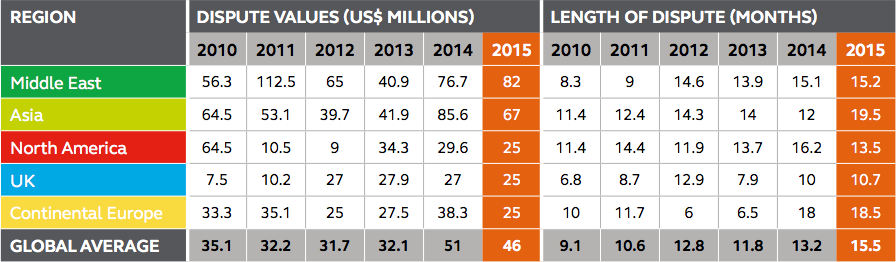

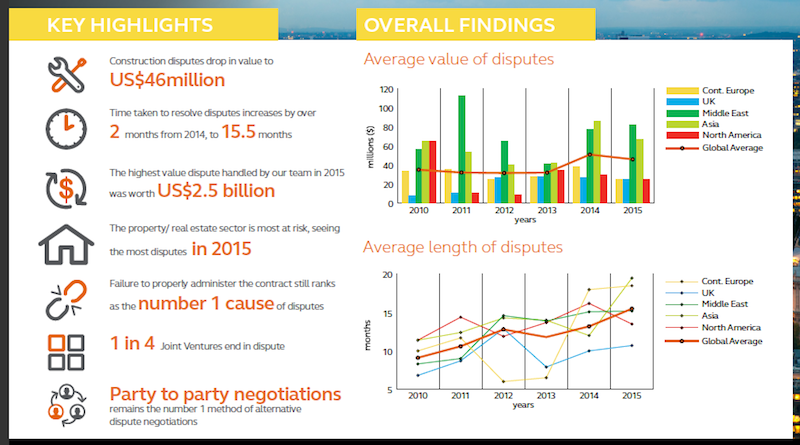

Most construction disputes are settled before they erupt into migraine-inducing litigation. But global asset volatility, currency turbulence, and the loss of economic momentum globally, have made dispute resolution tougher to reach amicably. And, in fact, for the third consecutive year, the length of disputes rose in 2015, according to a new report by Arcadis, the international design and consultancy firm, based on an in-depth review of projects that the firm’s Contract Solutions team handled last year.

Arcadis, which is active in 70 countries, defines a dispute as a “situation where two parties typically differ in the assertion of a contractual right.” Last year, the value of disputes fell by nearly 11% to an average of $46 million. However, the length of time it took to resolve these conflicts increased to a record average of 15.2 months, compared to 13.2 months in 2014 and 11.8 months in 2013.

The highest value dispute that Arcadis handled last year was worth a whopping $2.5 billion. (The firm did not state where that dispute arose.)

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

“The increased length of disputes will have multiple effects for both parties and are likely to, ultimately, have a negative impact on the construction industry,” Arcadis cautions in its report.

The No. 1 cause for disputes was failure to properly administer a contract, followed by a poorly written draft and unsubstantiated claims. The property/real estate sector had the most disputes, followed by the social infrastructure/public sector. Arcadis notes, ruefully, that more than one-quarter of joint ventures end in disputes.

Party-to-party negotiation is still the most common form of resolving disputes. And the best ways to avoid disputes in the first place is to make sure the contract is administered properly, the documents are accurate, and the contract has fair and appropriate risk and balances.

While the number of disputes in North America was up last year, their average values and lengths dipped. The value of disputes last year averaged $25 million, a 15.5% drop from the previous year. And the length of disputes in North America was down by nearly three months, to an average of 13.5 months compared to 16.2 in 2014.

Arcadis notes that the U.S. was the only global region to achieve both a decrease in construction dispute values and length of time to resolve disputes last year. “But there is one downside,” notes Roy Cooper, a Vice President for Arcadis North America. “Even though more disputes are being settled early, the ones that remain grow into complicated, emotional affairs, with large damages at stake. These also take longer to resolve, since U.S. courts hate to try construction cases due to their large volumes of documents and greater complexity.”

In North America, errors and omissions in contracts documents are the most common reasons for disputes.

“We expect that the decline in duration and value will continue into 2016 as the industry [in North America] continues to recognize the importance of addressing disputes early in their lifecycle, and contracts are written with provisions giving strict instruction on how and when to address disputes,” writes Arcadis.

Conversely, the Middle East now surpasses Asia as Dispute Central when it comes to contractual disagreements. The average dispute value in that region jumped by 6.9% last year to $82 million, and the length of disputes rose marginally to an average of 15.2 months.

Disputes drag out even longer in Continental Europe, which averaged 18.5 months last year. “Conflicting party interests” was cited by Arcadis as the No. 1 cause for disputes.

Joint ventures are most vulnerable to contract disputes. And the Middle East far exceeds global averages in the value and lenght of its construction disputes. Image: Arcadis “Global Construction Dispute Report 2016.”

Related Stories

Market Data | Jul 28, 2020

For the fourth consecutive quarter, Los Angeles leads the U.S. hotel construction pipeline at the close of Q2’ 20

New York City continues to have the greatest number of projects under construction, with 106 projects/18,354 rooms.

Market Data | Jul 28, 2020

6 must reads for the AEC industry today: July 28, 2020

St. Petersburg Pier reconstruction completes and post-pandemic workplace design will not be the same for all.

Market Data | Jul 28, 2020

Senate Republicans' coronavirus relief measure includes provisions that will help hard-hit construction firms recover

The HEALS Act includes essential liability, workforce, financial & unemployment reforms, but association will work to get needed infrastructure investments included in final relief measure.

Market Data | Jul 27, 2020

6 must reads for the AEC industry today: July 27, 2020

Customized labs give universities a recruiting edge and the U.S. construction pipeline remains robust through the first half of 2020.

Market Data | Jul 27, 2020

The U.S. construction pipeline remains robust through the first half of 2020, despite pandemic

Projects currently under construction stand at 1,771 projects/235,467 rooms, up 3% and 1% respectively, YOY.

Market Data | Jul 24, 2020

5 must reads for the AEC industry today: July 24, 2020

North Carolina will stop relying on FEMA flood mapping and Cal Poly Pomona's newest project.

Market Data | Jul 23, 2020

New LEED guidance from USGBC helps cities and communities expand resilience efforts in response to the COVID-19 pandemic

Credits integrate public health and social equity with sustainability planning.

Market Data | Jul 23, 2020

6 must reads for the AEC industry today: July 23, 2020

Skanska selects Pickard Chilton to design new ofice tower and days grow long at nursing homes as virus lockdowns drag on.

Market Data | Jul 22, 2020

6 must reads for the AEC industry today: July 22, 2020

Phase one of Toronto's The Orbit detailed and architecture billings remains in negative territory.

Market Data | Jul 21, 2020

Nonresidential building spending to decline through 2021

The commercial building sector is expected to be the hardest hit.