Fannie Mae and 24 lenders that are part of an underwriting and servicing risk-sharing program provided $28.9 billion in financing for 446,000 units of multifamily housing in 2014. Fannie backstopped nearly all of those loans through its mortgage-backed securitization execution.

“It’s not just the volume that’s impressive, it’s the quality of the business,” said Hilary Provinse, Senior Vice President for Multifamily Customer Engagement, Fannie Mae. “We’re taking smart risks and winning the right deals” in what she described as an “incredibly competitive” market.

Fannie Mae’s Delegated Underwriting and Servicing (DUS) program has played a significant role in the multifamily housing market for 27 years. For 2014, Fannie singled out Bethesda, Md.-based commercial real estate finance company Walker & Dunlop, with 22 officers nationwide, as the lender in that program that produced the highest volumes of multifamily housing. Walker & Dunlop was followed by Wells Fargo Multifamily Capital, Berkadia Commercial Mortgage, CBRE Multifamily Capital, and PNC Real Estate.

Capital One Multifamily Finance was the DUS program’s leading producer for affordable multifamily housing. And KeyBank National Association’s lending produced the most seniors multifamily housing.

All told, the two government-sponsored enterprises, Fannie Mae and Freddie Mac, and its lenders provided $57.2 billion to finance the construction of more than 850,000 multifamily housing units.

Freddie’s $28.3 billion in multifamily volume was the second most in its history. CRBE Capital Markets was Freddie’s leading “Program Plus” seller for multifamily financing; Citibank produced the most affordable multifamily housing through this program; Walker & Dunlop the most very low-income units; and CRBE the most seniors housing.

Related Stories

MFPRO+ News | Dec 18, 2023

Berkeley, Calif., raises building height limits in downtown area

Facing a severe housing shortage, the City of Berkeley, Calif., increased the height limits on residential buildings to 12 stories in the area close to the University of California campus.

Sponsored | Multifamily Housing | Dec 13, 2023

Mind the Gap

Incorporating temporary expansion joints on larger construction projects can help avoid serious consequences. Here's why and how.

Giants 400 | Dec 12, 2023

Top 35 Military Facility Construction Firms for 2023

Hensel Phelps, DPR Construction, Walsh Group, and Whiting-Turner top BD+C's ranking of the nation's largest military facility general contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 50 Military Facility Engineering Firms for 2023

Jacobs, Burns & McDonnell, WSP, and AECOM head BD+C's ranking of the nation's largest military facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Dec 12, 2023

Top 40 Military Facility Architecture Firms for 2023

Michael Baker International, HDR, Whitman, Requardt & Associates, and Stantec top BD+C's ranking of the nation's largest military facility architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Codes and Standards | Dec 11, 2023

Washington state tries new approach to phase out fossil fuels in new construction

After pausing a heat pump mandate earlier this year after a federal court overturned Berkeley, Calif.’s ban on gas appliances in new buildings, Washington state enacted a new code provision that seems poised to achieve the same goal.

MFPRO+ News | Dec 11, 2023

U.S. poorly prepared to house growing number of older adults

The U.S. is ill-prepared to provide adequate housing for the growing ranks of older people, according to a report from Harvard University’s Joint Center for Housing Studies. Over the next decade, the U.S. population older than 75 will increase by 45%, growing from 17 million to nearly 25 million, with many expected to struggle financially.

MFPRO+ News | Dec 7, 2023

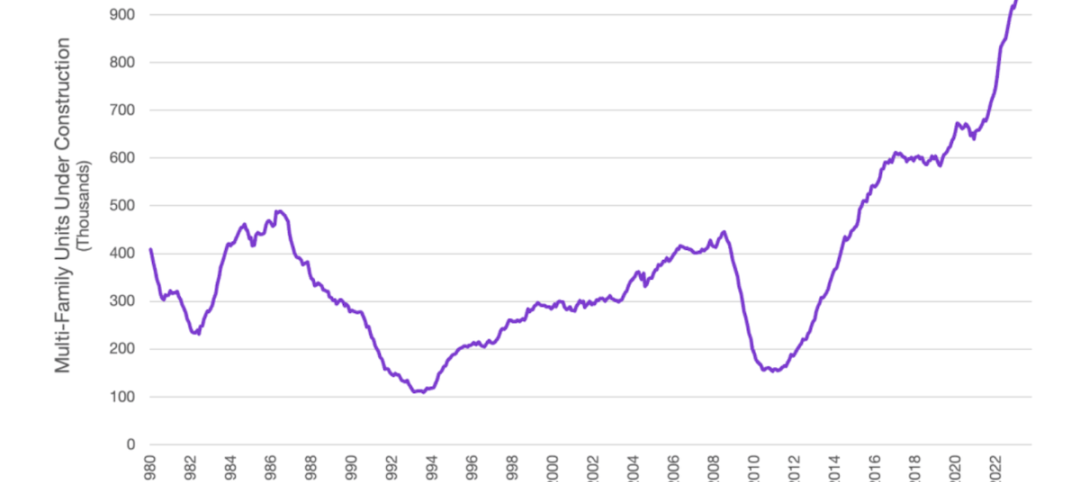

7 key predictions for the 2024 multifamily rental housing market

2024 will be the strongest year for new apartment construction in decades, says Apartment List's chief economist.

Codes and Standards | Dec 7, 2023

New York City aims to spur construction of more accessory dwelling units (ADUs)

To address a serious housing shortage, New York City is trying to get more homeowners to build accessory dwelling units (ADUs). The city recently unveiled a program that offers owners of single-family homes up to nearly $400,000 to construct an apartment on their property.

MFPRO+ News | Dec 5, 2023

DOE's Zero Energy Ready Home Multifamily Version 2 released

The U.S. Department of Energy has released Zero Energy Ready Home Multifamily Version 2. The latest version of the certification program increases energy efficiency and performance levels, adds electric readiness, and makes compliance pathways and the certification process more consistent with the ENERGY STAR Multifamily New Construction (ESMFNC) program.