Construction employment increased in nearly two out of three U.S. metro areas in 2021, according to an analysis by the Associated General Contractors of America of new government employment data. Yet association officials noted that labor shortages likely kept many firms from adding even more workers.

“Construction employment topped year-earlier levels in almost two-thirds of metros for the past few months,” said Ken Simonson, the association’s chief economist. “But contractors in many areas say they would have hired even more workers if qualified candidates were available.”

Job openings in construction totaled 273,000 at the end of December, an increase of 62,000 or nearly 30% from December 2020, according to the government’s latest Job Openings and Labor Turnover Survey. That figure exceeded the 220,000 employees that construction firms were able to hire in December, implying firms would have added over twice as many workers if they had been able to fill all openings, Simonson pointed out.

Construction employment rose in 231 or 65% of 358 metro areas in 2021. Houston-The Woodlands-Sugar Land, Texas added the most construction jobs (8,800 jobs, 4%), followed by Chicago-Naperville-Arlington Heights, Ill. (6,500 jobs, 5%) and Los Angeles-Long Beach-Glendale, Calif. (6,300 jobs, 4%). Sioux Falls, S.D. had the highest percentage gain (24%, 2,100 jobs), followed by Beaumont-Port Arthur, Texas (18%, 3,000 jobs) and Atlantic City-Hammonton, N.J. (18%, 900 jobs).

Construction employment declined from a year earlier in 76 metros and was flat in 51. Nassau County-Suffolk County, N.Y. lost the most jobs (-5,700 or -7%), followed by New York City (-4,200 jobs, -3%) and Baltimore-Columbia-Towson, Md. (-3,800 jobs, -5%). The largest percentage declines were in Evansville, Ind.-Ky. (-18%, -1,700 jobs); Napa, Calif. (-15%, -600 jobs); Anchorage, Alaska (-14%, -1,400 jobs); and Lewiston, Idaho-Wash. (-13%, -200 jobs). Seven areas set all-time lows for December, while 57 metros reached new December highs for construction jobs.

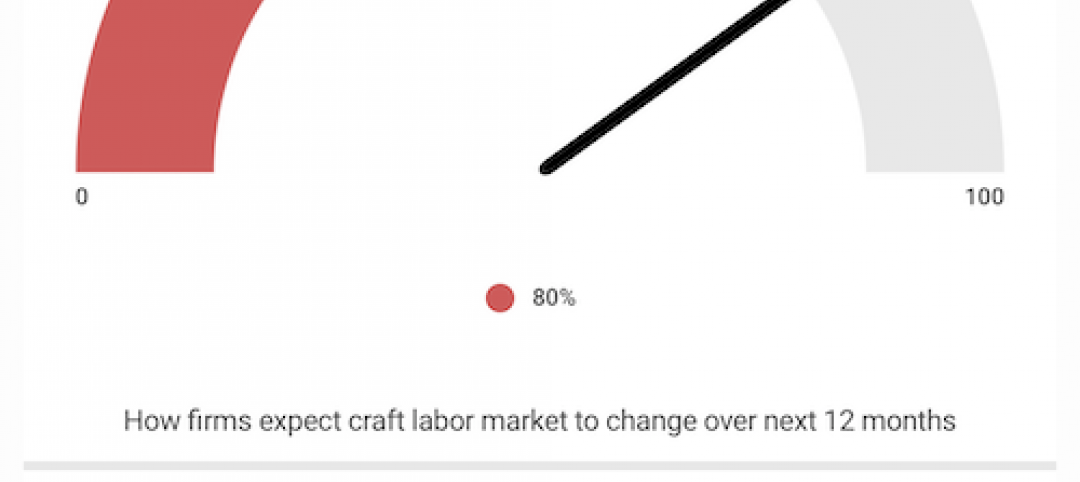

Association officials said that the growing number of job openings in the industry was a clear sign that labor shortages are getting worse. They noted that the association’s recently released 2022 Construction Hiring and Business Outlook found that 83% of contractors report having a hard time finding qualified workers to hire. They urged Congress and the Biden administration to boost funding for career and technical education to help recruit and prepare more people for high-paying construction careers.

“For every dollar the federal government currently invests in career and technical education, it spends six urging students to attend college and work in an office,” said Stephen E. Sandherr, the association’s chief executive officer. “Narrowing that funding gap will help more people understand that there are multiple paths to success.”

View the metro employment data, rankings, top 10, and new highs and lows.

Related Stories

Industry Research | Aug 29, 2019

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.

Market Data | Aug 21, 2019

Architecture Billings Index continues its streak of soft readings

Decline in new design contracts suggests volatility in design activity to persist.

Market Data | Aug 19, 2019

Multifamily market sustains positive cycle

Year-over-year growth tops 3% for 13th month. Will the economy stifle momentum?

Market Data | Aug 16, 2019

Students say unclean restrooms impact their perception of the school

The findings are part of Bradley Corporation’s Healthy Hand Washing Survey.

Market Data | Aug 12, 2019

Mid-year economic outlook for nonresidential construction: Expansion continues, but vulnerabilities pile up

Emerging weakness in business investment has been hinting at softening outlays.

Market Data | Aug 7, 2019

National office vacancy holds steady at 9.7% in slowing but disciplined market

Average asking rental rate posts 4.2% annual growth.

Market Data | Aug 1, 2019

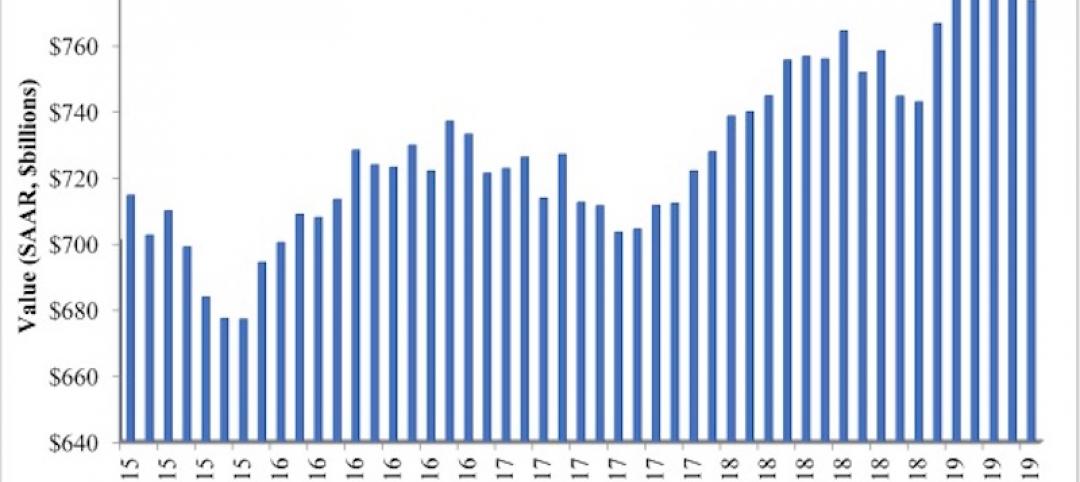

Nonresidential construction spending slows in June, remains elevated

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending.

Market Data | Jul 31, 2019

For the second quarter of 2019, the U.S. hotel construction pipeline continued its year-over-year growth spurt

The growth spurt continued even as business investment declined for the first time since 2016.

Market Data | Jul 23, 2019

Despite signals of impending declines, continued growth in nonresidential construction is expected through 2020

AIA’s latest Consensus Construction Forecast predicts growth.

Market Data | Jul 20, 2019

Construction costs continued to rise in second quarter

Labor availability is a big factor in that inflation, according to Rider Levett Bucknall report.