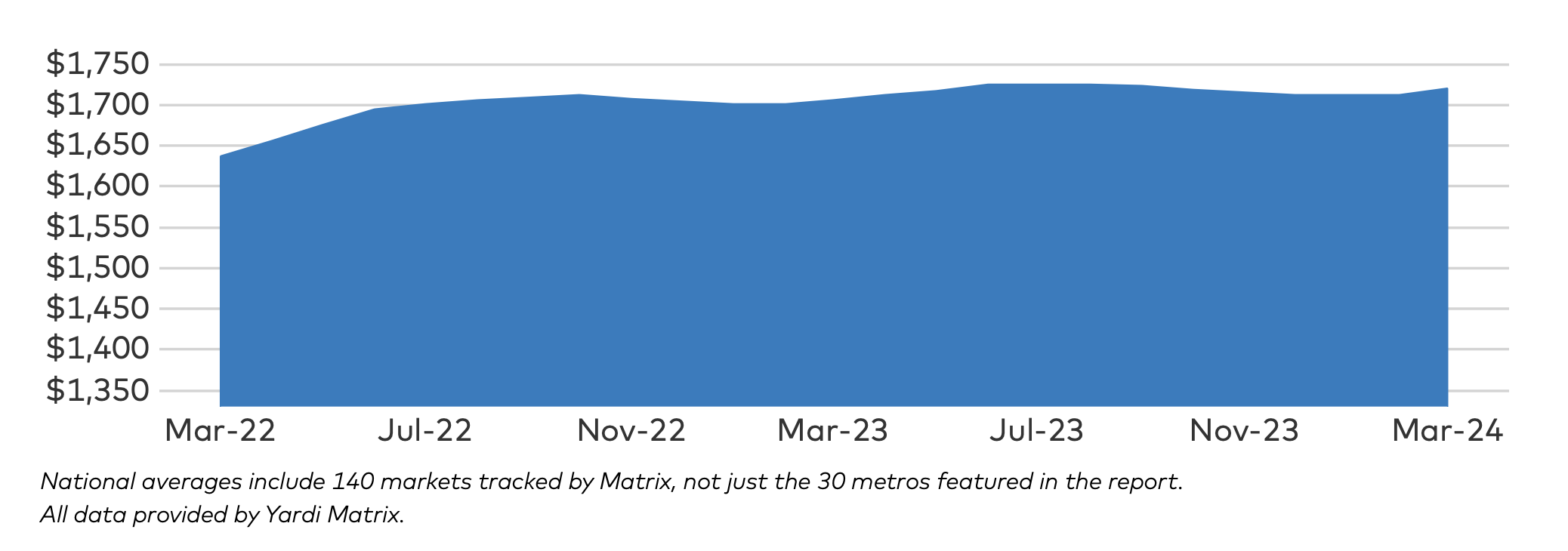

Multifamily rent growth reached a new record in March 2024, recording the largest gain in 20 months. Asking rents for multifamily units increased $8 during the month to $1,721; year-over-year growth grew 30 basis points to 0.9 percent—a normal seasonal growth pattern according to Yardi Matrix.

In the March 2024 National Multifamily Report, Matrix’s data provides “some level of comfort” for worried market observers. While 13 of the top metros had negative rent growth over the past year, only two metros reported negative growth in March.

Where is multifamily rent growth the highest?

As the economy continues to create jobs, with household growth boosted by immigration and wage growth, demand for multifamily units continues to rise. Markets in the midwest, such as Columbus, Ohio, Kansas City, Mo., and Indianapolis, Ind., have the highest multifamily rent growth. These metros trailed only New York City, N.Y., which topped the list with 5% year-over-year rent growth.

In March, San Francisco, Calif., was the only metropolitan city to report a growth in occupancy rate (0.1%) year-over-year. On the other hand, 21 metros have occupancy rates down by 0.5% or more, including Atlanta, Ga., and Indianapolis (both down 1.2%).

National Lease Renewals

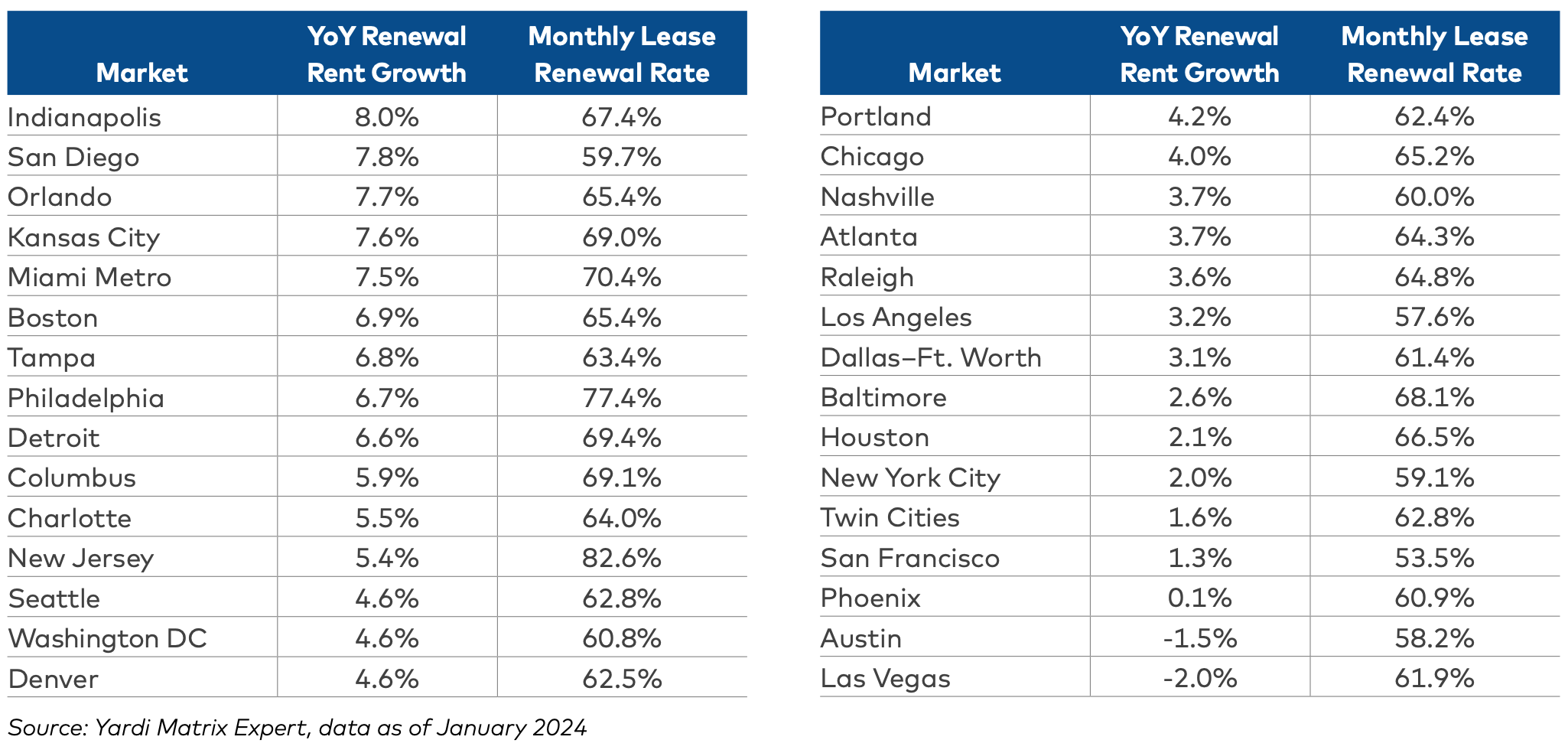

The national lease renewal rate averaged 64.8% at the beginning of 2024—the first time it’s dropped below 65% in more than two years.

Lease renewals were highest in metros like New Jersey (82.6%), Philadelphia, Pa. (77.4%), and Miami, Fla. (70.4%); renewals were lowest in San Francisco (53.5%), Los Angeles (57.6%), and Austin, Texas (58.2%).

Renewal Rent Growth

Year-over-year renewal rent growth—the change for residents that are rolling over existing leases—declined in January 2024 as well, to 4.6 percent.

According to the report, renewal rents have been down every month since May 2023. The metros with the highest year-over-year renewal rent growth include Indianapolis (8%), San Diego (7.8%), and Orlando (7.7%). Just two metros reported negative growth, with Las Vegas, Nev. (–2%) and Austin (–1.5%) at the end of the list.

RELATED

- Multifamily rent growth rate unchanged at 0.3%

- Expenses per multifamily unit reach $8,950 nationally

- Multifamily rents stable heading into spring 2024

Overall outlook for multifamily housing in 2024

From the December 2023 National Multifamily Report by Yardi Matrix:

- Expenses, income, deliveries, and interest rates pose key challenges for the multifamily industry this year

- Though the market is expected to deliver over 500,000 units this year, there is a dramatic decrease in starts

- Recent interest rate declines alleviate potential distress for multifamily owners, but long-term stability remains uncertain

Related Stories

Multifamily Housing | Aug 17, 2018

Sound advice on multifamily construction

Four leading experts tell how to ensure your next multifamily project achieves acoustic privacy.

Multifamily Housing | Aug 15, 2018

Memphis construction: Can this city become the next Austin?

One local design firm is trying to make it happen.

Multifamily Housing | Aug 8, 2018

Flyin' high: Humphreys & Partners Architects keeps soaring to new heights

HPA, which reported $78.2 million in multifamily design fees in 2017, ranks as the nation’s largest multifamily design firm.

Multifamily Housing | Aug 7, 2018

Even after redevelopment, the iconic 'Chicago Tribune' sign will remain at 435 N. Michigan Ave.

The newspaper and the building's new owners reached a settlement.

Multifamily Housing | Aug 2, 2018

The recipe for bicycle kitchens

Bike storage and workshop spaces are rapidly turning into full-service social amenity spaces in multifamily projects.

Multifamily Housing | Aug 2, 2018

Bicycle kitchens give cyclists their very own amenity space

Bike storage and workshop spaces are rapidly turning into full-service social amenity spaces in multifamily projects.

Multifamily Housing | Jul 31, 2018

Put air rights to better use

If your school district is building a new school, build housing in the air space above it and put lower-paid public employees at the front of the line to live there.

Multifamily Housing | Jul 25, 2018

Multifamily market trends 2018: Demographic shifts reshape the residential landscape

Changing generational preferences are prompting multifamily developers to re-strategize.

Multifamily Housing | Jul 19, 2018

Multifamily market stays hot in first half of 2018

The average rent grew by $12 in June, to an all-time high of $1,405, according to a survey of 127 markets by Yardi Matrix.

Multifamily Housing | Jul 18, 2018

First apartment building funded by Massachusetts’ workforce housing subsidy program opens

The transit-oriented Gateway North Residences is centrally located in Lynn, Mass.