Lodging Econometrics (LE) recently compiled construction pipeline counts for every country and market around the world. Their analysts state that the total global construction pipeline ascended to a record high of 14,051 projects/2,327,923 rooms, a 9% increase in projects and an 8% increase in rooms year-over-year (YOY). The report summarizes development in 176 countries worldwide.

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown. The fallout after the on-going trade dispute between the United States and China continues to be the leading contributor.

But, low-interest rates and accommodative lending terms are the primary catalysts behind pipeline growth as the global pipeline should continue to grow for the foreseeable future, albeit at a much slower pace.

There is a record high 6,565 projects currently under construction worldwide having 1,192,398 rooms. Projects scheduled to start construction in the next 12 months; peaking at an all-time high for both projects and rooms, stands at 4,392 projects/636,080 rooms. Projects in the early planning stage continue to grow, with a 6% increase in projects and 10% increase in rooms, YOY, standing at 3,094 and 499,445 respectively.

The top countries by project count are the United States with 5,653 projects/693,207 rooms, just 230 projects shy of its all-time high of 5,883 projects set in the second quarter of 2008, and China with a current pipeline of 2,991 projects/592,884 rooms, which is a new high. The U.S. accounts for 40% of projects in the total global construction pipeline while China has 21%, resulting in 61% of all global projects being concentrated in just these two countries. Distantly following are Indonesia with 378 projects/63,196 rooms, Germany with 320 projects/57,689 rooms, and the United Kingdom with 280 projects/40,970 rooms.

Around the world, the cities with the largest pipelines by project counts are Dubai with 173 projects/50,832 rooms, New York City with 166 projects/28,231 rooms, and Dallas, TX with 162 projects/19,972 rooms. Los Angeles, CA follows with 158 projects/25,428 rooms, and Houston, TX with 146 projects/14,998 rooms.

The leading franchise company in the global construction pipeline is Marriott International with 2,534 projects/420,562 rooms. Hilton Worldwide follows closely with 2,334 projects/340,626 rooms. Next is InterContinental Hotels Group (IHG) with 1,769 projects/259,057 rooms, and AccorHotels with 980 projects/175,002 rooms. These four company brands account for 54% of all projects in the pipeline.

Leading brands in the pipeline for each of these companies are IHG’s Holiday Inn Express with 737 projects/93,415 rooms, Hampton by Hilton with 689 projects/90,634 rooms, Marriott’s Fairfield Inn with 397 projects/43,451 rooms, and AccorHotel’s Ibis Brands with 387 projects/54,683 rooms.

The first half of 2019 saw a total of 1,374 new hotels/196,237 rooms open around the world with an additional 1,675 hotels/236,334 rooms scheduled to open by year-end. With the global pipeline being at an all-time high, LE forecasts that new hotel openings will continue to climb with 3,168 hotels expected to open in 2020. In 2021, new openings are forecast to reach 3,171 hotels. Should all hotels forecast to open by 2021 come to fruition, it will be the largest surge of new hotel openings, collectively around the world, that LE has ever recorded.

Related Stories

Contractors | Feb 14, 2023

The average U.S. contractor has nine months worth of construction work in the pipeline

Associated Builders and Contractors reports today that its Construction Backlog Indicator declined 0.2 months to 9.0 in January, according to an ABC member survey conducted Jan. 20 to Feb. 3. The reading is 1.0 month higher than in January 2022.

Office Buildings | Feb 9, 2023

Post-Covid Manhattan office market rebound gaining momentum

Office workers in Manhattan continue to return to their workplaces in sufficient numbers for many of their employers to maintain or expand their footprint in the city, according to a survey of more than 140 major Manhattan office employers conducted in January by The Partnership for New York City.

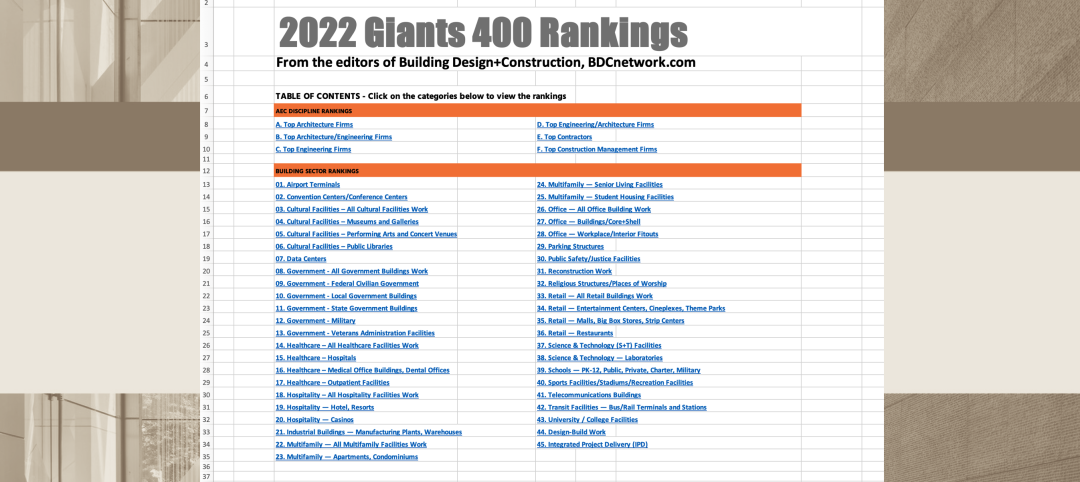

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Multifamily Housing | Feb 7, 2023

Multifamily housing rents flat in January, developers remain optimistic

Multifamily rents were flat in January 2023 as a strong jobs report indicated that fears of a significant economic recession may be overblown. U.S. asking rents averaged $1,701, unchanged from the prior month, according to the latest Yardi Matrix National Multifamily Report.

Market Data | Feb 6, 2023

Nonresidential construction spending dips 0.5% in December 2022

National nonresidential construction spending decreased by 0.5% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $943.5 billion for the month.

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

Market Data | Jan 10, 2023

Construction backlogs at highest level since Q2 2019, says ABC

Associated Builders and Contractors reports today that its Construction Backlog Indicator remained unchanged at 9.2 months in December 2022, according to an ABC member survey conducted Dec. 20, 2022, to Jan. 5, 2023. The reading is one month higher than in December 2021.

Market Data | Jan 6, 2023

Nonresidential construction spending rises in November 2022

Spending on nonresidential construction work in the U.S. was up 0.9% in November versus the previous month, and 11.8% versus the previous year, according to the U.S. Census Bureau.