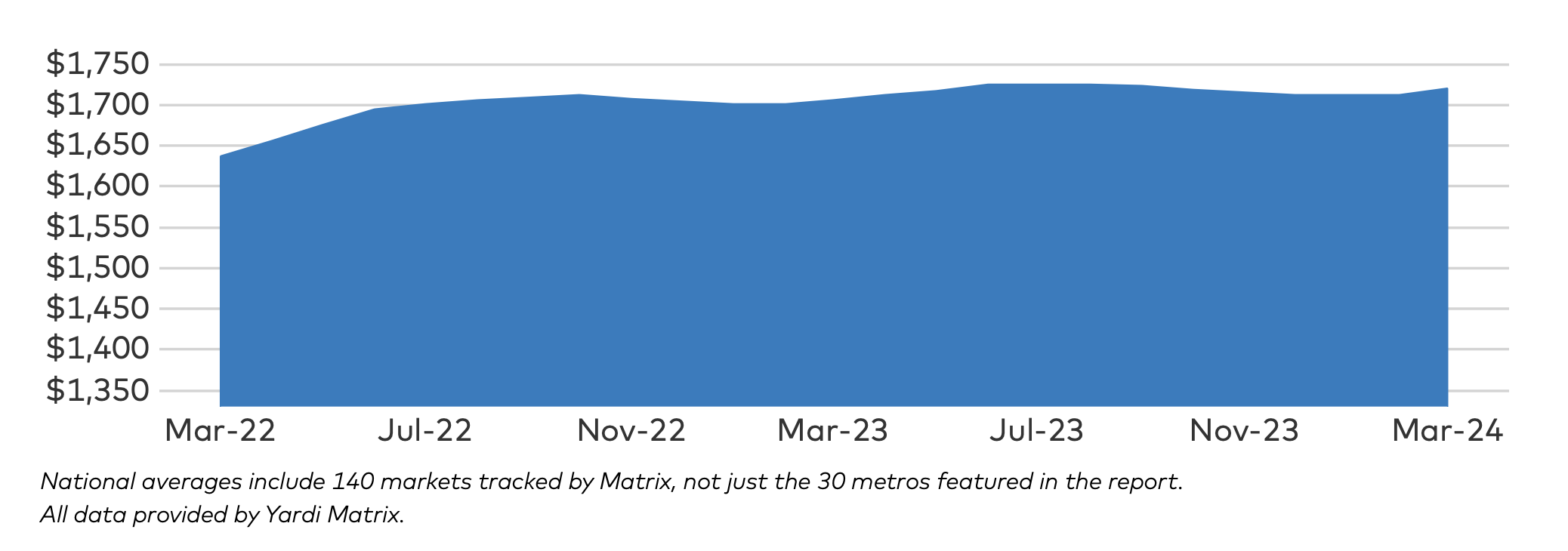

Multifamily rent growth reached a new record in March 2024, recording the largest gain in 20 months. Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

In the March 2024 National Multifamily Report, Matrix’s data provides “some level of comfort” for worried market observers. While 13 of the top metros had negative rent growth over the past year, only two metros reported negative growth in March.

Where is multifamily rent growth the highest?

As the economy continues to create jobs, with household growth boosted by immigration and wage growth, demand for multifamily units continues to rise. Markets in the midwest, such as Columbus, Ohio, Kansas City, Mo., and Indianapolis, Ind., have the highest multifamily rent growth. These metros trailed only New York City, N.Y., which topped the list with 5% year-over-year rent growth.

In March, San Francisco, Calif., was the only metropolitan city to report a growth in occupancy rate (0.1%) year-over-year. On the other hand, 21 metros have occupancy rates down by 0.5% or more, including Atlanta, Ga., and Indianapolis (both down 1.2%).

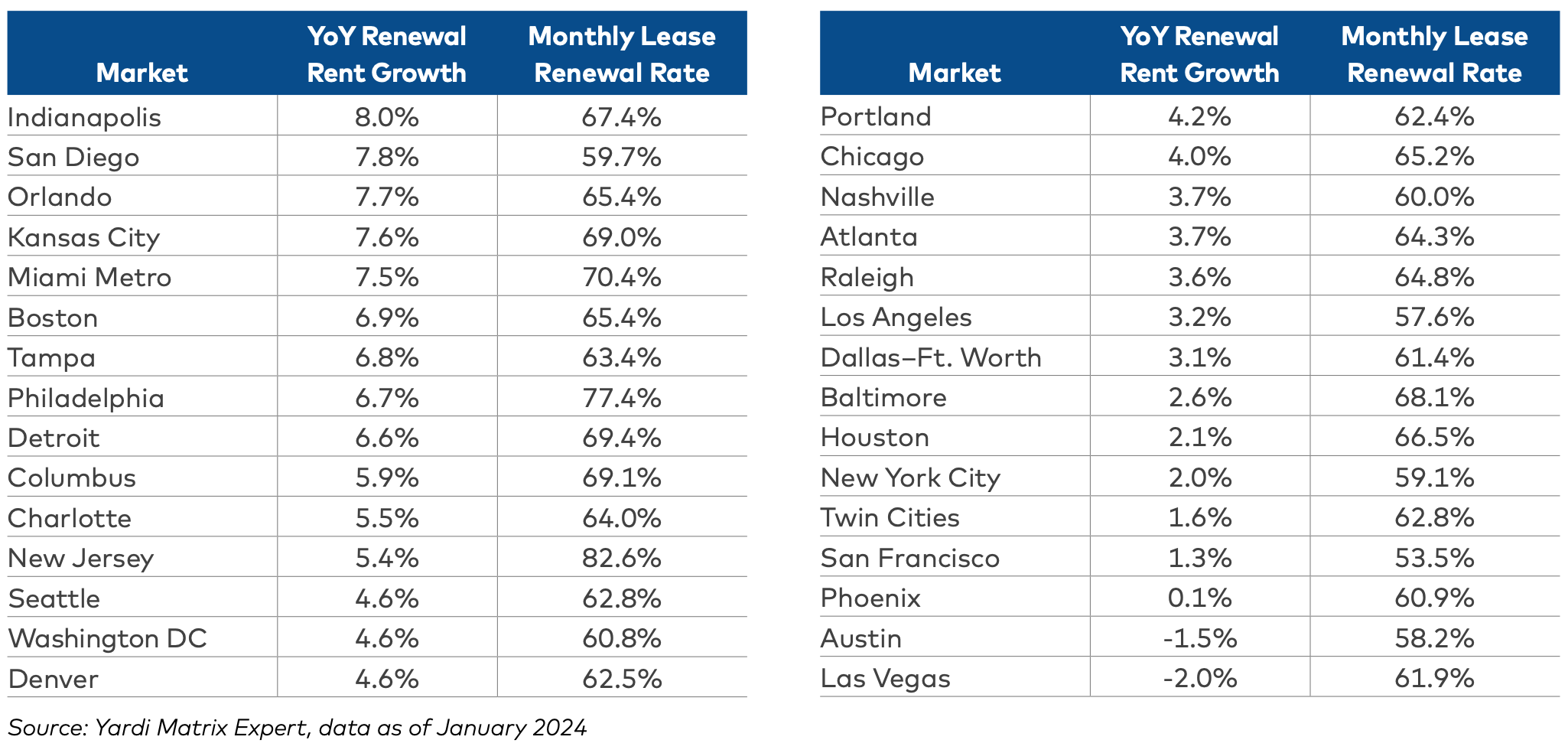

National Lease Renewals

The national lease renewal rate averaged 64.8% at the beginning of 2024—the first time it’s dropped below 65% in more than two years.

Lease renewals were highest in metros like New Jersey (82.6%), Philadelphia, Pa. (77.4%), and Miami, Fla. (70.4%); renewals were lowest in San Francisco (53.5%), Los Angeles (57.6%), and Austin, Texas (58.2%).

Renewal Rent Growth

Year-over-year renewal rent growth—the change for residents that are rolling over existing leases—declined in January 2024 as well, to 4.6 percent.

According to the report, renewal rents have been down every month since May 2023. The metros with the highest year-over-year renewal rent growth include Indianapolis (8%), San Diego (7.8%), and Orlando (7.7%). Just two metros reported negative growth, with Las Vegas, Nev. (–2%) and Austin (–1.5%) at the end of the list.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Expenses per multifamily unit reach $8,950 nationally

- Multifamily rents stable heading into spring 2024

Overall outlook for multifamily housing in 2024

From the December 2023 National Multifamily Report by Yardi Matrix:

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

Multifamily Housing | Oct 16, 2019

Covenant House New York will support the city’s homeless youth

FXCollaborative designed the building.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.

Multifamily Housing | Oct 14, 2019

Eleven, Minneapolis’ tallest condo tower, breaks ground

RAMSA designed the project.

| Oct 11, 2019

Tips on planning for video surveillance cameras for apartment and condominium projects

“Cameras can be part of a security program, but they’re not the security solution itself.” That’s the first thing to understand about video surveillance systems for apartment and condominium projects, according to veteran security consultant Michael Silva, CPP.

Multifamily Housing | Oct 9, 2019

Multifamily developers vs. Peloton: Round 2... Fight!

Readers and experts offer alternatives to Peloton bicycles for their apartment and condo projects.

Multifamily Housing | Oct 7, 2019

Plant Prefab and Brooks + Scarpa design scalable, multifamily kit-of-parts

It is Plant Prefab’s first multifamily system.

Multifamily Housing | Oct 3, 2019

50 Penn breaks ground in New York, will provide 218 units of affordable housing

Dattner Architects is designed the project.

Multifamily Housing | Sep 12, 2019

Meet the masters of offsite construction

Prescient combines 5D software, clever engineering, and advanced robotics to create prefabricated assemblies for apartment buildings and student housing.

Multifamily Housing | Sep 10, 2019

Carbon-neutral apartment building sets the pace for scalable affordable housing

Project Open has no carbon footprint, but the six-story, solar-powered building is already leaving its imprint on Salt Lake City’s multifamily landscape.