According to the Kroll Annual Global Fraud and Risk Report 2016/17, construction, engineering, and infrastructure companies around the globe are experiencing fraud, cyber, and security incidents so frequently it has become the “new normal.”

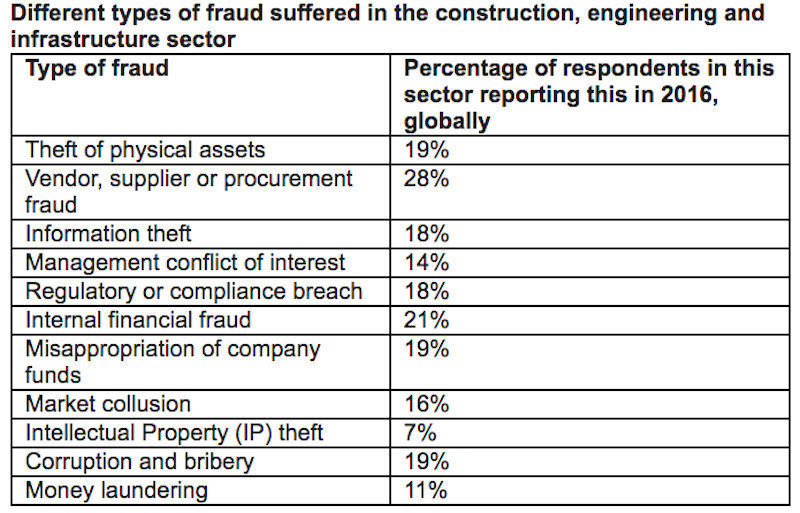

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year with vendor, supplier, or procurement fraud being the most prevalent kind of fraud suffered at 28%. Internal financial fraud followed at 21%, and corruption and bribery, theft of physical assets, and misappropriation of company funds were next with each one being reported by 19% of respondents.

Cyber attacks became increasingly common in 2016, as well. 77% of respondents reported their company suffered a cyber incident in the past 12 months with a virus or worm infestation being the most common at 35%. Email based phishing attacks were the next most common at 30%.

“This year’s Kroll Global Fraud and Risk Report shows that it’s becoming an increasingly risky world, with the largest ever proportion of companies reporting fraud and similarly high levels of cyber and security breaches,” said Tommy Helsby, Co-Chairman, Kroll Investigations & Disputes, in a press release.

Often, companies worry about attacks originating from external sources, but according to the report, across all sectors, the most common perpetrators of fraud, cyber, and security incidents in 2016 were current and former employees. On the reverse side, insiders were also the most likely people to discover fraud occurring. 44% of respondents across all sectors said a recent fraud has been discovered through a whistleblowing program. Additionally, 39% said it was detected through an internal audit.

You can receive a full copy of the report by clicking here.

Related Stories

Market Data | Apr 3, 2017

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Market Data | Mar 24, 2017

These are the most and least innovative states for 2017

Connecticut, Virginia, and Maryland are all in the top 10 most innovative states, but none of them were able to claim the number one spot.

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.