Healthcare providers have been grappling with a major structural shift that began two decades ago. With the implementation of the Affordable Care Act (ACA), they also have to navigate a new legislative landscape, making it more onerous to maximize resources and real estate. Existing hospitals are being renovated and new facilities are being built as the focus changes from treating diseases, illnesses, and injuries to promoting health and wellness.

“The industry is shifting from a fee-for-service model to a value-based healthcare approach, which means healthcare organizations get a certain amount of money to take care of a population,” says Patrick Duke, Managing Director with CBRE Healthcare, and a BD+C 40 Under 40 honoree (Class of 2009). “And if they don’t manage that population well, they’re in trouble.”

7 TRENDS TRANSFORMING THE HEALTHCARE INDUSTRY

- Healthcare is moving from a fee-for-service model to a value-based (or population-based) model, with an emphasis on prevention and wellness.

- Healthcare providers are scrutinizing their expenditures with an eye toward greater efficiencies across the board.

- Whether building new or renovating, the goal in healthcare construction is to ensure greater energy efficiency and patient comfort.

- Providers are diversifying their portfolios to include more outpatient locations, particularly health and wellness centers that offer a continuum of care.

- Healthcare systems are forming partnerships with teaching hospitals, cancer centers, and other providers.

- The use of physician extenders, such as nurse practitioners and physician assistants, is growing, especially in the delivery of primary care.

- Increasingly, healthcare providers are turning to integrated project delivery (IPD) on large construction projects because it produces more predictable outcomes and reduces inefficiencies.

Duke says providers are trying to “shift care into the right locations at the right price.” That means lower-cost settings, lower supply costs and cost of occupancy, and the use of physician extenders like nurse practitioners and physician assistants. This shift is driving the growth of a retail model of healthcare that demands decision-making based on demographics, psychographics, and consumer behavior patterns.

Another trend is physician groups being bought by hospitals. With those transactions comes a wide variety of real estate assets, says Duke, such as leased medical office space and Class B and C properties that the physicians built themselves. The purchasing hospital needs to determine the best use of that real estate, which might mean bundling and selling it, or consolidating the physicians in one location.

Lastly, the demand for inpatient beds is either flat or decreasing across the country. “Most facilities have too many beds,” says Duke. “You can shut floors down and not staff them, but what do you do with that space? What does the hospital on the hill become in 2020 or 2025?”

Healthcare providers are asking themselves just how many hospitals they need. With the mergers and acquisitions going on in the industry, there may be two hospitals in close proximity of each other that offer the same services. Duke cites an example in Albany, N.Y., where one hospital will continue to have beds and the other will focus on surgery and imaging.

That’s not to say inpatient clinical services are going by the wayside. “There’s always going to be a significant need for those services,” says Doug Ribley, SVP of Health and Wellness Services for Akron (Ohio) General Health System. “But the outpatient delivery model, when medically appropriate, creates improved efficiencies, patient outcomes, and access.”

Delivery model shifted well before Obamacare

The shift in the healthcare delivery model was under way well before the ACA, commonly referred to as Obamacare, was enacted, says Fady Barmada, AIA, LEED AP, Principal with Array Advisors, the consulting practice of Array Architects.

“It really started with the shifting of the healthcare cost burden to the patients, something that has been happening for a couple of decades and really accelerated over the past 10 years,” says Barmada. Co-pays have been increasing drastically, as have the popularity and availability of high-deductible health plans (HDHPs). These trends, says Barmada, have resulted in more scrutiny from consumers about which health plans they’re going to choose, the coverage offered, and ultimately the care they’re given. “They’re making quality- and value-based decisions about where to go for their healthcare,” he adds.

On top of that, the ACA changes the incentivization and reimbursement structures for healthcare systems, from a fee-for-service basis to a value- or outcomes-based system.

“Providers are beginning to assume the cost risk of care, and it will be up to them to figure out how best to utilize their assets in order to ensure positive outcomes for their patients,” says Barmada. “Value-based payment models are forcing healthcare systems to push care to the lowest-cost environment, yet consumer preference and market competition will ensure that the quality of care in those environments stays constant at a minimum, or improves if possible.”

As a result, providers’ understanding of how they value their physical assets and what value they provide to their patients and communities has to change.

Akron General’s newest health and wellness center in Summit County, Ohio, offers physical therapy and fitness facilities for recovering patients as well as members of the community who wish to stay healthy. Photo: Courtesy Akron General.

Akron General’s newest health and wellness center in Summit County, Ohio, offers physical therapy and fitness facilities for recovering patients as well as members of the community who wish to stay healthy. Photo: Courtesy Akron General.

The core value of an asset portfolio is its ability to support the mission of the healthcare organization, to provide an environment that is both appropriate and uplifting, and to enable and facilitate the provision of care, says Barmada.

“The key difference in the new healthcare era is in the relationships that these health systems are engaging in with their communities to provide social and lifestyle amenities geared toward fostering behavioral change for population health,” he says. “With the broadening of the continuum of care and the increasing programmatic responsibility of healthcare organizations, new organizational, operational, and facilities models are being developed to deliver value-based care.”

Partnerships between healthcare organizations and large academic teaching hospitals are becoming more common, says CBRE’s Duke. For example, Robert Wood Johnson University Hospital of New Brunswick, N.J., is partnering with Robert Wood Johnson Medical School and the Cancer Institute of New Jersey, both of which are part of Rutgers University.

Cleveland Clinic acquired Akron General Health System, allowing Akron General to offer area residents such benefits as close-to-home chemotherapy, ground and air critical-care and trauma-scene transportation services, a transplant evaluation clinic, and an electronic medical record (EMR) system to manage patient care.

Competing for capital

Livonia, Mich.-based Trinity Health is a national nonprofit healthcare system with 88 hospitals and 126 continuing-care locations. “Healthcare never stays static in terms of how we’re paid and the complexities of the business, because technology continues to allow us to treat people in different ways,” says Bev Erickson, VP of Fixed Asset Management for Trinity. “But presently we’re functioning in both worlds. We still, in many cases, get paid on a volume-based business. At the same time, we’re moving into more of an accountable-care environment with financial arrangements that bind different components of healthcare delivery together, making us jointly accountable for the care and health of the population.”

Healthcare being a bricks-and-mortar industry, providers like Trinity are continually faced with competition for capital to upgrade information technology applications, as well as to renovate and replace aging facilities.

“I wouldn’t say we’re on a building streak by any means,” says Erickson. “Our goal is to maintain our existing facilities, keep them modern, have them be as efficient as possible, and eliminate unneeded bricks and mortar.”

MODULAR RADIOTHERAPY VAULT REDUCES COSTLY DOWNTIME

Fighting cancer successfully requires cancer centers to utilize the latest technology. But upgrading sophisticated radiotherapy equipment takes time, which in turn leads to a gap in patient services.

Replacing a linear accelerator can take as much as three to five months, including remodeling, testing, commissioning, and training. Most cancer centers don’t have an alternate means or additional capacity to provide therapies during this transitional period.

The Temporary Radiotherapy Vault (TRV) offers a patented, unique solution. Developed by RAD Technology Medical Systems, the TRV duplicates the services of a cancer center with facilities and equipment that can be erected and operational in as little as five days, says RAD President John Lefkus.

“Our company rents the TRV and places it in the cancer center’s parking lot or a nearby open area for the period of time required to upgrade their existing equipment,” says Lefkus.

Since that period of time can be four months or more, with the average single-vault facility bringing in monthly revenues of approximately $500,000, cancer centers risk losing millions in revenue, and patients as well, says Lefkus.

The TRV relies on other radiotherapy facility patents previously developed by RAD, but it takes a leap forward by offering a pre-installed and precommissioned accelerator in a transportable building package—complete with clinical functions and utilizing a specialized foundation approach.

Lefkus says the TRV has been installed in several locations on the East and West Coasts, most recently at the Olympic Medical Center in Sequim, Wash.

Inspira Health Network of Woodbury, N.J., has three hospitals across three counties supplemented by 60 outpatient locations. “Two of the hospitals are either fairly new or have been kept up to date,” says Clare Sapienza-Eck, VP of Business Development. “The third merged with our system in 2012 and doesn’t meet the same standards. Our board made the decision to replace that building so that we could connect patients to our outpatient centers and build the EMR platform into that system.”

The new hospital is being built on a greenfield site, which was determined to be less costly than renovating the existing building. It will have private rooms instead of double-bedded rooms and utilize the latest techniques for energy efficiency, including solar power and other alternatives. To improve staff efficiencies, a pneumatic tube system will convey supplies and products to nursing stations and patient floors.

The latest thrust: Health and wellness centers

Health and wellness centers, a new breed of outpatient location that marries clinical care with membership-oriented fitness, are being developed across the country. In northeast Ohio, Akron General Health System has invested $110 million in three centers: a 200,000-sf facility and two others that are each 140,000 sf.

“In the early 1990s, we were trying to figure out where healthcare was headed, and we came to the conclusion that it was moving toward a system that would eventually focus on prevention, early detection, and outpatient treatment,” says Ribley.

A comprehensive health and wellness center, he says, brings together a wide range of clinical outpatient services and physicians with retail-oriented health and wellness and preventive-based services. It’s a full outpatient continuum of care: diagnostics, treatment, and rehabilitation. The treatment component is usually an outpatient surgery center, a freestanding emergency department, or express care—sometimes a combination of the three. Clinical rehab services include physical therapy, sports medicine and sports performance, and occupational therapy.

The fourth component is medical fitness and wellness, which is the retail portion. Patients transition to become members of the medical fitness center so they can continue on their path to recovery, says Ribley. “People from the community can join in order to stay healthy, or manage a chronic condition so they don’t need clinical care.”

Since most health systems already offer clinical outpatient services in satellite locations throughout their markets, a health and wellness center allows them to consolidate those services into a community hub. The clinical services experience better financial performance and more volume, and there’s an impact on downstream revenue for the sponsoring healthcare organization. “It’s a strategic way to differentiate your brand in a marketplace while helping people manage or prevent chronic disease, illness, and injury,” says Ribley.

Akron General’s health and wellness centers have been so successful that, three years ago, it started a division called Akron General Health & Wellness Innovations to help other providers plan, design, build, operate, and finance similar facilities.

“We believe that over the next 10 to 15 years, every health system and community will have this type of facility,” Ribley says.

Another Akron-based company, Signet Enterprises, has an affiliate named Integrated Wellness Partners (IWP) that works with healthcare organizations to help finance, develop, own, and operate their infrastructure.

“We take a customized approach with every project,” says Mark Corr, Signet’s President. “Our focus is on the retail/membership component. Our clinical partners, whether they’re physician groups, hospitals, or universities, provide the clinical expertise. Effectively, we are able to build two centers under one roof.”

With demand for inpatient beds either flat or decreasing across the U.S., providers like Robert Wood Johnson University Hospital are expanding to include other uses, such as a cardiac intensive-care unit, new operating rooms, and a private observation unit.

With demand for inpatient beds either flat or decreasing across the U.S., providers like Robert Wood Johnson University Hospital are expanding to include other uses, such as a cardiac intensive-care unit, new operating rooms, and a private observation unit.

One recent IWP endeavor is NEOMED (Northeast Ohio Medical University) in Rootstown. The medical school underwent a complete transformation that involved 10 different projects, including student housing, a STEM high school, a conference center, and a new food-service operation.

“We turned it from a commuter medical school into a university campus,” says Corr, in part by building a health and wellness center that served both the student population and the surrounding community.

Robert Wood Johnson Health System operates five health and wellness centers across central New Jersey, serving more than 27,000 members. “We view this as an integral part of our focus on population health,” says Michael Knecht, Corporate VP for Community Outreach. “These centers act as the front door to our health system.”

Gearing up for seniors

According to a CBRE study, by 2040 there are expected to be more than half a million Americans that are 100 years old or older. “We are actively moving into long-term care—assisted living, senior housing, and memory-care facilities,” says Denny Freudeman, President of healthcare development firm HPlex Solutions, Lewis Center, Ohio.

Signet’s menu of services includes programs that are geared specifically for the aging population. Trinity’s continuing-care locations include a Program of All-Inclusive Care for the Elderly and senior-living facilities. While Inspira cannot build a nursing home on its new campus without state approval, the property itself is large enough (100 acres) to accommodate an elder-care facility if one is needed in the future.

“We’ll soak up probably 20 or 25 acres for the hospital, parking, and a medical office building or ambulatory site,” says Inspira’s Sapienza-Eck. “Should there be a time when long-term-care beds are made available, we’ll get permission from the state to build a facility on our campus.”

Related Stories

Giants 400 | Jan 15, 2024

Top 130 Hospital Facility Architecture Firms for 2023

HKS, HDR, Stantec, CannonDesign, and Page Southerland Page top BD+C's ranking of the nation's largest hospital facility architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Healthcare Facilities | Jan 7, 2024

Two new projects could be economic catalysts for a central New Jersey city

A Cancer Center and Innovation district are under construction and expected to start opening in 2025 in New Brunswick.

Designers | Jan 3, 2024

Designing better built environments for a neurodiverse world

For most of human history, design has mostly considered “typical users” who are fully able-bodied without clinical or emotional disabilities. The problem with this approach is that it offers a limited perspective on how space can positively or negatively influence someone based on their physical, mental, and sensory abilities.

Healthcare Facilities | Dec 19, 2023

A new hospital in Duluth, Minn., is now the region’s largest healthcare facility

In Duluth, Minn., the new St. Mary’s Medical Center, designed by EwingCole, is now the largest healthcare facility in the region. The hospital consolidates Essentia Health’s healthcare services under one roof. At about 1 million sf spanning two city blocks, St. Mary’s overlooks Lake Superior, providing views on almost every floor of the world’s largest freshwater lake.

Healthcare Facilities | Dec 7, 2023

New $650 million Baptist Health Care complex opens in Pensacola

Baptist Health Care’s new $650 million healthcare complex opened recently in Pensacola, Fla. Featuring a 10-story, 268-bed hospital, the project “represents the single-largest investment in the healthcare history of northwest Florida,” said Gresham Smith project executive Robert “Skip” Yauger, AIA, LEED AP. The 602,000 sf Baptist Hospital is equipped with a Level II trauma center that provides 61 exam rooms and three triage areas.

Engineers | Nov 27, 2023

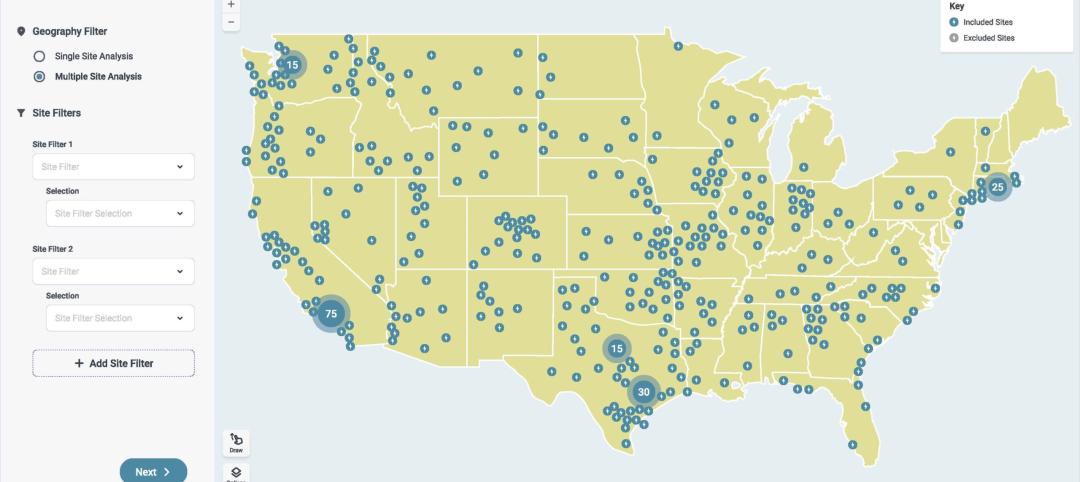

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

Healthcare Facilities | Nov 3, 2023

The University of Chicago Medicine is building its city’s first freestanding cancer center with inpatient and outpatient services

The University of Chicago Medicine (UChicago Medicine) is building Chicago’s first freestanding cancer center with inpatient and outpatient services. Aiming to bridge longstanding health disparities on Chicago’s South Side, the $815 million project will consolidate care and about 200 team members currently spread across at least five buildings. The new facility, which broke ground in September, is expected to open to patients in spring 2027.

Sponsored | | Oct 17, 2023

The Evolution of Medical Facility Security

As the healthcare system grows, securing these facilities becomes ever more challenging. Increasingly, medical providers have multiple facilities within their networks, making traditional keying systems and credentialing impractical.

Healthcare Facilities | Oct 11, 2023

Leveraging land and light to enhance patient care

GBBN interior designer Kristin Greeley shares insights from the firm's latest project: a cancer center in Santa Fe, N.M.

Healthcare Facilities | Oct 9, 2023

Design solutions for mental health as a secondary diagnosis

Rachel Vedder, RA, LEED AP, Senior Architect, Design Collaborative, shares two design solutions for hospitals treating behavioral health patients.