According to the Kroll Annual Global Fraud and Risk Report 2016/17, construction, engineering, and infrastructure companies around the globe are experiencing fraud, cyber, and security incidents so frequently it has become the “new normal.”

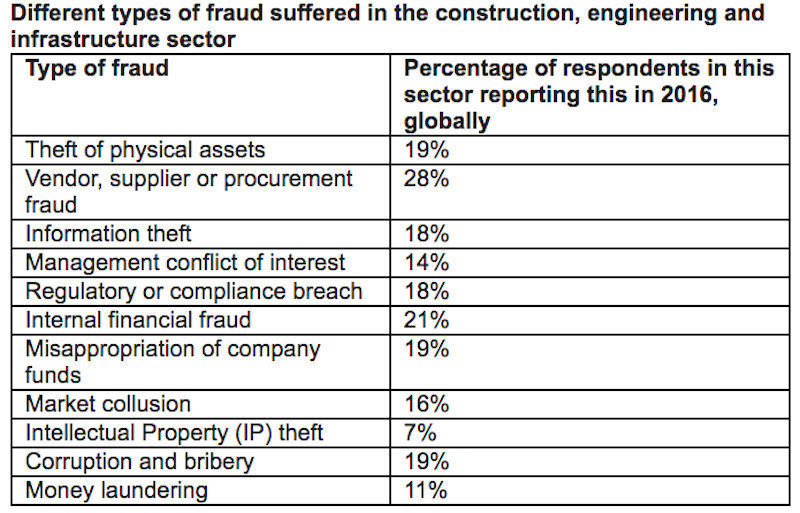

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year with vendor, supplier, or procurement fraud being the most prevalent kind of fraud suffered at 28%. Internal financial fraud followed at 21%, and corruption and bribery, theft of physical assets, and misappropriation of company funds were next with each one being reported by 19% of respondents.

Cyber attacks became increasingly common in 2016, as well. 77% of respondents reported their company suffered a cyber incident in the past 12 months with a virus or worm infestation being the most common at 35%. Email based phishing attacks were the next most common at 30%.

“This year’s Kroll Global Fraud and Risk Report shows that it’s becoming an increasingly risky world, with the largest ever proportion of companies reporting fraud and similarly high levels of cyber and security breaches,” said Tommy Helsby, Co-Chairman, Kroll Investigations & Disputes, in a press release.

Often, companies worry about attacks originating from external sources, but according to the report, across all sectors, the most common perpetrators of fraud, cyber, and security incidents in 2016 were current and former employees. On the reverse side, insiders were also the most likely people to discover fraud occurring. 44% of respondents across all sectors said a recent fraud has been discovered through a whistleblowing program. Additionally, 39% said it was detected through an internal audit.

You can receive a full copy of the report by clicking here.

Related Stories

Market Data | Jun 14, 2016

Transwestern: Market fundamentals and global stimulus driving economic growth

A new report from commercial real estate firm Transwestern indicates steady progress for the U.S. economy. Consistent job gains, wage growth, and consumer spending have offset declining corporate profits, and global stimulus plans appear to be effective.

Market Data | Jun 7, 2016

Global construction disputes took longer to resolve in 2015

The good news: the length and value of disputes in the U.S. fell last year, according to latest Arcadis report.

Market Data | Jun 3, 2016

JLL report: Retail renovation drives construction growth in 2016

Retail construction projects were up nearly 25% year-over-year, and the industrial and office construction sectors fared well, too. Economic uncertainty looms over everything, however.

Market Data | Jun 2, 2016

ABC: Nonresidential construction spending down in April

Lower building material prices, a sluggish U.S. economy, and hesitation among private developers all factor into the 2.1% drop.

Market Data | May 20, 2016

Report: Urban area population growth slows

Older Millennials are looking to buy homes and move away to more affordable suburbs and exurbs.

Market Data | May 17, 2016

Modest growth for AIA’s Architecture Billings Index in April

The American Institute of Architects reported the April ABI score was 50.6, down from the mark of 51.9 in the previous month. This score still reflects an increase in design services.

Market Data | Apr 29, 2016

ABC: Quarterly GDP growth slowest in two years

Bureau of Economic Analysis data indicates that the U.S. output is barely growing and that nonresidential investment is down.

Market Data | Apr 20, 2016

AIA: Architecture Billings Index ends first quarter on upswing

The multi-family residential sector fared the best. The Midwest was the only U.S. region that didn't see an increase in billings.

Building Technology | Apr 11, 2016

A nascent commercial wireless sensor market is poised to ascend in the next decade

Europe and Asia will propel that growth, according to a new report from Navigant.

Industry Research | Apr 7, 2016

CBRE provides latest insight into healthcare real estate investors’ strategies

Survey respondents are targeting smaller acquisitions, at a time when market cap rates are narrowing for different product types.