On March 29, Cushman & Wakefield brokered the $14.7 million sale of a two-story, 24,600-sf medical building in North Hills, N.Y., which traded at a 6% cap rate. Around the same time, an affiliate of Inland Real Estate Acquisitions sold four newly constructed medical buildings totaling 119,000 sf in the Houston, Raleigh, N.C., and Salt Lake City markets. And early this month in Scottsdale, Ariz., Helix Properties sold two Class A medical offices totaling 42,183 sf for $12.13 million.

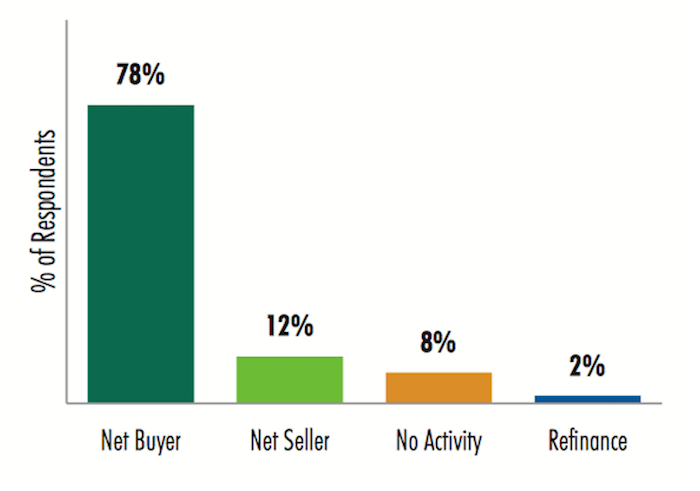

The market for quality healthcare-related buildings remains robust. A recent poll found the majority of real estate investors and developers expect to be “net buyers” of medical office buildings in 2017, and many believe health systems’ development requests for proposals would be higher this year than in 2016.

Those are some of the findings from a just-released 2017 Healthcare Real Estate Investor and Developer Survey conducted by CBRE’s U.S. Healthcare Capital Markets Group. The results of the 27-question survey are based on a total of 91 respondents.

Sixty three of those firms say they’ve allocated an aggregate of $14.9 billion in equity for healthcare real estate investment and development this year. That total represents about a 3% increase over what respondents said they allocated in 2016.

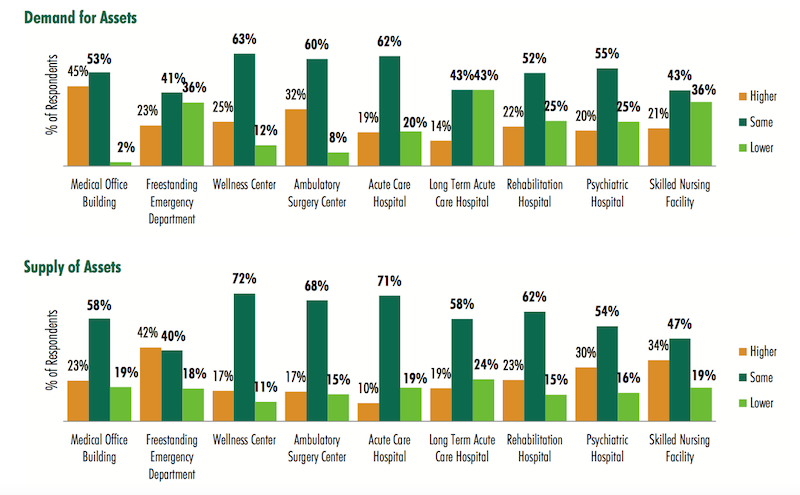

However, the survey notes that this sector’s supply-demand imbalance would continue this year, “as the total allocation of funds to purchase medical office buildings is far greater than the available supply.” Respondents expect that demand and supply for every healthcare real estate asset type would remain relatively the same in 2017. (At the time of the survey, 57% of respondents said the occupancy rates in their healthcare portfolios were about level with a year ago.)

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

Investors and developers surveyed by CBRE expect supply of quality healthcare facilities for purchase will continue to fall short of the capital available for purchases in 2017. Image: CBRE 2017 Healthcare Real Estate Investor and Developer Survey

The preferred transaction size for a sizable majority of respondents—72%—falls somewhere between $10 million and $50 million. Nearly all of the respondents indicated they were most interested in MOBs, followed by Ambulatory Surgery Centers (80%), Wellness Centers (36%), and Freestanding Emergency Departments (35%).

More than three-quarters of respondents rely on bank debt to finance their transactions, although nearly two fifths (39%) said they’d pay for purchases with cash exclusively.

Retention plans vary markedly, as 29% said they expected to hold onto their healthcare purchases for 5-7 years, whereas 28% would retain the asset for more than 10 years (that percentage goes up to 60% among healthcare REITs that responded to the survey).

The survey takes investors’ and developers’ pulses on their Internal Rate of Return requirements by product type. (For example, 42% indicated their target all-cash IRR this year ranges from 7% to 9.49%.)

Value for core product—namely, Class “A” on-campus medical office buildings—continues to be high, with 49% of the survey respondents projecting cap rates below 6%.

Single-tenant medical office buildings are being priced the most aggressively again this year, with the largest group of survey respondents (39%) indicating a cap rate range of between 6% and 6.49%. Ambulatory Surgery Centers followed medical office buildings, but respondents expressed a wide variety of expectations, with 26% projecting a cap rate between 6% and 6.49%, 26% of respondents projecting a cap rate in the range of 6.5% to 6.99%, and 28% of respondents projecting a cap rate between 7% and 7.49%.

More than two-fifths of respondents expect MOB lease rates to increase 1-2% this year, compared to 26% that predicted that rate level in 2016. There was also a drop—to 55% from 60%—of respondents to this year’s survey from last year’s that thought lease rates would increase 2-3%

Nearly 90% of respondents said the minimum lease term they would accept for a sale-leaseback by a healthcare system would be at least 10 years (it’s 10-14 years for 70%). More than two-fifths of respondents—42%—said the minimum annual rental rate hike they’d consider for a sale-leaseback would be 2-2.49%

The highest percentage of respondents said the minimum hospital credit rating they’d consider investing in would be BBB- to BBB+. Sixteen percent, though, said they wouldn’t go below A- to A+.

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

The vast majority of investors and developers polled will be buyers of healthcare-related assets this year. Image: CBRE

Twenty-seven percent said that 60-69 years was the minimum ground lease they would consider for investment, compared to a 50-59 year threshold that 35% responding to the 2016 survey would accept. When structuring a ground lease with a hospital for an MOB, 48% of respondents said a fair land value to use in the calculation to determine rent is 5-6%.

CBRE conducted this survey before Republicans pulled their bill to repeal and replace the Affordable Care Act. But developers and investors were asked to predict what they thought would happen, and majorities expected a repeal of the individual mandate for insurance coverage, a repeal of state and federal insurance marketplace exchanges, and a rollback of Medicaid funding.

They also predicted that health insurers would be allowed to sell policies across state borders; that the Trump administration would favor the expansion of Health Savings Accounts; and that insurers would funnel their most expensive patients into subsidized high-risk pools.

Related Stories

| Aug 11, 2010

MOB added to new hospital project

A late-2009 ground breaking is planned for a $20 million medical office building on the grounds of the $211 million, 106-bed Loma Linda University Medical Center in Murrieta, Calif., which itself is under construction. Minneapolis-based Frauenshuh HealthCare Real Estate Solutions is developing the five-story, 160,000-sf MOB, which will accommodate 60 physician offices.

| Aug 11, 2010

Rehabilitation center helps patients transition

Construction is under way on the Polytrauma Transitional Rehabilitation Center on the VA Medical Center campus in Richmond, Va. The $8 million, 22,000-sf facility will provide physical therapy, housing, and education to veterans as part of their transition back into their communities. The center was designed by HDR, Alexandria, Va.

| Aug 11, 2010

Medical office building planned in Fort Worth, Texas

Dallas-based TGS Architects has unveiled its design for the five-story, 130,000-sf Plaza Medical Office Building, planned for Fort Worth, Texas. The Class A development will include space for orthopedic care, surgery, breast center, diagnostic imaging, cardiovascular, and rehabilitation therapy services.

| Aug 11, 2010

Philadelphia cancer center seeks LEED certification

The New York office of Thornton Tomasetti provided structural engineering services for the Ruth and Raymond Perelman Center for Advanced Medicine in Philadelphia, a $232 million medical research center and advanced treatment center for cancer and cardiovascular disease. Designed by a joint venture of Perkins Eastman Architects and Rafael Vinõly Architects, the 340,000-sf facility will hous...

| Aug 11, 2010

High-level NICU opens in Washington, D.C.

Design to the highest distinction available by the American Academy of Pediatrics, the new Level IIIC neonatal intensive care unit (NICU) at Children's National Medical Center in Washington D.C., is equipped to care for the sickest premature babies, including those that require open-heart surgery. The 54-bed facility, designed by Karlsberger with KLMK Group as space planner, is four times large...

| Aug 11, 2010

San Bernardino health center doubles in size

Temecula, Calif.-based EDGE was awarded the contract for California State University San Bernardino's health center renovation and expansion. The two-phase, $4 million project was designed by RSK Associates, San Francisco, and includes an 11,000-sf, tilt-up concrete expansion—which doubles the size of the facility—and site and infrastructure work.

| Aug 11, 2010

New hospital expands Idaho healthcare options

Ascension Group Architects, Arlington, Texas, is designing a $150 million replacement hospital for Portneuf Medical Center in Pocatello, Idaho. An existing facility will be renovated as part of the project. The new six-story, 320-000-sf complex will house 187 beds, along with an intensive care unit, a cardiovascular care unit, pediatrics, psychiatry, surgical suites, rehabilitation clinic, and ...

| Aug 11, 2010

Manhattan's Gouverneur Healthcare Services tops out renovation, expansion

One year after breaking ground, the Building Team for the renovation and expansion of the Gouverneur Healthcare Services facility on Manhattan's Lower East Side topped out the $180 million project. Designed by New York-based RMJM, the development involves a 316,000-sf renovation and 108,000-sf addition that will house a 295-bed nursing facility and five-story ambulatory care center.

| Aug 11, 2010

Decline expected as healthcare slows, but hospital work will remain steady

The once steady 10% growth rate in healthcare construction spending has slowed, but hasn't entirely stopped. Spending is currently 1.7% higher than the same time last year when construction materials costs were 8% higher. The 2.5% monthly jobsite spending decline since last fall is consistent with the decline in materials costs.

| Aug 11, 2010

Construction under way on LEED Platinum DOE energy lab

Centennial, Colo.-based Haselden Construction has topped out the $64 million Research Support Facilities, located on the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) campus in Golden, Colo. Designed by RNL and Stantec to achieve LEED Platinum certification and net zero energy performance, the 218,000-sf facility will feature natural ventilation through operable ...