According to the Kroll Annual Global Fraud and Risk Report 2016/17, construction, engineering, and infrastructure companies around the globe are experiencing fraud, cyber, and security incidents so frequently it has become the “new normal.”

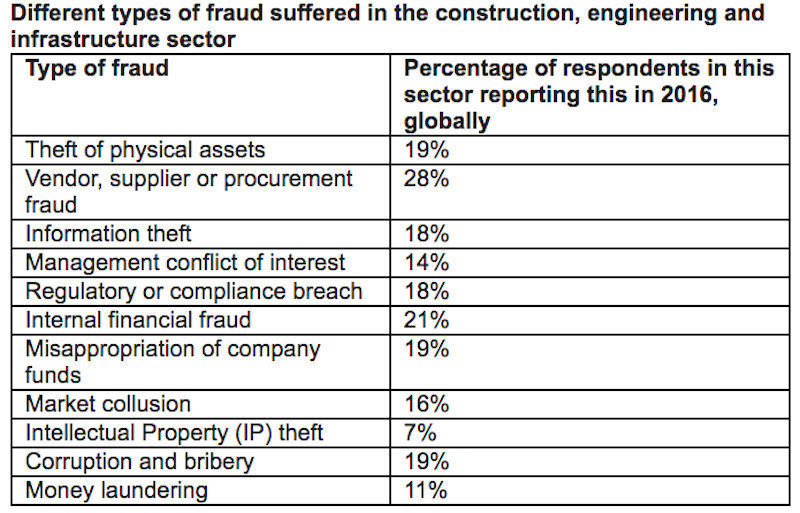

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year with vendor, supplier, or procurement fraud being the most prevalent kind of fraud suffered at 28%. Internal financial fraud followed at 21%, and corruption and bribery, theft of physical assets, and misappropriation of company funds were next with each one being reported by 19% of respondents.

Cyber attacks became increasingly common in 2016, as well. 77% of respondents reported their company suffered a cyber incident in the past 12 months with a virus or worm infestation being the most common at 35%. Email based phishing attacks were the next most common at 30%.

“This year’s Kroll Global Fraud and Risk Report shows that it’s becoming an increasingly risky world, with the largest ever proportion of companies reporting fraud and similarly high levels of cyber and security breaches,” said Tommy Helsby, Co-Chairman, Kroll Investigations & Disputes, in a press release.

Often, companies worry about attacks originating from external sources, but according to the report, across all sectors, the most common perpetrators of fraud, cyber, and security incidents in 2016 were current and former employees. On the reverse side, insiders were also the most likely people to discover fraud occurring. 44% of respondents across all sectors said a recent fraud has been discovered through a whistleblowing program. Additionally, 39% said it was detected through an internal audit.

You can receive a full copy of the report by clicking here.

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.