The chief executive officer of the Associated General Contractors of America, Stephen E. Sandherr, issued the following statement in reaction to release today of House Democrats’ Proposed Coronavirus Recovery Measure:

“It is encouraging to see House Democrats moving quickly on legislation intended to help the economy recover from the coronavirus. Their proposal includes measures that will help construction firms that have been hard-hit by declining demand and uncertainty about future market conditions. But the proposal’s authors missed an opportunity to address some of the most significant challenges facing the industry.

“On the positive side, the measure includes some needed relief for state highway programs that have been hammered by declining gas tax revenue amid broad economic lockdown measures. The measure also includes an expansion of the employee retention tax credit that will benefit construction firms that have worked to retain employees. It authorizes composite retirement plans, which hold great potential to address the challenges facing multiemployer retirement plans in which many construction firms participate and provides other needed pension relief. And it includes measures to help construction firms working on federal projects cope with schedule delays and other impacts related to the coronavirus.

“The measure, however, fails to include any safe harbor language to protect firms that are safeguarding workers and the public from the coronavirus from limitless litigation. Meanwhile, the proposed repeal of the net operating loss carryback provision will punish firms, especially family-owned businesses, that suffered losses of $250,000 or more this year. This will make it even harder for these firms to retain staff. And the proposed expansion of the unemployment supplement through January 31 will make it more challenging for firms to rehire employees once demand begins to rebound.

“We appreciate that this measure advances a much-needed debate about the best way to re-start the economy. That is why we will continue to work with members of both parties to craft measures, including liability protections, new infrastructure investments and pension relief, that will help the construction industry recover and rebuild.”

Related Stories

Industry Research | Aug 29, 2019

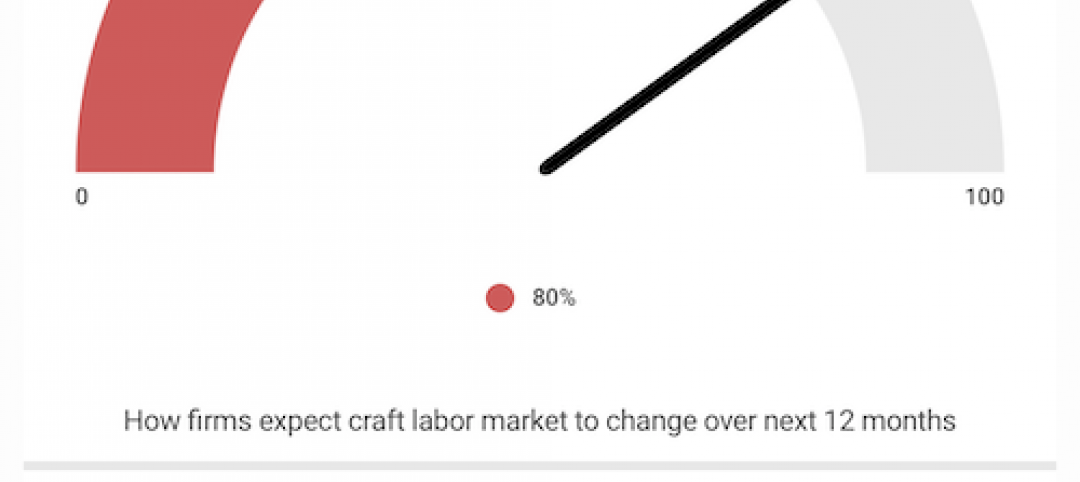

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

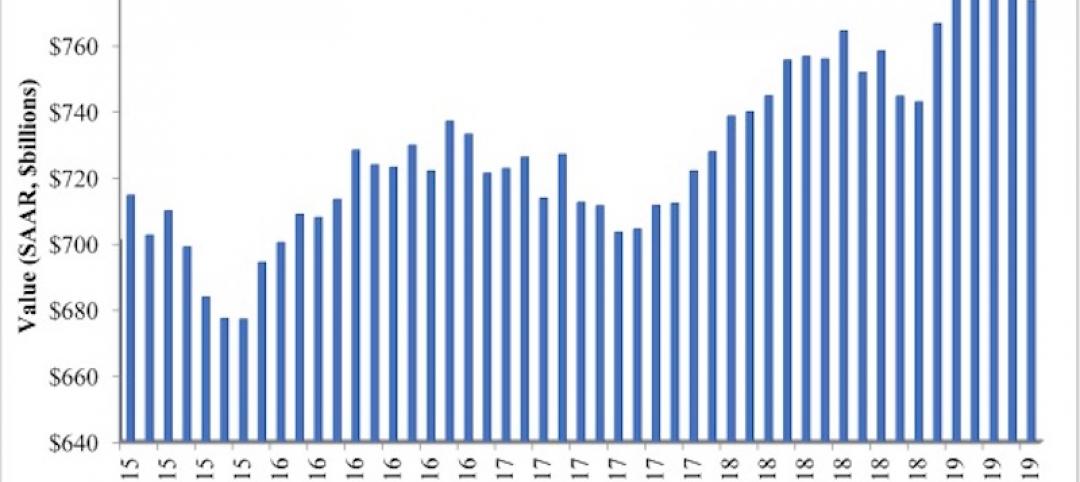

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.

Market Data | Jul 20, 2019

Construction costs continued to rise in second quarter

Labor availability is a big factor in that inflation, according to Rider Levett Bucknall report.