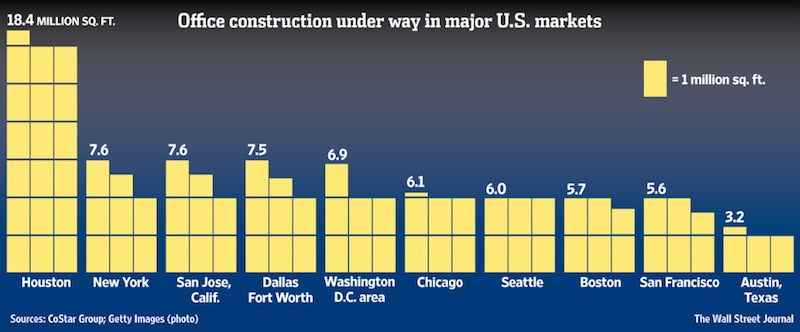

A few days ago, The Wall Street Journal reported that one-sixth of all office space under construction nationwide is located in the Houston metropolitan area.

The Journal quoted the property data firm CoStar Group, which stated that by the end of 2014, 80 buildings with about 18 million sf of office space were started in Greater Houston.

This wouldn’t be earthshaking news—Houston, after all, continues to be one of country’s more vibrant markets, ranking 39th out of 300 of the largest metropolitan economies worldwide, according to the Brookings Institution’s Global MetroMonitor—were it not for the fact that all this office construction is occurring at a time when the price of oil—a commodity that helps lubricate Houston’s economic engine—has plummeted by more than 50% since last summer.

Several of the biggest energy companies have announced more than 30,000 layoffs worldwide, and a sizable number of those workers could be Houstonians. Fewer workers require fewer offices, and employers are already rushing to sublease the space they occupy, the Journal reports.

Sources: WSJ, CoStar Group

Sources: WSJ, CoStar Group

In a follow-up story, the Journal reports that 13.2 million sf of office space are on schedule to be completed in 2015, the highest total since 1984.

CoStar now estimates that Houston’s vacancy rate could rise to 15.3% by 2016, from 10.8% at the end of 2014.

The newspaper singles out one development firm, Hines, that’s building a 48-story tower on spec, without tenants lined up, as an example of how certain companies suddenly find themselves exposed to a potential economic downturn. On the flip side, excess office space and higher vacancy rates could lead to lower rents, and opportunities to find existing space rather than building new.

HOUSTON NOT AS OIL DEPENDENT

But is Houston really headed for a fall? Not if you listen to some of the comments posted about the Journal article. One reader insisted that Houston is nowhere near as oil dependent as it was in the 1980s, when its housing market all but collapsed and nine of Texas’s 10 largest banks failed.

“Houston is twice as large as it was in 1980, and its dynamic economy is now twice as diversified,” one reader commented. “Also, the oil industry has fortified itself since 1980. Houston now boasts 11 major economic sectors in its massive economy.”

(Similar arguments about Louisiana’s supposedly more-diverse economy were made recently in an article published by The Advocate in Baton Rouge, La., which reported that only 13% of that state’s proceeds is now tied to mineral revenue, compared to 42% in the 1980s.)

A recent survey of Houston-area purchasing managers at 45 companies found that those not so tightly bound to oil prices—such as utilities and non-energy manufacturing—have seen a boost in new orders, production levels, and supplier purchases.

“We’ll have to see where things go in the next few months,” Ross Harvison, Chairman of the Institute for Supply Management-Houston Business Survey Committee, told the Houston Chronicle.

Even the Journal article acknowledges that any “bust” in Houston’s economy might turn out to be short term. The newspaper quotes Mike Mair, Executive VP in charge of Skanska’s construction in Houston, who says his company isn’t panicking about what he concedes could be as “soft” 2015. Skanska is currently building two 12-story towers, one of which doesn’t have tenants yet, and Mair says those projects will proceed. “I’m not afraid of ’16 and ’17,” he is quoted as saying.

Mair’s optimism is promulgated, in part, on long-range projections about Houston’s population, now at around 6.5 million. The Texas State Data Centers expects that people count to expand by an average 2.2 million residents per decade over the next 40 years.

Even with falling oil prices, Houston is expected to add 62,900 jobs in 2015, according to the Greater Houston Partnership. Most cities would welcome such a bounty, but the bar is set higher for Houston, which added 120,000 jobs last year.

Related Stories

Transit Facilities | Dec 4, 2023

6 guideposts for cities to create equitable transit-oriented developments

Austin, Texas, has developed an ETOD Policy Toolkit Study to make transit-oriented developments more equitable for current and future residents and businesses.

Office Buildings | Dec 1, 2023

Amazon office building doubles as emergency housing for Seattle families

The unusual location for services of this kind serves over 300 people per day. Mary's Place spreads across eight of the office's floors—all designed by Graphite—testing the status quo for its experimental approach to homelessness support.

Engineers | Nov 27, 2023

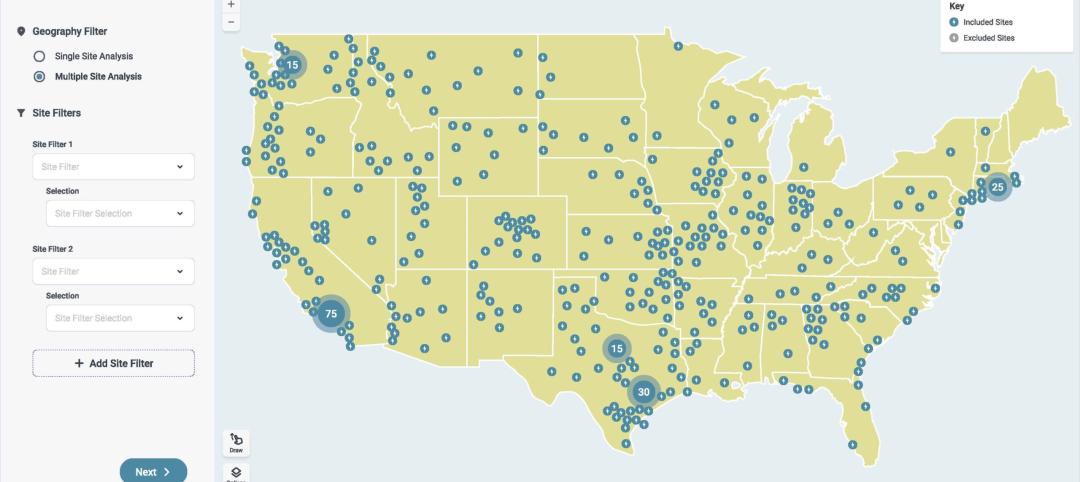

Kimley-Horn eliminates the guesswork of electric vehicle charger site selection

Private businesses and governments can now choose their new electric vehicle (EV) charger locations with data-driven precision. Kimley-Horn, the national engineering, planning, and design consulting firm, today launched TREDLite EV, a cloud-based tool that helps organizations develop and optimize their EV charger deployment strategies based on the organization’s unique priorities.

Market Data | Nov 27, 2023

Number of employees returning to the office varies significantly by city

While the return-to-the-office trend is felt across the country, the percentage of employees moving back to their offices varies significantly according to geography, according to Eptura’s Q3 Workplace Index.

Office Buildings | Nov 10, 2023

3 important early considerations for office-to-residential conversions

Scott Campagna, PE, Senior Director of Housing, IMEG Corp, shares insights from experts on office-to-residential conversion issues that may be mitigated when dealt with early.

Laboratories | Nov 8, 2023

Boston’s FORUM building to support cutting-edge life sciences research and development

Global real estate companies Lendlease and Ivanhoé Cambridge recently announced the topping-out of FORUM, a nine-story, 350,000-sf life science building in Boston. Located in Boston Landing, a 15-acre mixed-use community, the $545 million project will achieve operational net zero carbon upon completion in 2024.

Giants 400 | Nov 6, 2023

Top 100 Government Building Construction Firms for 2023

Hensel Phelps, Turner Construction, Clark Group, Fluor, and BL Harbert top BD+C's rankings of the nation's largest government building sector general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes revenue from all government building sectors, including federal, state, local, military, and Veterans Affairs (VA) buildings.

Giants 400 | Nov 6, 2023

Top 90 Government Building Engineering Firms for 2023

Fluor, Jacobs, AECOM, WSP, and Burns & McDonnell head BD+C's rankings of the nation's largest government building sector engineering and engineering architecture (EA) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes revenue from all government building sectors, including federal, state, local, military, and Veterans Affairs (VA) buildings.

Giants 400 | Nov 6, 2023

Top 170 Government Building Architecture Firms for 2023

Page Southerland Page, Gensler, Stantec, HOK, and Skidmore, Owings & Merrill top BD+C's ranking of the nation's largest government building sector architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report. Note: This ranking includes revenue from all government building sectors, including federal, state, local, military, and Veterans Affairs (VA) buildings.

Office Buildings | Nov 2, 2023

Amazon’s second headquarters completes its first buildings: a pair of 22-story towers

Amazon has completed construction of the first two buildings of its second headquarters, located in Arlington, Va. The all-electric structures, featuring low carbon concrete and mass timber, help further the company’s commitment to achieving net zero carbon emissions by 2040 and 100% renewable energy consumption by 2030. Designed by ZGF Architects, the two 22-story buildings are on track to become the largest LEED v4 Platinum buildings in the U.S.