According to a new report from Mid-America Real Estate Corp.’s Urban Team, much of Chicago lacks the type of product that today’s downsized big box retailers—or “mid-box”—are looking for.

“Retailers’ footprints are shrinking,” says Mid-America Principal Dan Tausk, author of the report. “From Wal-Mart to Best Buy to Office Depot, we continue to see a national trend toward shrinking square footage, which is expanding the vernacular from ‘super’ or ‘mega’ stores to include ‘market,’ ‘express’ and ‘neighborhood’ stores. If that trend continues—and I expect it to—then we’ve got a real lack of product to offer them in most of urban Chicago.”

Because of the national trend in retailer downsizing, Mid-America undertook its first “Urban Chicago Mid-Box Retail Study” this summer to create a better barometer of supply and demand in this sector. The team defined City limits and all directly neighboring suburbs into eight zones roughly following existing retail trade areas.

The team then examined existing and vacant space for stores between 15,000 and 50,000-sf, excluding proposed new development that hadn’t been delivered. To get a clearer picture of category activity, the team also excluded Chicago’s dense penetration of urban drugstores, typically 10,000 to 14,000-sf, but included the newer large format “market” drugstores that are between 25,000 and 30,000-sf. The study uncovered nearly 11.2 million square feet of existing supply in the mid-box category, or 389 total spaces. It also discovered a vacancy rate in this size category at 7%, with strong absorption of existing vacancy.

While it was not surprising to find that Central City (Zone 1)—with State Street, Michigan Avenue and Lincoln Park—carries 34% of the mid-box supply and only 8.6 % of the population, it was a surprise for Tausk to see that pockets of densely populated, high income submarkets such as Lincoln Square, River Forest, Streeterville, West Loop and Bucktown have virtually no mid-box retail supply in this size range. While Zone 5 (the Northeast City) holds the highest percentage of the population in the study, 20.4%, it holds only 9.5% of the mid-box supply.

“The average amount of mid-box retail in urban Chicago is 3.5 square feet/person,” says Tausk., “Zone 1 (Central City) shows 14.6 square feet/person while Zone 5 shows the lowest in Chicago of 1.2 square feet/person. That’s a wide disparity of haves and have-nots.”

He says the residential density in Zone 5 is obviously high enough to support more retail with residents. But he suggests that because the price of land here is high and land size is limited, retailers are pushed to accept multi-level buildings, which are lacking in this zone. “Right now, it’s difficult for them to expand here, despite the desirable demographics,” he says.

Overall, according to the report, five of the eight zones show that almost every category of mid-box retail is underserved for similar reasons -- from grocery and apparel to electronics and discount. The three zones that are doing best are Central City (Zone 1) with 14.6 square feet/person, Near Southwest Suburban (Zone 7) with 5.7 square feet/person, and Near West Suburban (Zone 8) with 4.4 square feet/person.

As was similarly indicated in Mid-America’s Urban Grocery Study last year, the West City (Zone 2) is the most underserved with only 16 mid-box retail stores or 4.11% of Chicago’s total supply. “In addition,” Tausk says, “the West Side has the least amount of category options. While each zone’s dominant category is grocery, that category averages only + 20% Citywide. In the West City, however, grocery accounts for 53% of the mid-box retail, showing a void of other shopping options.”

Other category highlights:

- Zone 1 (Central City) showed a dominating penetration of apparel versus all other zones combined. State Street and Michigan Avenue, and Lincoln Park carry the most supply. Zone 1 also dominates in the home furnishings category with 12 mid-box retail stores, as well as electronics with 9 and office supply with 6.

- Zone 2 (West City), as already noted above, is void of shopping options in most categories other than grocery. There is plenty of affordable, developable land, but lower incomes and high crime rates continue to stall development.

- Zone 5 (S/SE City) has a large number of grocers totaling 35% of all mid-box categories in that zone. Category sales clearly bleed from the south and southeast side to the Southwest City or Southwest suburbs, due to lack of options in other retail categories.

“In conclusion,” says Tausk. “There’s demand for mid-box growth in urban Chicago, despite a tough economy.” However, existing supply is tight everywhere and almost non-existent in the most attractive zones. He adds that there are three main considerations retailers will be forced to evaluate in the process.

- Retailers with expansion/rollouts for Chicago will need to continue to think creatively, finding opportunities in multi-levels, mezzanines or even smaller stores to meet future demand.

- Retailers can expect rents to remain high in the mid-size sector due to obvious lack of supply and low vacancy.

- Future opportunity in this mid-box size category may best come from downsizing / sublease space or the splitting of outdated larger footprints and future bankruptcies of other retailers.

Absorption in this size range is strong and happens quickly with greater than a half-million square feet of leasing currently proposed in existing space.

From the supply side, Tausk says that based on this supply/demand dynamic, “we can expect to see a slow but steady flow of new projects in this size range. Several developments are underway currently that are focused on the 15,000 to 50,000-sf user. Mid-box retailers such as Ross Dress for Less, Marshalls, Michaels, WalMart Market, hhGregg and Planet Fitness continue to pursue active expansion across Chicagoland.” +

Related Stories

Windows and Doors | Mar 5, 2023

2022 North American Fenestration Standard released

The 2022 edition of AAMA/WDMA/CSA 101/I.S.2/A440, “North American Fenestration Standard/Specification for windows, doors, and skylights” (NAFS) has been published. The updated 2022 standard replaces the 2017 edition, part of a continued evolution of the standard to improve harmonization across North America, according to a news release.

AEC Innovators | Mar 3, 2023

Meet BD+C's 2023 AEC Innovators

More than ever, AEC firms and their suppliers are wedding innovation with corporate responsibility. How they are addressing climate change usually gets the headlines. But as the following articles in our AEC Innovators package chronicle, companies are attempting to make an impact as well on the integrity of their supply chains, the reduction of construction waste, and answering calls for more affordable housing and homeless shelters. As often as not, these companies are partnering with municipalities and nonprofit interest groups to help guide their production.

Modular Building | Mar 3, 2023

Pallet Shelter is fighting homelessness, one person and modular pod at a time

Everett, Wash.-based Pallet Inc. helped the City of Burlington, Vt., turn a municipal parking lot into an emergency shelter community, complete with 30 modular “sleeping cabins” for the homeless.

Codes | Mar 2, 2023

Biden Administration’s proposed building materials rules increase domestic requirements

The Biden Administration’s proposal on building materials rules used on federal construction and federally funded state and local buildings would significantly boost the made-in-America mandate. In the past, products could qualify as domestically made if at least 55% of the value of their components were from the U.S.

Industry Research | Mar 2, 2023

Watch: Findings from Gensler's latest workplace survey of 2,000 office workers

Gensler's Janet Pogue McLaurin discusses the findings in the firm's 2022 Workplace Survey, based on responses from more than 2,000 workers in 10 industry sectors.

AEC Innovators | Mar 2, 2023

Turner Construction extends its ESG commitment to thwarting forced labor in its supply chain

Turner Construction joins a growing AEC industry movement, inspired by the Design for Freedom initiative, to eliminate forced labor and child labor from the production and distribution of building products.

Multifamily Housing | Mar 1, 2023

Multifamily construction startup Cassette takes a different approach to modular building

Prefabricated modular design and construction have made notable inroads into such sectors as industrial, residential, hospitality and, more recently, office and healthcare. But Dafna Kaplan thinks that what’s held back the modular building industry from even greater market penetration has been suppliers’ insistence that they do everything: design, manufacture, logistics, land prep, assembly, even onsite construction. Kaplan is CEO and Founder of Cassette, a Los Angeles-based modular building startup.

Airports | Feb 28, 2023

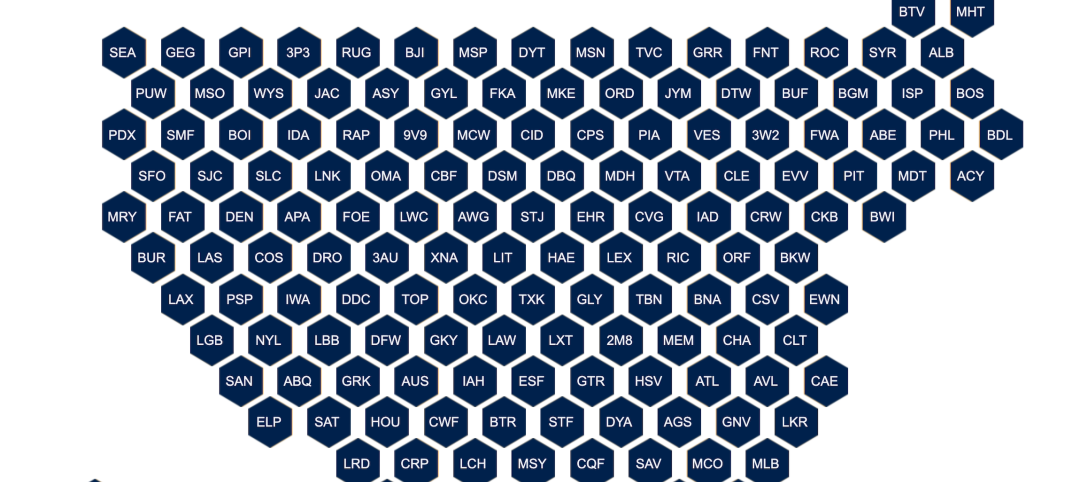

Data visualization: $1 billion earmarked for 2023 airport construction projects

Ninety-nine airports across 47 states and two territories are set to share nearly $1 billion in funding in 2023 from the Federal Aviation Administration. The funding is aimed at help airports of all sizes meet growing air travel demand, with upgrades like larger security checkpoints and more reliable and faster baggage systems.

Seismic Design | Feb 27, 2023

Turkey earthquakes provide lessons for California

Two recent deadly earthquakes in Turkey and Syria offer lessons regarding construction practices and codes for California. Lax building standards were blamed for much of the devastation, including well over 35,000 dead and countless building collapses.

Sports and Recreational Facilities | Feb 27, 2023

New 20,000-seat soccer stadium will anchor neighborhood development in Indianapolis

A new 20,000-seat soccer stadium for United Soccer League’s Indy Eleven will be the centerpiece of a major neighborhood development in Indianapolis. The development will transform the southwest quadrant of downtown Indianapolis by adding more than 600 apartments, 205,000 sf of office space, 197,000 sf for retail space and restaurants, parking garages, a hotel, and public plazas with green space.