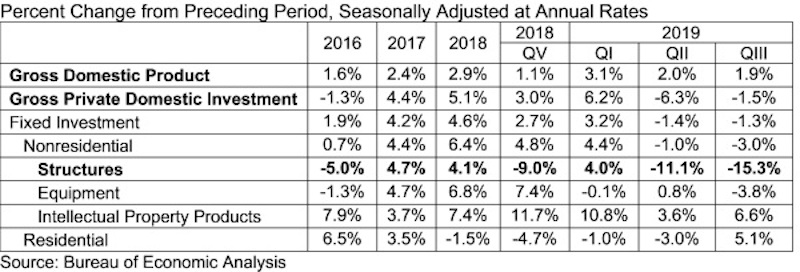

The U.S. economy expanded at an annualized rate of 1.9% in the third quarter of 2019 despite contracting levels of nonresidential investment, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Economic Analysis. Nonresidential fixed investment declined at a 3% annual rate in the third quarter after declining at a 1% rate in the second quarter.

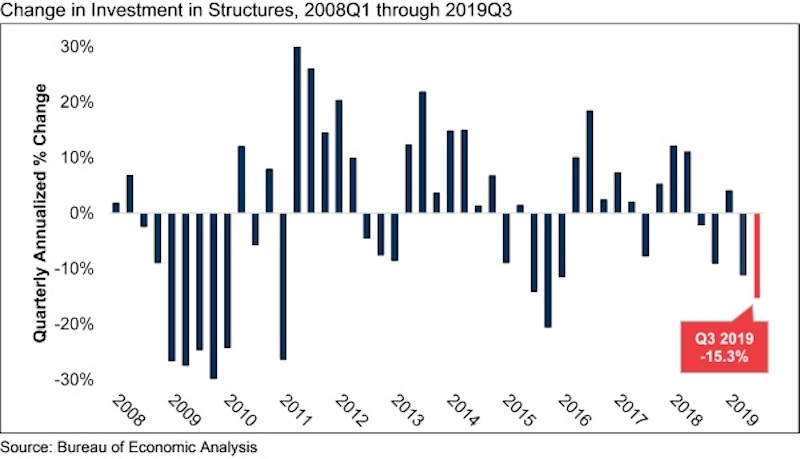

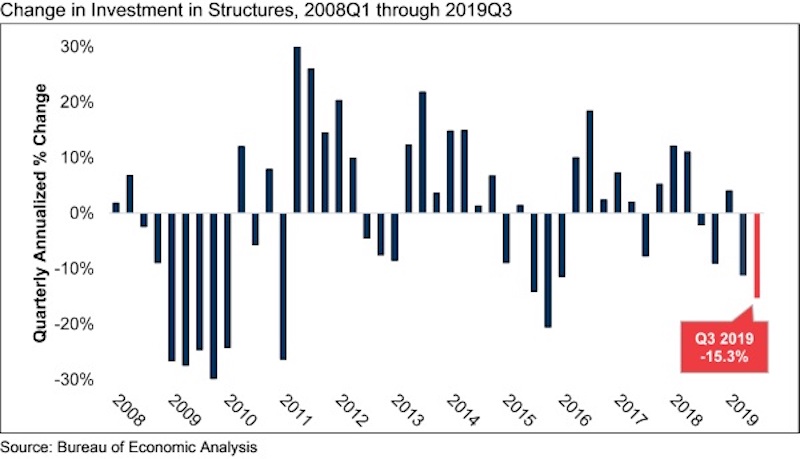

The annual rate for nonresidential fixed investment in structures, a component closely tied to construction, declined 15.3% in the third quarter. Investment in structures has now contracted in four of the previous five quarters, including an 11.1% decline in the second quarter of 2019.

“Today’s report reinforced a number of observations regarding the U.S. economy and the nation’s nonresidential construction sector,” said ABC Chief Economist Anirban Basu. “First, the economy is slowing. While consumer spending and government outlays remain elevated, gross private domestic investment continues to slip, this time by 1.5% on an annualized basis in the third quarter. While this is less than the 6.3% decline registered during the second quarter, the key takeaway is that the current economic expansion is narrowing, increasingly fueled by consumers and public agencies taking on additional debt.

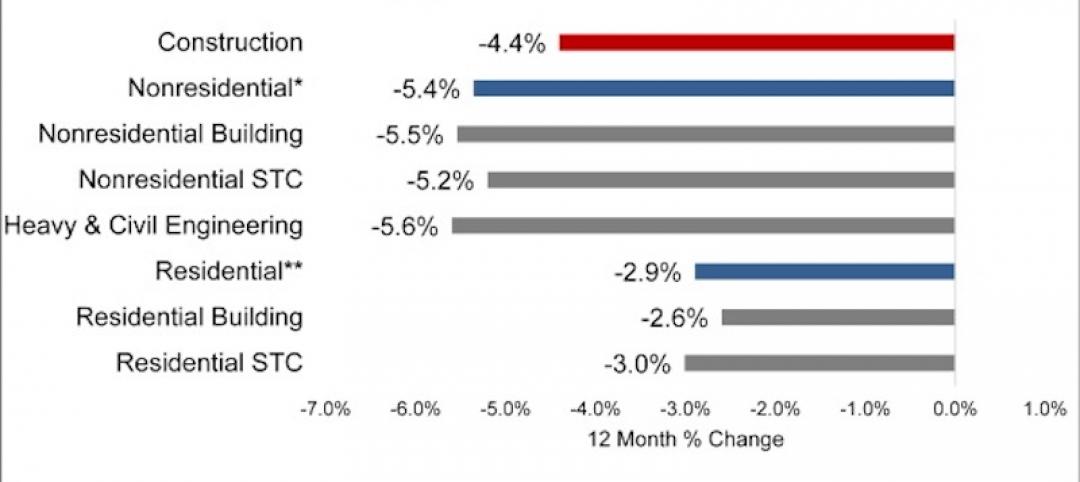

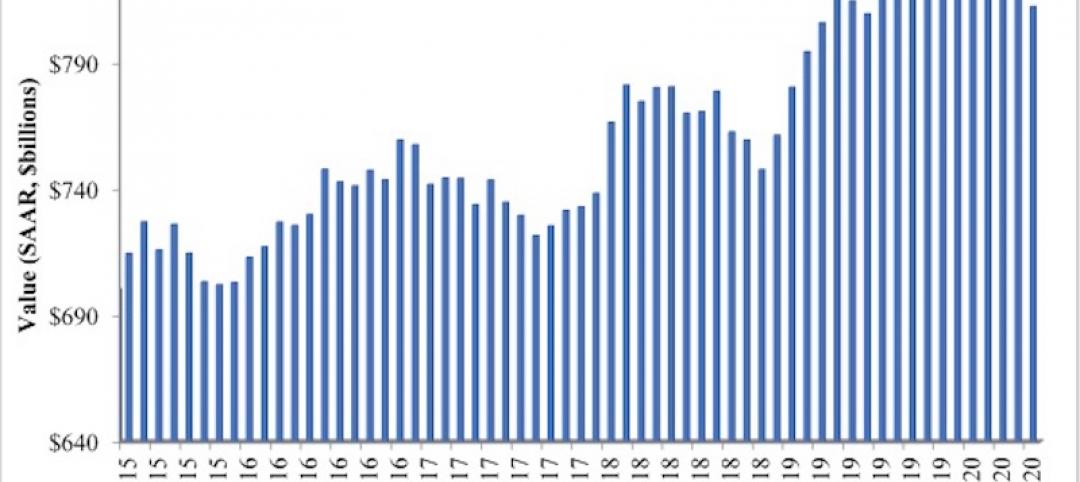

“Second, certain segments of nonresidential construction continue to soften,” said Basu. “Recent data regarding nonresidential construction spending indicate weaker spending in categories such as office and lodging. This was reflected in today’s GDP report, which indicated that spending on structures contracted significantly during the third quarter. For the most part, nonresidential construction spending growth continues to be driven by public construction, including in categories such as water supply and public safety.

“The primary question now is whether the slowdown in economic activity will persist into 2020,” said Basu. “Many factors suggest it will, including a weakening global economy, a U.S. manufacturing sector that is arguably already in recession, vulnerability attributable to massive accumulations of public, corporate and household debt and the uncertain outcomes attached to ongoing trade negotiations. On the other hand, U.S. equity markets have continued to surge higher in the context of better-than-expected corporate earnings and ongoing accommodation by the Federal Reserve. Put it all together and the outlook for the U.S. economy has seldom been more uncertain, especially given next year’s elections.

Related Stories

Market Data | Jul 7, 2020

Nonresidential construction has recovered 56% of jobs lost since March employment report

Nonresidential construction employment added 74,700 jobs on net in June.

Market Data | Jul 7, 2020

7 must reads for the AEC industry today: July 7, 2020

Construction industry adds 158,000 workers in June and mall owners open micro distribution hubs for e-commerce fulfillment.

Market Data | Jul 6, 2020

Nonresidential construction spending falls modestly in May

Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

Market Data | Jul 6, 2020

Construction industry adds 158,000 workers in June but infrastructure jobs decline

Gains in June are concentrated in homebuilding as state and local governments postpone or cancel roads and other projects in face of looming budget deficits.

Market Data | Jul 6, 2020

5 must reads for the AEC industry today: July 6, 2020

Demand growth for mass timber components and office demand has increased as workers return.

Market Data | Jul 2, 2020

Fall in US construction spending in May shows weakness of country’s construction industry, says GlobalData

Dariana Tani, Economist at GlobalData, a leading data and analytics company, offers her view on the situation

Market Data | Jul 2, 2020

6 must reads for the AEC industry today: July 2, 2020

Construction spending declines 2.1% in May and how physical spaces may adapt to a post-COVID world.

Market Data | Jul 1, 2020

Construction spending declines 2.1% in May as drop in private work outweighs public pickup

Federal infrastructure measure can help offset private-sector demand that is likely to remain below pre-coronavirus levels amid economic uncertainty.

Market Data | Jul 1, 2020

7 must reads for the AEC industry today: July 1, 2020

Facebook to build $800 million data center and 329 metro areas added construction jobs in May.

Market Data | Jun 30, 2020

AIA releases strategies and illustrations for reducing risk of COVID-19 in senior living communities

Resources were developed as part of AIA’s “Reopening America: Strategies for Safer Buildings” initiative.