Millennials are impacting the built environment under construction in 2015, according to a report from JLL tracking national construction trends. Throughout 2015, tenant improvement (TI)—or the renovation of existing space—has been a bright spot in the construction industry, even as labor and construction costs continue to rise.

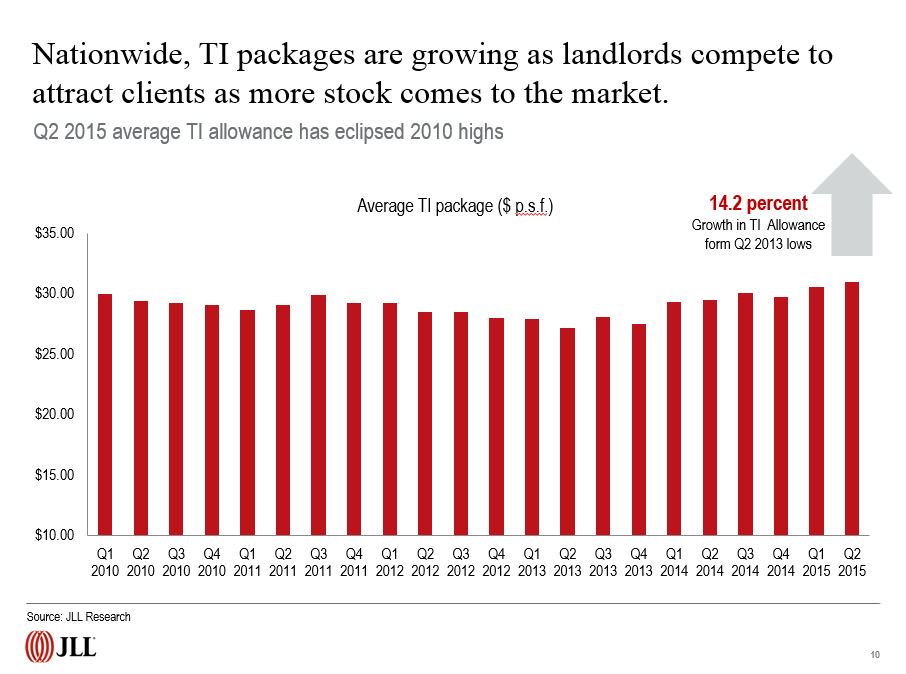

There has been a 14.2% rise in TI projects since the second quarter of 2013, as landlords compete to attract tenants and companies compete for Millennial talent. This is especially prevalent in office markets that are saturated with new construction and renovation.

According to JLL’s latest report on U.S. non-residential construction activity, TI costs are declining in most key markets, as landlords are more willing to pay for them. For office building owners, the average TI package nationwide is approximately $30-$50 per-sf in Central Business Districts (CBDs). These packages have become especially important as tenants look to customize office space to attract and retain employees, especially Millennials.

“Millennials are shaping how and where we work, and also how and where we shop, and even the path our packages take from ship to doorstep,” said Todd Burns, President, JLL Project and Development Services, Americas. “By 2020, the U.S. workforce will be comprised of 50% Millennials. Individually, they may not realize that they’re influencing national construction trends to favor tenant improvement over new construction, but the numbers show it’s no coincidence.”

Companies are focused on accommodating their Millennial employees and their preference for offices in existing urban locations that are close to amenities and often with unique, open interior spaces. As a result, as companies begin to renovate older buildings, office space vacancies are slowly declining and are down 10.2% since Q2 2011.

The JLL research also points to other key construction industry trends playing out in 2015 including:

• Rethinking the retail environment: New “omnichannel” strategies emphasize convenience for customers by leveraging their brick-and-mortar stores as e-commerce pick-up/return depots, which in turn requires a revamped store configuration.

• Manufacturing industry driving construction volume: While construction in the education sector has been strong as universities focus on building new space to keep students engaged on campus, it’s been upstaged by a surprising category: manufacturing. Annual project spend on construction within the manufacturing sector has increased from $57.8 billion in 2014 to $90.3 billion YTD in 2015.

• Technology leads the charge: Technology companies are driving demand for cool, renovated office space. At the same time, industrial occupiers want and need, more custom e-commerce space, with higher shelving, specialized lighting, new technology and office space. Similarly, in retail, quick service restaurant chains are investing in new, creative interior build-outs to better compete with fast casual concepts.

• Future opportunity and capital planning: With construction starts at their highest point since the recession, the industry is still in the early stages of its recovery and will continue to grow in response to overall economic growth. Activity is still far below pre-recession highs, indicating growth will continue over the next several years, and dollar value of TI allowances will too.

Related Stories

Giants 400 | Dec 1, 2022

Top 100 Office Building Core+Shell Contractors and CM Firms for 2022

Turner Construction, AECOM, Clayco, and Gilbane top the ranking of the nation's largest office building core+shell contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Dec 1, 2022

Top 75 Office Building Core+Shell Engineering + EA Firms for 2022

Jacobs, Alfa Tech, Burns & McDonnell, and Arup head the ranking of the nation's largest office building core+shell engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Dec 1, 2022

Top 150 Office Building Core+Shell Architecture + AE Firms for 2022

Gensler, NBBJ, Perkins and Will, and Stantec top the ranking of the nation's largest office building core+shell architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Multifamily Housing | Nov 29, 2022

Number of office-to-apartment conversion projects has jumped since start of pandemic

As remote work rose and demand for office space declined since the start of the Covid-19 pandemic, developers have found converting some offices to residential use to be an attractive option. Apartment conversions rose 25% in the two years since the start of the pandemic, with 28,000 new units converted from other property types, according to a report from RentCafe.

Giants 400 | Nov 28, 2022

Top 130 Office Sector Contractors and CM Firms for 2022

Turner Construction, STO Building Group, Gilbane, and CBRE top the ranking of the nation's largest office sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 28, 2022

Top 85 Office Sector Engineering and EA Firms for 2022

Jacobs, Alfa Tech, AECOM, and Burns & McDonnell head the ranking of the nation's largest office sector engineering and engineering/architecture (EA) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 28, 2022

Top 200 Office Sector Architecture and AE Firms for 2022

Gensler, Perkins and Will, Stantec, and HOK top the ranking of the nation's largest office sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Data Centers | Nov 28, 2022

Data centers are a hot market—don't waste the heat!

SmithGroup's Brian Rener shares a few ways to integrate data centers in mixed-use sites, utilizing waste heat to optimize the energy demands of the buildings.

BAS and Security | Oct 19, 2022

The biggest cybersecurity threats in commercial real estate, and how to mitigate them

Coleman Wolf, Senior Security Systems Consultant with global engineering firm ESD, outlines the top-three cybersecurity threats to commercial and institutional building owners and property managers, and offers advice on how to deter and defend against hackers.

Giants 400 | Oct 6, 2022

Top 60 Medical Office Building Contractors + CM Firms for 2022

PCL Construction, Adolfson & Peterson, Swinerton, and Skanska USA top the ranking of the nation's largest medical office building (MOB) contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.