The chief executive officer of the Associated General Contractors of America, Stephen E. Sandherr, issued the following statement in reaction to release today of House Democrats’ Proposed Coronavirus Recovery Measure:

“It is encouraging to see House Democrats moving quickly on legislation intended to help the economy recover from the coronavirus. Their proposal includes measures that will help construction firms that have been hard-hit by declining demand and uncertainty about future market conditions. But the proposal’s authors missed an opportunity to address some of the most significant challenges facing the industry.

“On the positive side, the measure includes some needed relief for state highway programs that have been hammered by declining gas tax revenue amid broad economic lockdown measures. The measure also includes an expansion of the employee retention tax credit that will benefit construction firms that have worked to retain employees. It authorizes composite retirement plans, which hold great potential to address the challenges facing multiemployer retirement plans in which many construction firms participate and provides other needed pension relief. And it includes measures to help construction firms working on federal projects cope with schedule delays and other impacts related to the coronavirus.

“The measure, however, fails to include any safe harbor language to protect firms that are safeguarding workers and the public from the coronavirus from limitless litigation. Meanwhile, the proposed repeal of the net operating loss carryback provision will punish firms, especially family-owned businesses, that suffered losses of $250,000 or more this year. This will make it even harder for these firms to retain staff. And the proposed expansion of the unemployment supplement through January 31 will make it more challenging for firms to rehire employees once demand begins to rebound.

“We appreciate that this measure advances a much-needed debate about the best way to re-start the economy. That is why we will continue to work with members of both parties to craft measures, including liability protections, new infrastructure investments and pension relief, that will help the construction industry recover and rebuild.”

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

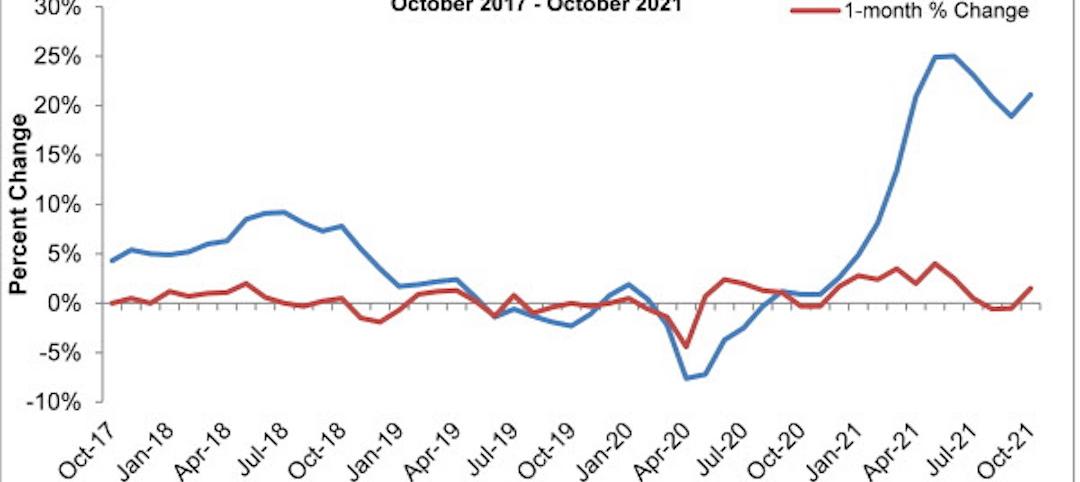

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

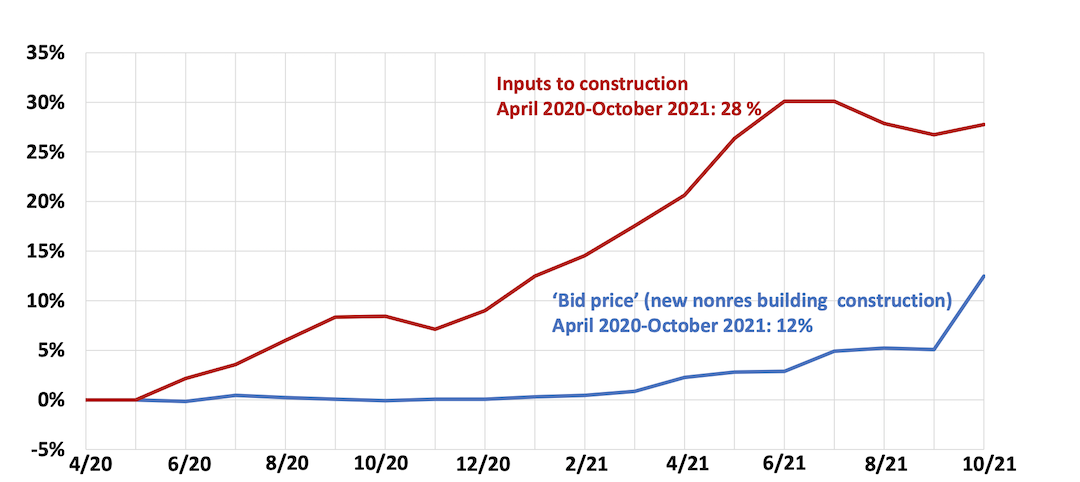

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.