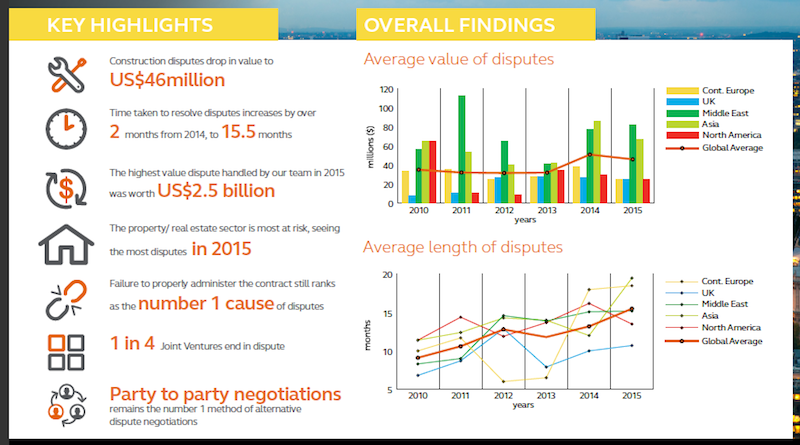

Most construction disputes are settled before they erupt into migraine-inducing litigation. But global asset volatility, currency turbulence, and the loss of economic momentum globally, have made dispute resolution tougher to reach amicably. And, in fact, for the third consecutive year, the length of disputes rose in 2015, according to a new report by Arcadis, the international design and consultancy firm, based on an in-depth review of projects that the firm’s Contract Solutions team handled last year.

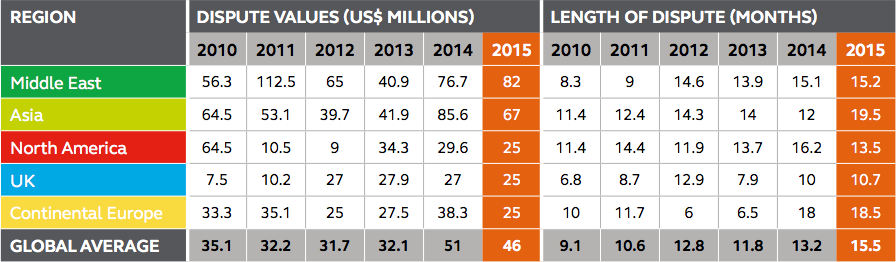

Arcadis, which is active in 70 countries, defines a dispute as a “situation where two parties typically differ in the assertion of a contractual right.” Last year, the value of disputes fell by nearly 11% to an average of $46 million. However, the length of time it took to resolve these conflicts increased to a record average of 15.2 months, compared to 13.2 months in 2014 and 11.8 months in 2013.

The highest value dispute that Arcadis handled last year was worth a whopping $2.5 billion. (The firm did not state where that dispute arose.)

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

Contractual disputes took longer to mediate for the third consecutive year in 2015. The No. 1 cause for disputes continues to be faulty contract administration. Image: Arcadis “Global Construction Dispute Report 2016.”

“The increased length of disputes will have multiple effects for both parties and are likely to, ultimately, have a negative impact on the construction industry,” Arcadis cautions in its report.

The No. 1 cause for disputes was failure to properly administer a contract, followed by a poorly written draft and unsubstantiated claims. The property/real estate sector had the most disputes, followed by the social infrastructure/public sector. Arcadis notes, ruefully, that more than one-quarter of joint ventures end in disputes.

Party-to-party negotiation is still the most common form of resolving disputes. And the best ways to avoid disputes in the first place is to make sure the contract is administered properly, the documents are accurate, and the contract has fair and appropriate risk and balances.

While the number of disputes in North America was up last year, their average values and lengths dipped. The value of disputes last year averaged $25 million, a 15.5% drop from the previous year. And the length of disputes in North America was down by nearly three months, to an average of 13.5 months compared to 16.2 in 2014.

Arcadis notes that the U.S. was the only global region to achieve both a decrease in construction dispute values and length of time to resolve disputes last year. “But there is one downside,” notes Roy Cooper, a Vice President for Arcadis North America. “Even though more disputes are being settled early, the ones that remain grow into complicated, emotional affairs, with large damages at stake. These also take longer to resolve, since U.S. courts hate to try construction cases due to their large volumes of documents and greater complexity.”

In North America, errors and omissions in contracts documents are the most common reasons for disputes.

“We expect that the decline in duration and value will continue into 2016 as the industry [in North America] continues to recognize the importance of addressing disputes early in their lifecycle, and contracts are written with provisions giving strict instruction on how and when to address disputes,” writes Arcadis.

Conversely, the Middle East now surpasses Asia as Dispute Central when it comes to contractual disagreements. The average dispute value in that region jumped by 6.9% last year to $82 million, and the length of disputes rose marginally to an average of 15.2 months.

Disputes drag out even longer in Continental Europe, which averaged 18.5 months last year. “Conflicting party interests” was cited by Arcadis as the No. 1 cause for disputes.

Joint ventures are most vulnerable to contract disputes. And the Middle East far exceeds global averages in the value and lenght of its construction disputes. Image: Arcadis “Global Construction Dispute Report 2016.”

Related Stories

Market Data | Feb 19, 2020

Architecture billings continue growth into 2020

Demand for design services increases across all building sectors.

Market Data | Feb 5, 2020

Construction employment increases in 211 out of 358 metro areas from December 2018 to 2019

Dallas-Plano-Irving, Texas and Kansas City have largest gains; New York City and Fairbanks, Alaska lag the most as labor shortages likely kept firms in many areas from adding even more workers.

Market Data | Feb 4, 2020

Construction spending dips in December as nonresidential losses offset housing pickup

Homebuilding strengthens but infrastructure and other nonresidential spending fades in recent months, reversing pattern in early 2019.

Market Data | Feb 4, 2020

IMEG Corp. acquires Clark Engineering

Founded in 1938 in Minneapolis, Clark Engineering has an extensive history of public and private project experience.

Market Data | Jan 30, 2020

U.S. economy expands 2.1% in 4th quarter

Investment in structures contracts.

Market Data | Jan 30, 2020

US construction & real estate industry sees a drop of 30.4% in deal activity in December 2019

A total of 48 deals worth $505.11m were announced in December 2019.

Market Data | Jan 29, 2020

Navigant research report finds global wind capacity value is expected to increase tenfold over the next decade

Wind power is being developed in more countries as well as offshore and onshore.

Market Data | Jan 28, 2020

What eight leading economists predict for nonresidential construction in 2020 and 2021

Public safety, education, and healthcare highlight a market that is entering growth-slowdown mode, but no downturn is projected, according to AIA's latest Consensus Construction Forecast panel.

Market Data | Jan 28, 2020

Los Angeles has the largest hotel construction pipeline in the United States

Los Angeles will have a growth rate of 2.5% with 19 new hotels/2,589 rooms opening.

Market Data | Jan 27, 2020

U.S. hotel construction pipeline finishes 2019 trending upward

Projects under construction continue to rise reaching an all-time high of 1,768 projects.