Prices of construction materials jumped nearly 20% in 2021 despite moderating in December, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said contractors rate materials costs as a top concern for 2022, according to a survey predicting the industry’s outlook for the industry the association released yesterday.

“Costs may not rise as steeply in 2022 as they did last year but they are likely to remain volatile, with unpredictable prices and delivery dates for key materials,” said Ken Simonson, the association’s chief economist. “That volatility can be as hard to cope with as steadily rising prices and lead times.”

In the association’s 2022 Construction Hiring and Business Outlook Survey, material costs were listed as a top concern by 86% of contractors, more than any concern. Availability of materials and supply chain disruptions were the second most frequent concern, listed by 77% of the more than 1000 respondents.

The producer price index for inputs to new nonresidential construction—the prices charged by goods producers and service providers such as distributors and transportation firms—increased by 0.5% in December and 19.6% in 2021 as a whole. Those gains topped the rise in the index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings, Simonson noted. That index climbed by 0.3% for the month and 12.5% from a year earlier.

Prices moderated for some construction materials in December but still ended the year with large gains, Simonson observed. The price index for steel mill products rose 0.2% in December, its smallest rise in 15 months, but soared 127.2% over 12 months. The index for diesel fuel declined 5.3% for the month but increased 54.9% for the year. The index for aluminum mill shapes slid 4.9% in December but rose 29.8% over 12 months, while the index for copper and brass mill shapes fell 3.3% in December but rose 23.4% over the year.

Some prices accelerated in December. The index for plastic construction products climbed 1.3% for the month and 34.0% over 12 months. The index for lumber and plywood rose 12.7% and 17.6%.

Association officials said rising materials prices threaten to undermine what is otherwise a strong outlook for the construction industry in 2022. They urged the Biden administration to reconsider its plans to double tariffs on Canadian lumber and leave other trade barriers in place that artificially inflate the costs of key construction materials.

“Making lumber and other materials even more expensive will not tame inflation, boost supplies of affordable housing or help the economy grow,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead, the administration should be removing tariffs and beating inflation.”

View producer price index data. View chart of gap between input costs and bid prices. View the 2022 AGC/Sage Construction Hiring and Business Outlook Survey.

Related Stories

Market Data | Aug 2, 2017

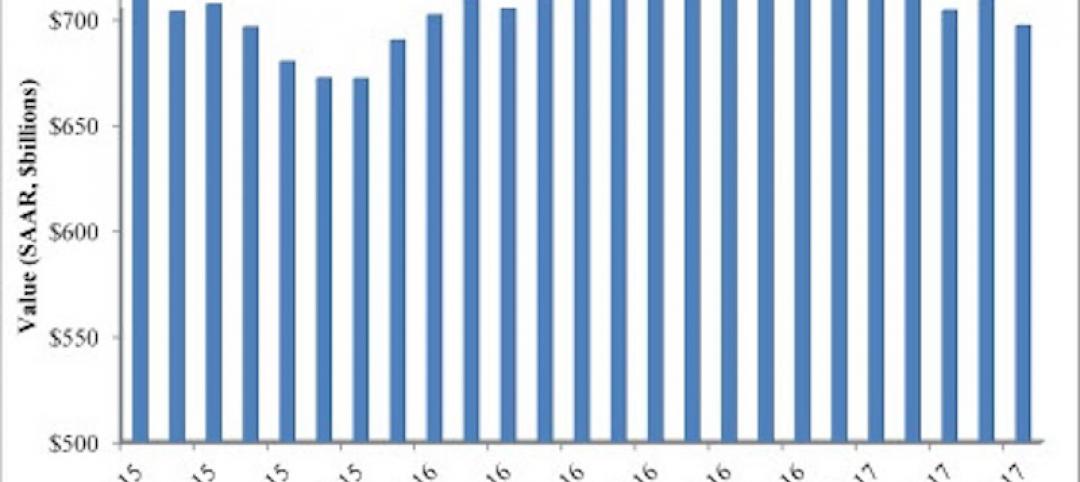

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

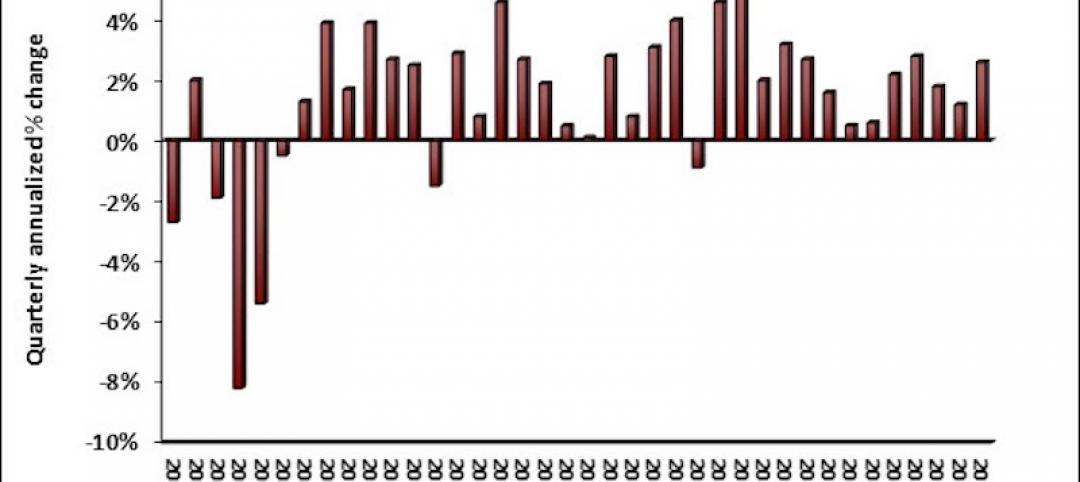

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

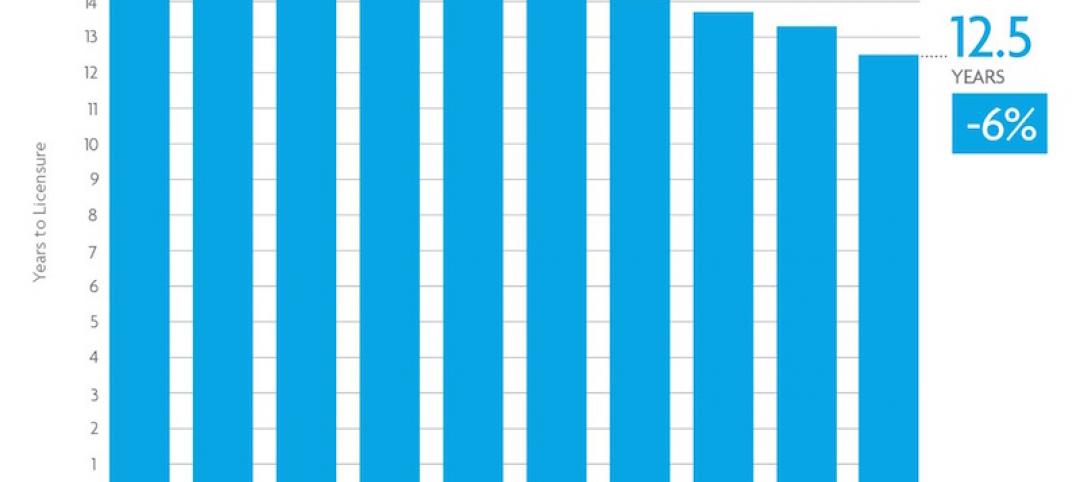

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

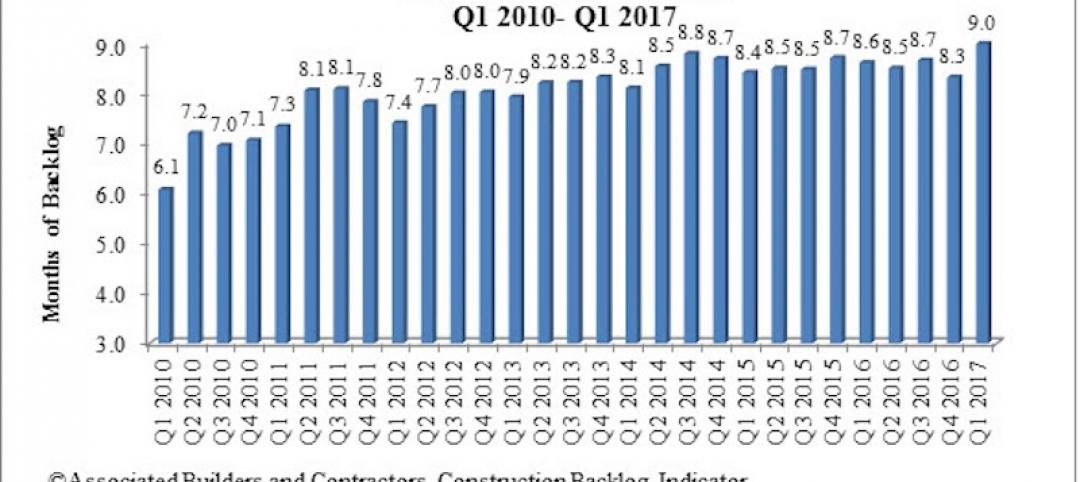

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.