The GDP, which in 2020 contracted for the first time in 11 years, is expected to grow by 6.5% in 2021, and keep growing (albeit at a slower pace) in the proceeding two years. In 2021, the U.S. should recover about 60% of the 9.42 million jobs it lost last year, and pick up another 5.1 million jobs over the following two years. Consequently, the unemployment rate is expected to recede to 4% by the end of 2023, close to where it was pre-pandemic.

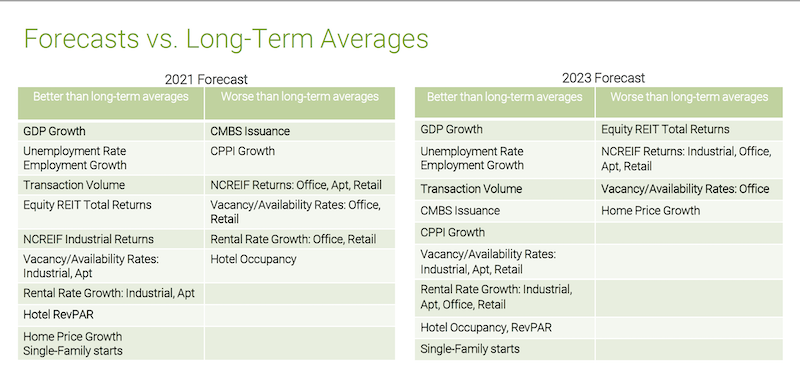

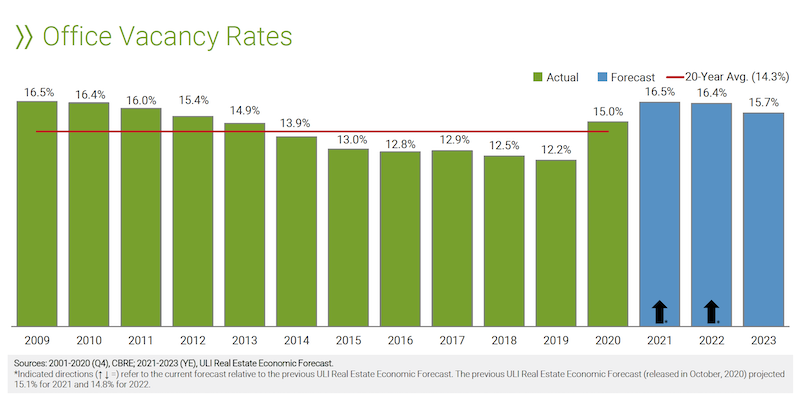

This economy and jobs picture, coupled with positive predictions about inflation, interest rates, and capitalization rates, sets the stage for the Urban Land Institute’s Real Estate Economic Forecast, released on May 19, which sees a sector poised to rebound, led by returns from single-family, hotel, and industrial assets. The biggest red flag is the office sector, whose national vacancy rates are expected to rise by a higher-than-usual three-year average, but to also recover starting in 2023.

The forecasts for 27 economic and real estate indicators, published in this report, ULI’s 19th, are derived from a survey this spring of 42 economists and analysts from 39 real estate organizations.

Commercial real estate should benefit from a strong economy through 2023. Graphic: ULI

Among the report’s notable findings are these:

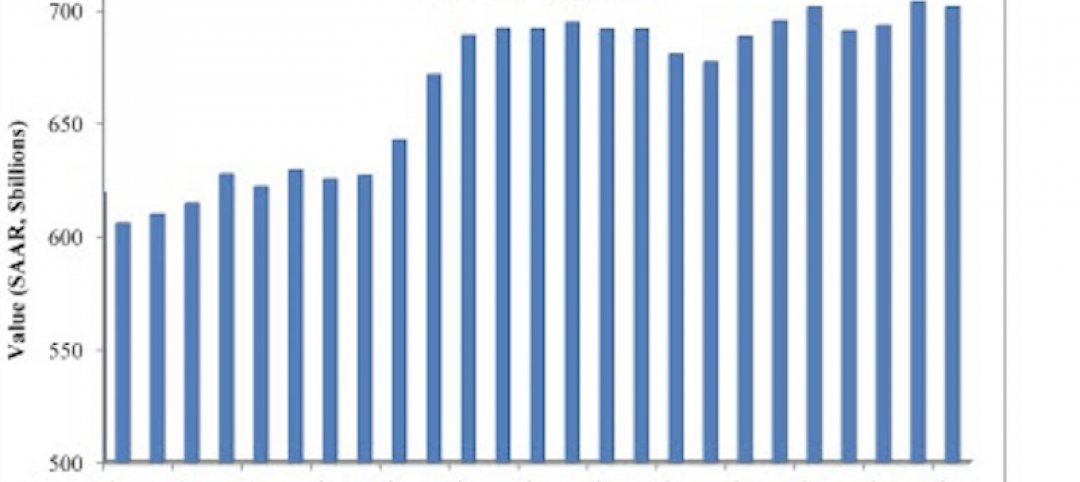

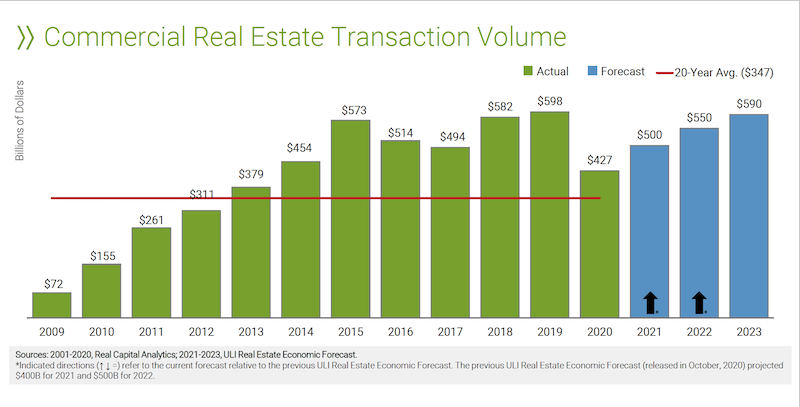

• Commercial real estate transaction volume should recover quickly. It is expected to hit $500 billion this year and $550 billion next year. (The latest peak was $598 billion in 2019.) Commercial mortgage-backed securities issuance is projected at $70 billion this year, and to rise to $90 billion in 2023, exceeding the 20-year $82 billion average.

Transaction volume from real estate is expected to approach pre-pandemic levels again by 2023. Chart: ULI

• Price growth, as measured by the RCA Commercial Property Price Index, should remain below the 2020 level during all three proceeding years. The good news is that ULI is forecasting 5% increases in each of the next two years.

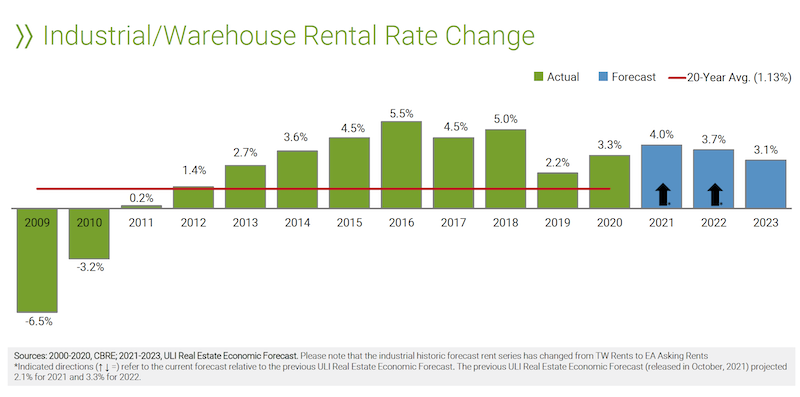

• Rent growth will be similarly volatile. Industrial rents will lead the pack with an average of 3.6% growth between 2021-2023. Multifamily rents will also rise, but office and retail rents are expected to stay in the negative column for a while.

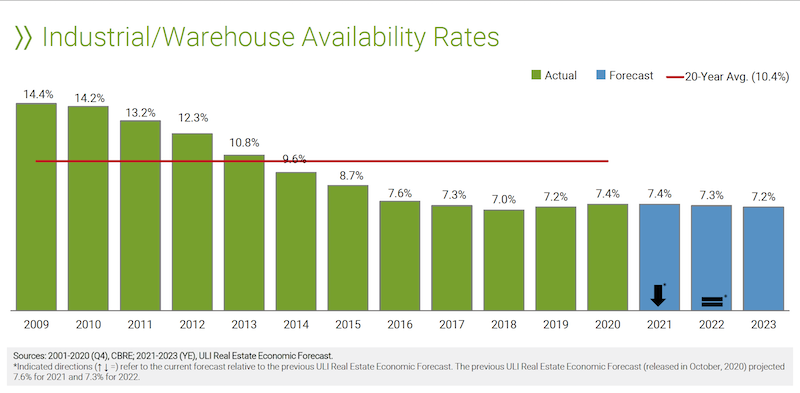

As demand for industrial space increases, so will its rental rates. Charts: ULI

• The report looks at potential vacancy rates for five property types. Availability of warehouses and apartments is expected to remain below their 20-year averages over the next three years. Offices, on the other hand, will see vacancy rates rise to a three-year average of 16.2%, substantively above the sector’s 14.3% 20-year average. Retail vacancy rates, somewhat surprisingly, are projected to average 9.8%, below the sector’s 9.9% 20-year average.

The office sector will have high vacancy rates for at least the next two years. Chart: ULI

• Last year, housing starts exceeded their 20-year average for the first time since the 2008-10 financial crisis. They are expected to hit 1.1 million units this year, and 1.2 million in 2022 and 2023.

• Real estate returns, as measured by the National Council of Real Estate Investment Fiduciaries, are forecast at 4.5%, 5.9%, and 6.5%, respectively, for 2021-2023. Industrial should lead all property types, but even office and retail are projected to generate positive returns.

Related Stories

Market Data | Oct 4, 2016

Nonresidential spending slips in August

Public sector spending is declining faster than the private sector.

Industry Research | Oct 3, 2016

Structure Tone survey shows cost is still a major barrier to building green

Climate change, resilience and wellness are also growing concerns.

Industry Research | Sep 28, 2016

Worldwide hotel construction shows modest year-over-year growth

Overall construction for hotel projects is up, but the current number of hotels currently being built has dipped slightly from one year ago.

Industry Research | Sep 27, 2016

Sterling Risk Sentiment Index indicates risk exposure perception remains stable in construction industry

Nearly half (45%) of those polled say election year uncertainty has a negative effect on risk perception in the construction market.

Industry Research | Sep 21, 2016

The global penetration of smart meters is expected to reach approximately 53% by the end of 2025

Large-scale smart meter deployments are underway across Western Europe, while new deployments continue among later adopters in the United States.

Industry Research | Sep 12, 2016

Evidence linking classroom design to improved learning mounts

A study finds the impact can be as much as 25% per year.

Healthcare Facilities | Sep 6, 2016

Chicago Faucets releases white paper: Reducing the risk of HAIs in healthcare facilities

The white paper discusses in detail four options used to mitigate transmission of waterborne bacteria

Market Data | Sep 2, 2016

Nonresidential spending inches lower in July while June data is upwardly revised to eight-year record

Nonresidential construction spending has been suppressed over the last year or so with the primary factor being the lack of momentum in public spending.

Industry Research | Sep 1, 2016

CannonDesign releases infographic to better help universities obtain more R&D funding

CannonDesign releases infographic to better help universities obtain more R&D funding.

Industry Research | Aug 25, 2016

Building bonds: The role of 'trusted advisor' is earned not acquired

A trusted advisor acts as a guiding partner over the full course of a professional relationship.