support social distancing and with economic activity generally grinding toward a halt, the construction spending data will undoubtedly deteriorate further and faster during the months to come,” said Basu. “Unfortunately, that is not where the pain will end. Once the crisis is over, hotel chains will be weaker financially, more storefronts will be empty and fewer employers will be interested in relocating to high-end office space, which will result in diminished demand for nonresidential construction services even after the broader economy comes back to life.

“Typically, nonresidential construction holds up better during the early stages of a downturn as contractors continue to work through their collective backlog, which stood at 8.9 months in January 2020, according to ABC’s Construction Backlog Indicator,” said Basu. “That may still be the case, but, given growing liquidity and solvency problems spreading through the economy, it is quite likely that many construction projects presently on the drawing board will be postponed or canceled. Backlog may disappear quickly as project owners resort to the use of force majeure clauses or other mechanisms to back out of contractual obligations. Time will tell, and eventually the extent to which projects are delayed will be reflected in the construction spending data.”

Related Stories

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.

Market Data | Sep 17, 2018

ABC’s Construction Backlog Indicator hits a new high in second quarter of 2018

Backlog is up 12.2% from the first quarter and 14% compared to the same time last year.

Market Data | Sep 12, 2018

Construction material prices fall in August

Softwood lumber prices plummeted 9.6% in August yet are up 5% on a yearly basis (down from a 19.5% increase year-over-year in July).

Market Data | Sep 7, 2018

Safety risks in commercial construction industry exacerbated by workforce shortages

The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years.

Market Data | Sep 5, 2018

Public nonresidential construction up in July

Private nonresidential spending fell 1% in July, while public nonresidential spending expanded 0.7%.

Market Data | Aug 30, 2018

Construction in ASEAN region to grow by over 6% annually over next five years

Although there are disparities in the pace of growth in construction output among the ASEAN member states, the region’s construction industry as a whole will grow by 6.1% on an annual average basis in the next five years.

Market Data | Aug 22, 2018

July architecture firm billings remain positive despite growth slowing

Architecture firms located in the South remain especially strong.

Market Data | Aug 15, 2018

National asking rents for office space rise again

The rise in rental rates marks the 21st consecutive quarterly increase.