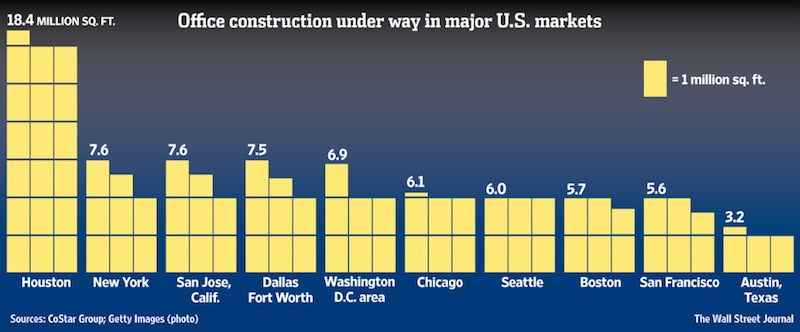

A few days ago, The Wall Street Journal reported that one-sixth of all office space under construction nationwide is located in the Houston metropolitan area.

The Journal quoted the property data firm CoStar Group, which stated that by the end of 2014, 80 buildings with about 18 million sf of office space were started in Greater Houston.

This wouldn’t be earthshaking news—Houston, after all, continues to be one of country’s more vibrant markets, ranking 39th out of 300 of the largest metropolitan economies worldwide, according to the Brookings Institution’s Global MetroMonitor—were it not for the fact that all this office construction is occurring at a time when the price of oil—a commodity that helps lubricate Houston’s economic engine—has plummeted by more than 50% since last summer.

Several of the biggest energy companies have announced more than 30,000 layoffs worldwide, and a sizable number of those workers could be Houstonians. Fewer workers require fewer offices, and employers are already rushing to sublease the space they occupy, the Journal reports.

Sources: WSJ, CoStar Group

Sources: WSJ, CoStar Group

In a follow-up story, the Journal reports that 13.2 million sf of office space are on schedule to be completed in 2015, the highest total since 1984.

CoStar now estimates that Houston’s vacancy rate could rise to 15.3% by 2016, from 10.8% at the end of 2014.

The newspaper singles out one development firm, Hines, that’s building a 48-story tower on spec, without tenants lined up, as an example of how certain companies suddenly find themselves exposed to a potential economic downturn. On the flip side, excess office space and higher vacancy rates could lead to lower rents, and opportunities to find existing space rather than building new.

HOUSTON NOT AS OIL DEPENDENT

But is Houston really headed for a fall? Not if you listen to some of the comments posted about the Journal article. One reader insisted that Houston is nowhere near as oil dependent as it was in the 1980s, when its housing market all but collapsed and nine of Texas’s 10 largest banks failed.

“Houston is twice as large as it was in 1980, and its dynamic economy is now twice as diversified,” one reader commented. “Also, the oil industry has fortified itself since 1980. Houston now boasts 11 major economic sectors in its massive economy.”

(Similar arguments about Louisiana’s supposedly more-diverse economy were made recently in an article published by The Advocate in Baton Rouge, La., which reported that only 13% of that state’s proceeds is now tied to mineral revenue, compared to 42% in the 1980s.)

A recent survey of Houston-area purchasing managers at 45 companies found that those not so tightly bound to oil prices—such as utilities and non-energy manufacturing—have seen a boost in new orders, production levels, and supplier purchases.

“We’ll have to see where things go in the next few months,” Ross Harvison, Chairman of the Institute for Supply Management-Houston Business Survey Committee, told the Houston Chronicle.

Even the Journal article acknowledges that any “bust” in Houston’s economy might turn out to be short term. The newspaper quotes Mike Mair, Executive VP in charge of Skanska’s construction in Houston, who says his company isn’t panicking about what he concedes could be as “soft” 2015. Skanska is currently building two 12-story towers, one of which doesn’t have tenants yet, and Mair says those projects will proceed. “I’m not afraid of ’16 and ’17,” he is quoted as saying.

Mair’s optimism is promulgated, in part, on long-range projections about Houston’s population, now at around 6.5 million. The Texas State Data Centers expects that people count to expand by an average 2.2 million residents per decade over the next 40 years.

Even with falling oil prices, Houston is expected to add 62,900 jobs in 2015, according to the Greater Houston Partnership. Most cities would welcome such a bounty, but the bar is set higher for Houston, which added 120,000 jobs last year.

Related Stories

Office Buildings | Apr 8, 2019

It’s time for office amenities to get to work

Amenities with the greatest impact on effectiveness and experience are those that directly support the work needs of individual employees and their teams.

Office Buildings | Apr 8, 2019

Denver office building features 13,000 sf green roof

Dynia Architects designed the building.

Office Buildings | Apr 5, 2019

2019 trends in the workplace

From retention and career advancement to the ethics of inclusion and diversity, these five trends will play a major role this year in design, strategic planning and workplace development.

Industrial Facilities | Mar 10, 2019

The burgeoning Port San Antonio lays out growth plans

Expansions would accommodate cybersecurity, aerospace, and defense tenants, and help commercialize technologies.

Office Buildings | Mar 6, 2019

How to leverage design and culture’s two-way relationship for better workplaces

The relationship between workplace design and company culture isn’t all that different from a tango.

Office Buildings | Feb 15, 2019

A healthier perspective: Office developers bet on wellness amenities to attract top-notch tenants

Owners and developers are driving demand for wellness features and practices—active stairways, biophilia, enhanced air quality, etc.—as one more way draw tenants.

Office Buildings | Feb 15, 2019

Vancouver’s new office building will be a stack of reflective boxes

OSO and Merrick Architecture designed the building.

Office Buildings | Feb 11, 2019

Real-world wellness pays off

3form, a materials manufacturer, did a top-to-bottom remodel of its Salt Lake City headquarters campus that included adding a 14,500-sf gym.

Office Buildings | Feb 5, 2019

Duluth Trading Company moves to new HQ building

Plunkett Raysich Architects designed the project.

Interior Architecture | Jan 14, 2019

To get more involved earlier in projects, a leading furniture dealer launches a firm for commercial interiors construction

Vantis is positioned to integrate design with offsite customized fabrication.