Lodging Econometrics (LE) recently compiled construction pipeline counts for every country and market around the world. Their analysts state that the total global construction pipeline ascended to a record high of 14,051 projects/2,327,923 rooms, a 9% increase in projects and an 8% increase in rooms year-over-year (YOY). The report summarizes development in 176 countries worldwide.

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown. The fallout after the on-going trade dispute between the United States and China continues to be the leading contributor.

But, low-interest rates and accommodative lending terms are the primary catalysts behind pipeline growth as the global pipeline should continue to grow for the foreseeable future, albeit at a much slower pace.

There is a record high 6,565 projects currently under construction worldwide having 1,192,398 rooms. Projects scheduled to start construction in the next 12 months; peaking at an all-time high for both projects and rooms, stands at 4,392 projects/636,080 rooms. Projects in the early planning stage continue to grow, with a 6% increase in projects and 10% increase in rooms, YOY, standing at 3,094 and 499,445 respectively.

The top countries by project count are the United States with 5,653 projects/693,207 rooms, just 230 projects shy of its all-time high of 5,883 projects set in the second quarter of 2008, and China with a current pipeline of 2,991 projects/592,884 rooms, which is a new high. The U.S. accounts for 40% of projects in the total global construction pipeline while China has 21%, resulting in 61% of all global projects being concentrated in just these two countries. Distantly following are Indonesia with 378 projects/63,196 rooms, Germany with 320 projects/57,689 rooms, and the United Kingdom with 280 projects/40,970 rooms.

Around the world, the cities with the largest pipelines by project counts are Dubai with 173 projects/50,832 rooms, New York City with 166 projects/28,231 rooms, and Dallas, TX with 162 projects/19,972 rooms. Los Angeles, CA follows with 158 projects/25,428 rooms, and Houston, TX with 146 projects/14,998 rooms.

The leading franchise company in the global construction pipeline is Marriott International with 2,534 projects/420,562 rooms. Hilton Worldwide follows closely with 2,334 projects/340,626 rooms. Next is InterContinental Hotels Group (IHG) with 1,769 projects/259,057 rooms, and AccorHotels with 980 projects/175,002 rooms. These four company brands account for 54% of all projects in the pipeline.

Leading brands in the pipeline for each of these companies are IHG’s Holiday Inn Express with 737 projects/93,415 rooms, Hampton by Hilton with 689 projects/90,634 rooms, Marriott’s Fairfield Inn with 397 projects/43,451 rooms, and AccorHotel’s Ibis Brands with 387 projects/54,683 rooms.

The first half of 2019 saw a total of 1,374 new hotels/196,237 rooms open around the world with an additional 1,675 hotels/236,334 rooms scheduled to open by year-end. With the global pipeline being at an all-time high, LE forecasts that new hotel openings will continue to climb with 3,168 hotels expected to open in 2020. In 2021, new openings are forecast to reach 3,171 hotels. Should all hotels forecast to open by 2021 come to fruition, it will be the largest surge of new hotel openings, collectively around the world, that LE has ever recorded.

Related Stories

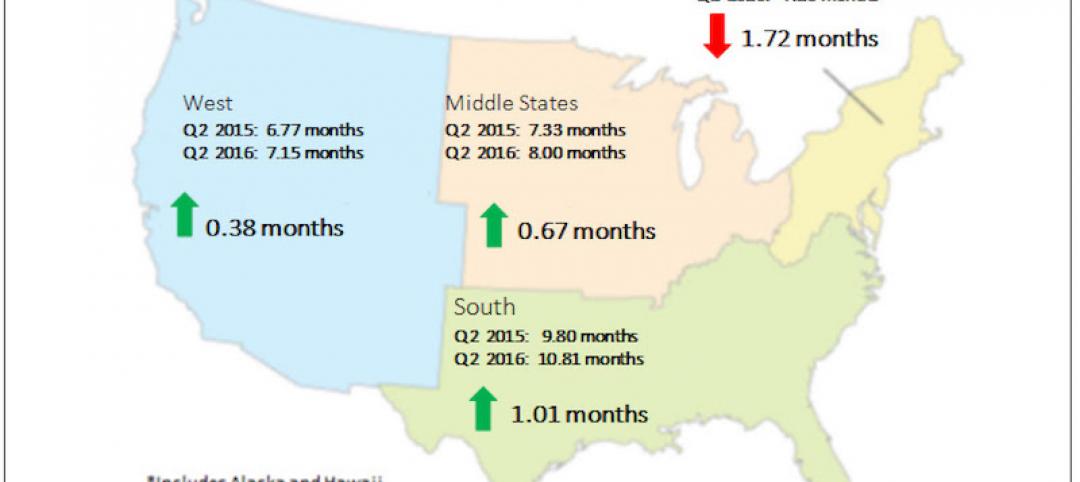

Market Data | Sep 22, 2016

Architecture Billings Index slips, overall outlook remains positive

Business conditions are slumping in the Northeast.

Market Data | Sep 20, 2016

Backlog skyrockets for largest firms during second quarter, but falls to 8.5 months overall

While a handful of commercial construction segments continue to be associated with expanding volumes, for the most part, the average contractor is no longer getting busier, says ABC Chief Economist Anirban Basu.

Designers | Sep 13, 2016

5 trends propelling a new era of food halls

Food halls have not only become an economical solution for restauranteurs and chefs experiencing skyrocketing retail prices and rents in large cities, but they also tap into our increased interest in gourmet locally sourced food, writes Gensler's Toshi Kasai.

Building Team | Sep 6, 2016

Letting your resource take center stage: A guide to thoughtful site selection for interpretive centers

Thoughtful site selection is never about one factor, but rather a confluence of several components that ultimately present trade-offs for the owner.

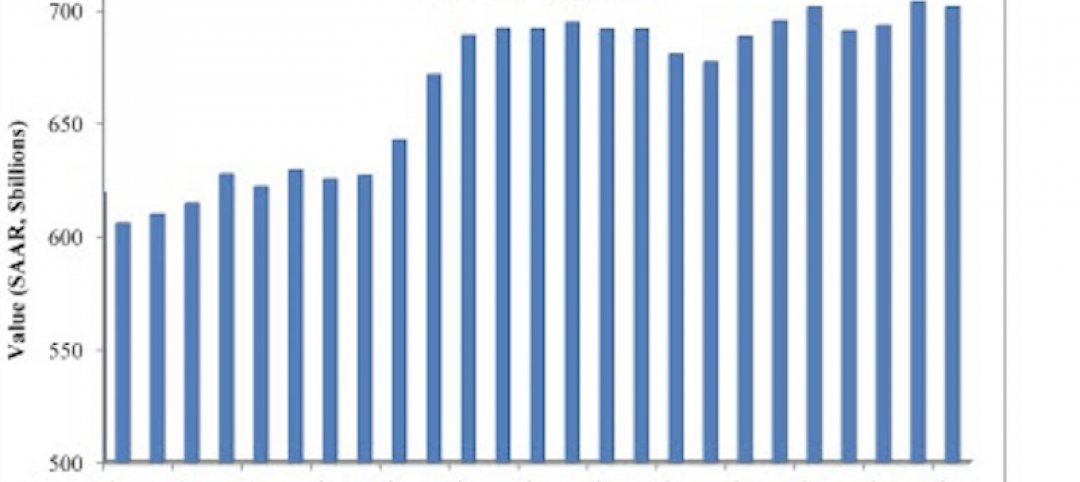

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.

Multifamily Housing | Aug 17, 2016

A new research platform launches for a data-deprived multifamily sector

The list of leading developers, owners, and property managers that are funding the NMHC Research Foundation speaks to the information gap it hopes to fill.

Hotel Facilities | Aug 17, 2016

Hotel construction continues to flourish in major cities

But concerns about overbuilding persist.

Market Data | Aug 16, 2016

Leading economists predict construction industry growth through 2017

The Chief Economists for ABC, AIA, and NAHB all see the construction industry continuing to expand over the next year and a half.