More than 85% of contractors have been negatively impacted by COVID-19, according to the results of an August reader survey conducted by Construction Executive magazine, which is published by Associated Builders and Contractors. Supply chain disruptions, prolonged municipal permitting processes and delayed inspections due to office closures are all factors contributing to the increased rate of postponement and/or cancellation of construction projects.

While many contractors have not yet seen drastic impacts to their business, as construction was in many areas considered an “essential” service, the long-term implications are concerning. Seventy percent of contractors did not expect the construction industry to stabilize until at least 2021, while an additional 10.4% say they believe it may never reach pre-pandemic levels.

“While the survey respondents’ concerns about market viability and the health fears of the virus itself will remain in place for the duration of 2020 and into next year, contractors did report bright spots, such as a widespread adoption of technology after the outbreak of COVID-19,” said Lauren Pinch, editor-in-chief of CE. “That said, as the pandemic continues to change the landscape of the U.S. construction industry and state and local economies, contractors are continuously trying to assess the near- and long-term effects.”

While an uptick in office renovations to meet social distancing guidelines and to implement other COVID-19-related precautions was expected, more than three-quarters of respondents (76.12%) stated that they have not found this to be the case. Concerns over indoor air quality and proper ventilation may have also led people to believe there would also be a large increase in HVAC upgrade projects, but only 31.79% of respondents stated that this was the case.

Looking toward economic recovery, three-quarters of contractors believe that there will be more interest in construction education programs as people seek out new types of work. Specialty trades, apprenticeship programs, project management training and more tech-focused construction jobs were all listed as areas that contractors believe will see high levels of interest.

Read more about the survey results at ConstructionExec.com and subscribe to CE This Week for the latest news, market developments and business issues impacting the construction industry.

Related Stories

Market Data | Apr 16, 2019

ABC’s Construction Backlog Indicator rebounds in February

ABC's Construction Backlog Indicator expanded to 8.8 months in February 2019.

Market Data | Apr 8, 2019

Engineering, construction spending to rise 3% in 2019: FMI outlook

Top-performing segments forecast in 2019 include transportation, public safety, and education.

Market Data | Apr 1, 2019

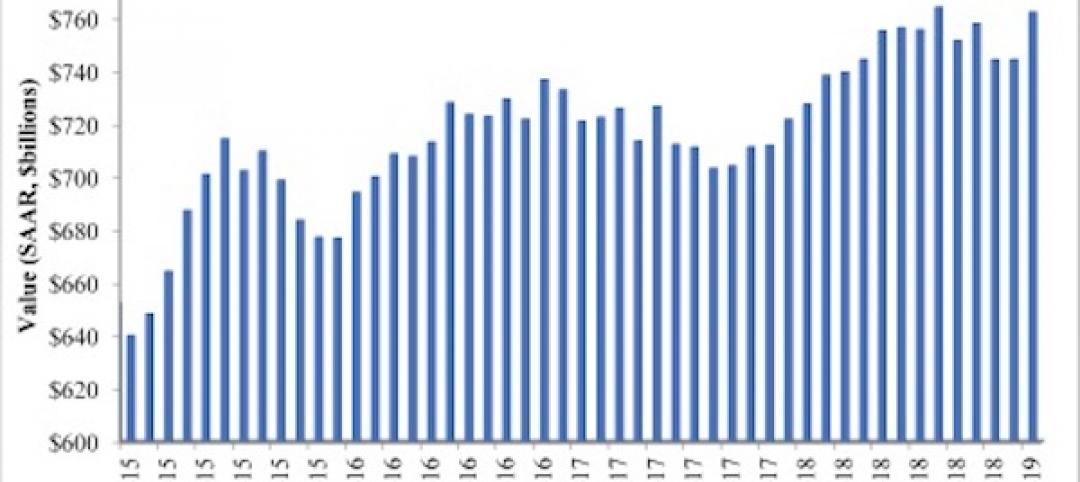

Nonresidential spending expands again in February

Private nonresidential spending fell 0.5% for the month and is only up 0.1% on a year-over-year basis.

Market Data | Mar 22, 2019

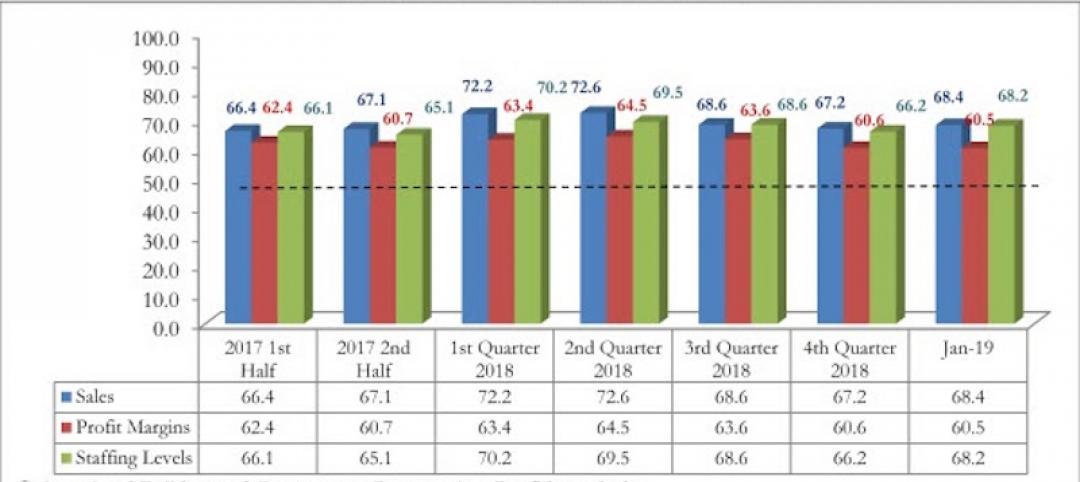

Construction contractors regain confidence in January 2019

Expectations for sales during the coming six-month period remained especially upbeat in January.

Market Data | Mar 21, 2019

Billings moderate in February following robust New Year

AIA’s Architecture Billings Index (ABI) score for February was 50.3, down from 55.3 in January.

Market Data | Mar 19, 2019

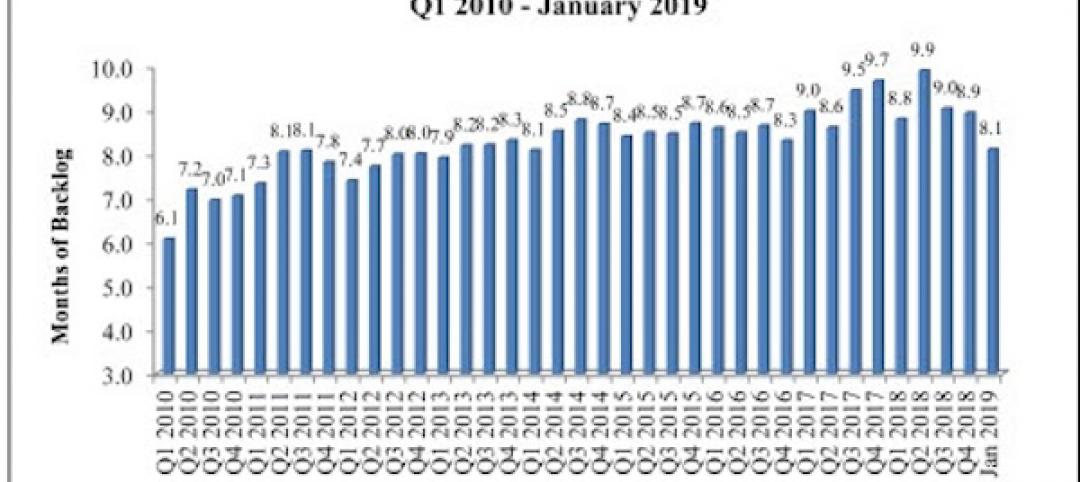

ABC’s Construction Backlog Indicator declines sharply in January 2019

The Construction Backlog Indicator contracted to 8.1 months during January 2019.

Market Data | Mar 15, 2019

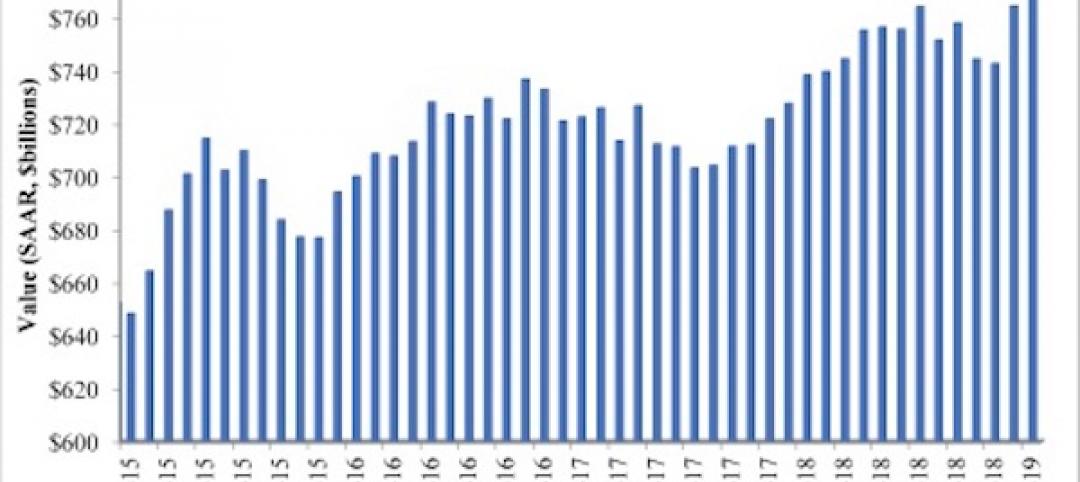

2019 starts off with expansion in nonresidential spending

At a seasonally adjusted annualized rate, nonresidential spending totaled $762.5 billion for the month.

Market Data | Mar 14, 2019

Construction input prices rise for first time since October

Of the 11 construction subcategories, seven experienced price declines for the month.

Market Data | Mar 6, 2019

Global hotel construction pipeline hits record high at 2018 year-end

There are a record-high 6,352 hotel projects and 1.17 million rooms currently under construction worldwide.

Market Data | Feb 28, 2019

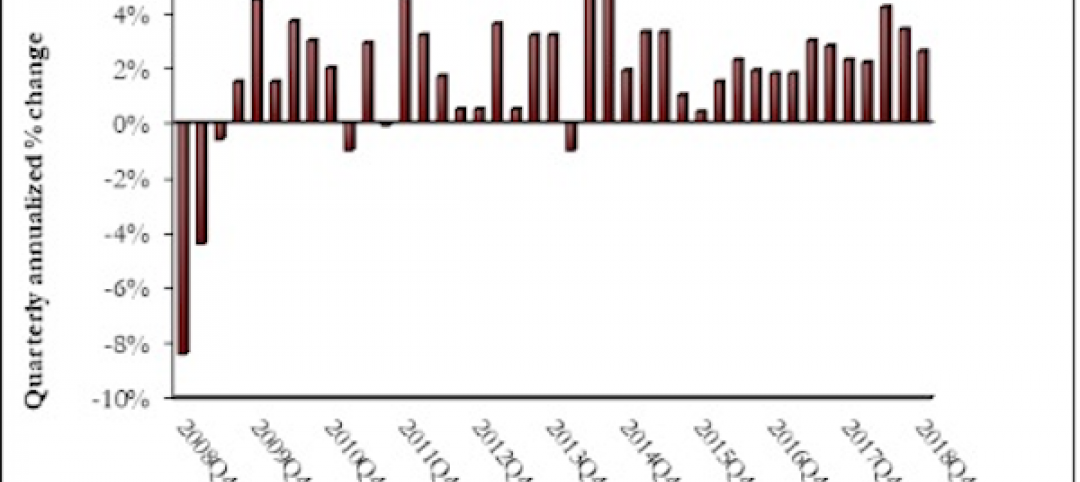

U.S. economic growth softens in final quarter of 2018

Year-over-year GDP growth was 3.1%, while average growth for 2018 was 2.9%.