On March 29, Cushman & Wakefield brokered the $14.7 million sale of a two-story, 24,600-sf medical building in North Hills, N.Y., which traded at a 6% cap rate. Around the same time, an affiliate of Inland Real Estate Acquisitions sold four newly constructed medical buildings totaling 119,000 sf in the Houston, Raleigh, N.C., and Salt Lake City markets. And early this month in Scottsdale, Ariz., Helix Properties sold two Class A medical offices totaling 42,183 sf for $12.13 million.

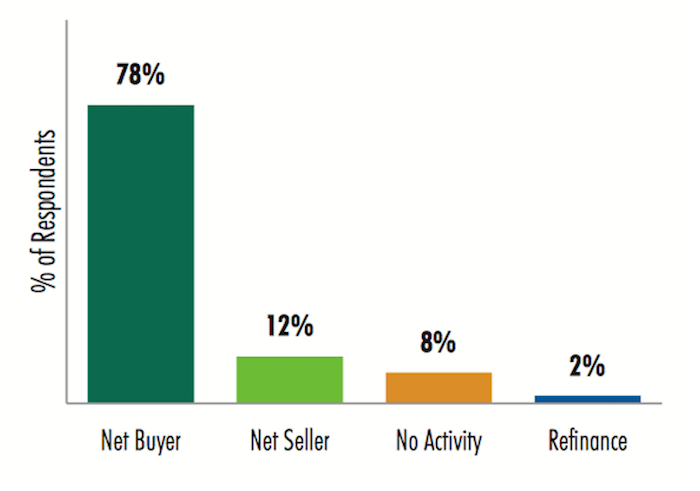

The market for quality healthcare-related buildings remains robust. A recent poll found the majority of real estate investors and developers expect to be “net buyers” of medical office buildings in 2017, and many believe health systems’ development requests for proposals would be higher this year than in 2016.

Those are some of the findings from a just-released 2017 Healthcare Real Estate Investor and Developer Survey conducted by CBRE’s U.S. Healthcare Capital Markets Group. The results of the 27-question survey are based on a total of 91 respondents.

Sixty three of those firms say they’ve allocated an aggregate of $14.9 billion in equity for healthcare real estate investment and development this year. That total represents about a 3% increase over what respondents said they allocated in 2016.

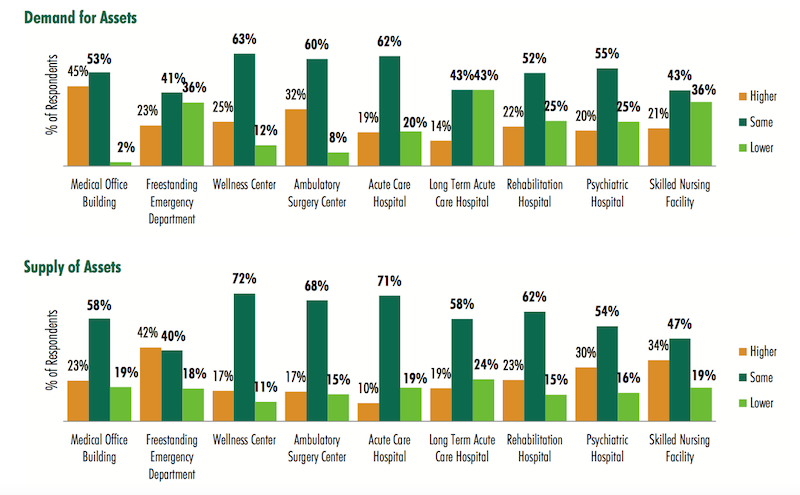

However, the survey notes that this sector’s supply-demand imbalance would continue this year, “as the total allocation of funds to purchase medical office buildings is far greater than the available supply.” Respondents expect that demand and supply for every healthcare real estate asset type would remain relatively the same in 2017. (At the time of the survey, 57% of respondents said the occupancy rates in their healthcare portfolios were about level with a year ago.)

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

The preferred transaction size for a sizable majority of respondents—72%—falls somewhere between $10 million and $50 million. Nearly all of the respondents indicated they were most interested in MOBs, followed by Ambulatory Surgery Centers (80%), Wellness Centers (36%), and Freestanding Emergency Departments (35%).

More than three-quarters of respondents rely on bank debt to finance their transactions, although nearly two fifths (39%) said they’d pay for purchases with cash exclusively.

Retention plans vary markedly, as 29% said they expected to hold onto their healthcare purchases for 5-7 years, whereas 28% would retain the asset for more than 10 years (that percentage goes up to 60% among healthcare REITs that responded to the survey).

The survey takes investors’ and developers’ pulses on their Internal Rate of Return requirements by product type. (For example, 42% indicated their target all-cash IRR this year ranges from 7% to 9.49%.)

Value for core product—namely, Class “A” on-campus medical office buildings—continues to be high, with 49% of the survey respondents projecting cap rates below 6%.

Single-tenant medical office buildings are being priced the most aggressively again this year, with the largest group of survey respondents (39%) indicating a cap rate range of between 6% and 6.49%. Ambulatory Surgery Centers followed medical office buildings, but respondents expressed a wide variety of expectations, with 26% projecting a cap rate between 6% and 6.49%, 26% of respondents projecting a cap rate in the range of 6.5% to 6.99%, and 28% of respondents projecting a cap rate between 7% and 7.49%.

More than two-fifths of respondents expect MOB lease rates to increase 1-2% this year, compared to 26% that predicted that rate level in 2016. There was also a drop—to 55% from 60%—of respondents to this year’s survey from last year’s that thought lease rates would increase 2-3%

Nearly 90% of respondents said the minimum lease term they would accept for a sale-leaseback by a healthcare system would be at least 10 years (it’s 10-14 years for 70%). More than two-fifths of respondents—42%—said the minimum annual rental rate hike they’d consider for a sale-leaseback would be 2-2.49%

The highest percentage of respondents said the minimum hospital credit rating they’d consider investing in would be BBB- to BBB+. Sixteen percent, though, said they wouldn’t go below A- to A+.

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

Twenty-seven percent said that 60-69 years was the minimum ground lease they would consider for investment, compared to a 50-59 year threshold that 35% responding to the 2016 survey would accept. When structuring a ground lease with a hospital for an MOB, 48% of respondents said a fair land value to use in the calculation to determine rent is 5-6%.

CBRE conducted this survey before Republicans pulled their bill to repeal and replace the Affordable Care Act. But developers and investors were asked to predict what they thought would happen, and majorities expected a repeal of the individual mandate for insurance coverage, a repeal of state and federal insurance marketplace exchanges, and a rollback of Medicaid funding.

They also predicted that health insurers would be allowed to sell policies across state borders; that the Trump administration would favor the expansion of Health Savings Accounts; and that insurers would funnel their most expensive patients into subsidized high-risk pools.

Related Stories

| Aug 11, 2010

Jacobs, HDR top BD+C's ranking of the nation's 100 largest institutional building design firms

A ranking of the Top 100 Institutional Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Nonprofit healthcare providers turn to real estate for liquidity and to preserve capital, says Jones Lang LaSalle report

Long considered to be stable investments immune to recession, hospitals and other healthcare facilities are now feeling the effects of a cash-strapped economy as decreased charitable contributions are forcing nonprofit hospitals to pare back and seek new financing sources, according to Jones Lang LaSalle’s 2009 Healthcare Real Estate Financing Outlook.

| Aug 11, 2010

Gafcon announces completion of Coronado animal care facility

Gafcon, a leading California-based construction management and consulting firm, announced today that construction is now complete on a new $1.6 million animal care facility located at 1395 First Street in Coronado, Calif.

| Aug 11, 2010

Colorado hospital wins LEED Gold

The main building of the Medical Center of the Rockies in Loveland, Colo., is a 136-bed regional medical center offering a full spectrum of services, with specialties in cardiac and trauma care. Constructed primarily of brick, native sandstone, and 85,000 sf of metal panels manufactured by Centria, the 600,000-sf main building, by Denver-based HLM Design, is one of the few hospitals in the nati...

| Aug 11, 2010

Biomedical center to join London's research scene

The UK Centre for Medical Research and Innovation, a partnership of scientific organizations researching new treatments for illnesses such as cancer and heart disease, hopes to attract leading medical scientists to its planned research center. Designed by HOK London, the building will be located on 3.

| Aug 11, 2010

Design ups comfort, care in cancer center

A new cancer center is slated to open in fall 2011 at Banner Gateway Medical Center, Gilbert, Ariz. The three-story, 120,000-sf, $107 million cancer center will contain physician clinics, medical imaging, radiation oncology, infusion therapy, and support services. A/E firm Cannon Design has created a visually open, column-free interior to increase patient comfort and care.

| Aug 11, 2010

Charlotte hospital expands its surgery capabilities

The Chicago office of RTKL designed Carolinas HealthCare System's Mercy Medical Plaza, Charlotte, N.C. The 150,000-sf hospital houses 12 operating rooms with expanded pre-operative and recovery space, a pharmacy, and a central sterile processing unit. Tenant space occupies 75,000 sf. RTKL mimicked the materials and mass of older buildings on the campus but created a more modern look by using ex...

| Aug 11, 2010

And the world's tallest building is…

At more than 2,600 feet high, the Burj Dubai (right) can still lay claim to the title of world's tallest building—although like all other super-tall buildings, its exact height will have to be recalculated now that the Council on Tall Buildings and Urban Habitat (CTBUH) announced a change to its height criteria.

| Aug 11, 2010

East meets West in hospital design

The Los Angeles office of HMC Architects and the Chinese firm Shunde Architectural Design Institute won the commission to design the 2.15 million-sf First People's Hospital in the Shunde District of Foshan, China. The team's winning concept organizes a series of buildings around a dynamic, curved spine element to create an interior “eco-atrium” with outdoor green space and healing g...