According to a new report from Mid-America Real Estate Corp.’s Urban Team, much of Chicago lacks the type of product that today’s downsized big box retailers—or “mid-box”—are looking for.

“Retailers’ footprints are shrinking,” says Mid-America Principal Dan Tausk, author of the report. “From Wal-Mart to Best Buy to Office Depot, we continue to see a national trend toward shrinking square footage, which is expanding the vernacular from ‘super’ or ‘mega’ stores to include ‘market,’ ‘express’ and ‘neighborhood’ stores. If that trend continues—and I expect it to—then we’ve got a real lack of product to offer them in most of urban Chicago.”

Because of the national trend in retailer downsizing, Mid-America undertook its first “Urban Chicago Mid-Box Retail Study” this summer to create a better barometer of supply and demand in this sector. The team defined City limits and all directly neighboring suburbs into eight zones roughly following existing retail trade areas.

The team then examined existing and vacant space for stores between 15,000 and 50,000-sf, excluding proposed new development that hadn’t been delivered. To get a clearer picture of category activity, the team also excluded Chicago’s dense penetration of urban drugstores, typically 10,000 to 14,000-sf, but included the newer large format “market” drugstores that are between 25,000 and 30,000-sf. The study uncovered nearly 11.2 million square feet of existing supply in the mid-box category, or 389 total spaces. It also discovered a vacancy rate in this size category at 7%, with strong absorption of existing vacancy.

While it was not surprising to find that Central City (Zone 1)—with State Street, Michigan Avenue and Lincoln Park—carries 34% of the mid-box supply and only 8.6 % of the population, it was a surprise for Tausk to see that pockets of densely populated, high income submarkets such as Lincoln Square, River Forest, Streeterville, West Loop and Bucktown have virtually no mid-box retail supply in this size range. While Zone 5 (the Northeast City) holds the highest percentage of the population in the study, 20.4%, it holds only 9.5% of the mid-box supply.

“The average amount of mid-box retail in urban Chicago is 3.5 square feet/person,” says Tausk., “Zone 1 (Central City) shows 14.6 square feet/person while Zone 5 shows the lowest in Chicago of 1.2 square feet/person. That’s a wide disparity of haves and have-nots.”

He says the residential density in Zone 5 is obviously high enough to support more retail with residents. But he suggests that because the price of land here is high and land size is limited, retailers are pushed to accept multi-level buildings, which are lacking in this zone. “Right now, it’s difficult for them to expand here, despite the desirable demographics,” he says.

Overall, according to the report, five of the eight zones show that almost every category of mid-box retail is underserved for similar reasons -- from grocery and apparel to electronics and discount. The three zones that are doing best are Central City (Zone 1) with 14.6 square feet/person, Near Southwest Suburban (Zone 7) with 5.7 square feet/person, and Near West Suburban (Zone 8) with 4.4 square feet/person.

As was similarly indicated in Mid-America’s Urban Grocery Study last year, the West City (Zone 2) is the most underserved with only 16 mid-box retail stores or 4.11% of Chicago’s total supply. “In addition,” Tausk says, “the West Side has the least amount of category options. While each zone’s dominant category is grocery, that category averages only + 20% Citywide. In the West City, however, grocery accounts for 53% of the mid-box retail, showing a void of other shopping options.”

Other category highlights:

- Zone 1 (Central City) showed a dominating penetration of apparel versus all other zones combined. State Street and Michigan Avenue, and Lincoln Park carry the most supply. Zone 1 also dominates in the home furnishings category with 12 mid-box retail stores, as well as electronics with 9 and office supply with 6.

- Zone 2 (West City), as already noted above, is void of shopping options in most categories other than grocery. There is plenty of affordable, developable land, but lower incomes and high crime rates continue to stall development.

- Zone 5 (S/SE City) has a large number of grocers totaling 35% of all mid-box categories in that zone. Category sales clearly bleed from the south and southeast side to the Southwest City or Southwest suburbs, due to lack of options in other retail categories.

“In conclusion,” says Tausk. “There’s demand for mid-box growth in urban Chicago, despite a tough economy.” However, existing supply is tight everywhere and almost non-existent in the most attractive zones. He adds that there are three main considerations retailers will be forced to evaluate in the process.

- Retailers with expansion/rollouts for Chicago will need to continue to think creatively, finding opportunities in multi-levels, mezzanines or even smaller stores to meet future demand.

- Retailers can expect rents to remain high in the mid-size sector due to obvious lack of supply and low vacancy.

- Future opportunity in this mid-box size category may best come from downsizing / sublease space or the splitting of outdated larger footprints and future bankruptcies of other retailers.

Absorption in this size range is strong and happens quickly with greater than a half-million square feet of leasing currently proposed in existing space.

From the supply side, Tausk says that based on this supply/demand dynamic, “we can expect to see a slow but steady flow of new projects in this size range. Several developments are underway currently that are focused on the 15,000 to 50,000-sf user. Mid-box retailers such as Ross Dress for Less, Marshalls, Michaels, WalMart Market, hhGregg and Planet Fitness continue to pursue active expansion across Chicagoland.” +

Related Stories

Multifamily Housing | Jun 28, 2023

Sutton Tower, an 80-story multifamily development, completes construction in Manhattan’s Midtown East

In Manhattan’s Midtown East, the construction of Sutton Tower, an 80-story residential building, has been completed. Located in the Sutton Place neighborhood, the tower offers 120 for-sale residences, with the first move-ins scheduled for this summer. The project was designed by Thomas Juul-Hansen and developed by Gamma Real Estate and JVP Management. Lendlease, the general contractor, started construction in 2018.

Architects | Jun 27, 2023

Why architects need to think like developers, with JZA Architecture's Jeff Zbikowski

Jeff Zbikowski, Principal and Founder of Los Angeles-based JZA Architecture, discusses the benefits of having a developer’s mindset when working with clients, and why architecture firms lose out when they don’t have a thorough understanding of real estate regulations and challenges.

Apartments | Jun 27, 2023

Average U.S. apartment rent reached all-time high in May, at $1,716

Multifamily rents continued to increase through the first half of 2023, despite challenges for the sector and continuing economic uncertainty. But job growth has remained robust and new households keep forming, creating apartment demand and ongoing rent growth. The average U.S. apartment rent reached an all-time high of $1,716 in May.

Apartments | Jun 27, 2023

Dallas high-rise multifamily tower is first in state to receive WELL Gold certification

HALL Arts Residences, 28-story luxury residential high-rise in the Dallas Arts District, recently became the first high-rise multifamily tower in Texas to receive WELL Gold Certification, a designation issued by the International WELL Building Institute. The HKS-designed condominium tower was designed with numerous wellness details.

University Buildings | Jun 26, 2023

Addition by subtraction: The value of open space on higher education campuses

Creating a meaningful academic and student life experience on university and college campuses does not always mean adding a new building. A new or resurrected campus quad, recreational fields, gardens, and other greenspaces can tie a campus together, writes Sean Rosebrugh, AIA, LEED AP, HMC Architects' Higher Education Practice Leader.

Standards | Jun 26, 2023

New Wi-Fi standard boosts indoor navigation, tracking accuracy in buildings

The recently released Wi-Fi standard, IEEE 802.11az enables more refined and accurate indoor location capabilities. As technology manufacturers incorporate the new standard in various devices, it will enable buildings, including malls, arenas, and stadiums, to provide new wayfinding and tracking features.

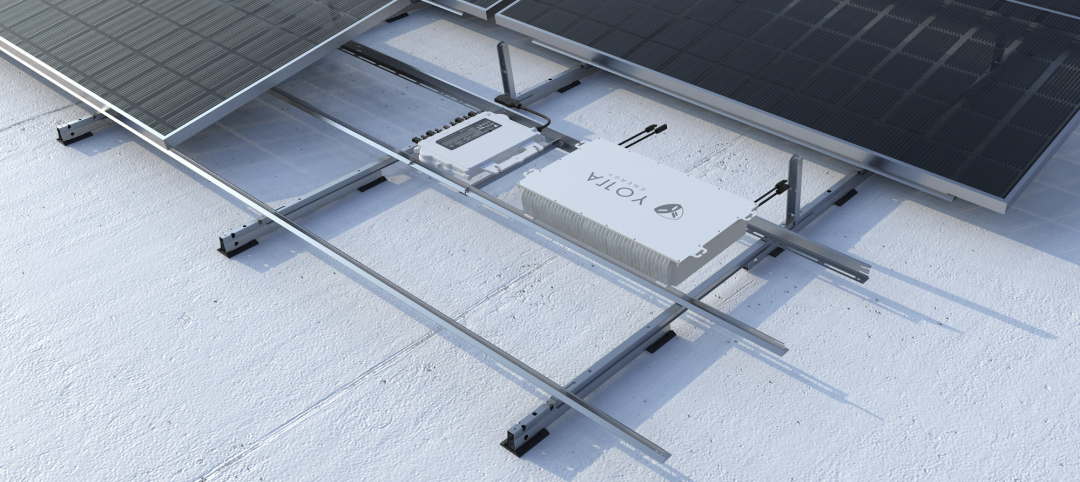

Green | Jun 26, 2023

Federal government will spend $30 million on novel green building technologies

The U.S. General Services Administration (GSA), and the U.S. Department of Energy (DOE) will invest $30 million from the Inflation Reduction Act to increase the sustainability of federal buildings by testing novel technologies. The vehicle for that effort, the Green Proving Ground (GPG) program, will invest in American-made technologies to help increase federal electric vehicle supply equipment, protect air quality, reduce climate pollution, and enhance building performance.

Office Buildings | Jun 26, 2023

Electric vehicle chargers are top priority for corporate office renters

Businesses that rent office space view electric vehicle (EV) charging stations as a top priority. More than 40% of companies in the Americas and EMEA (Europe, the Middle East and Africa) are looking to include EV charging stations in future leases, according to JLL’s 2023 Responsible Real Estate study.

Laboratories | Jun 23, 2023

A New Jersey development represents the state’s largest-ever investment in life sciences and medical education

In New Brunswick, N.J., a life sciences development that’s now underway aims to bring together academics and researchers to work, learn, and experiment under one roof. HELIX Health + Life Science Exchange is an innovation district under development on a four-acre downtown site. At $731 million, HELIX, which will be built in three phases, represents New Jersey’s largest-ever investment in life sciences and medical education, according to a press statement.

Sports and Recreational Facilities | Jun 22, 2023

NFL's Jacksonville Jaguars release conceptual designs for ‘stadium of the future’

Designed by HOK, the Stadium of the Future intends to meet the evolving needs of all stadium stakeholders—which include the Jaguars, the annual Florida-Georgia college football game, the TaxSlayer.com Gator Bowl, international sporting events, music festivals and tours, and the thousands of fans and guests who attend each event.