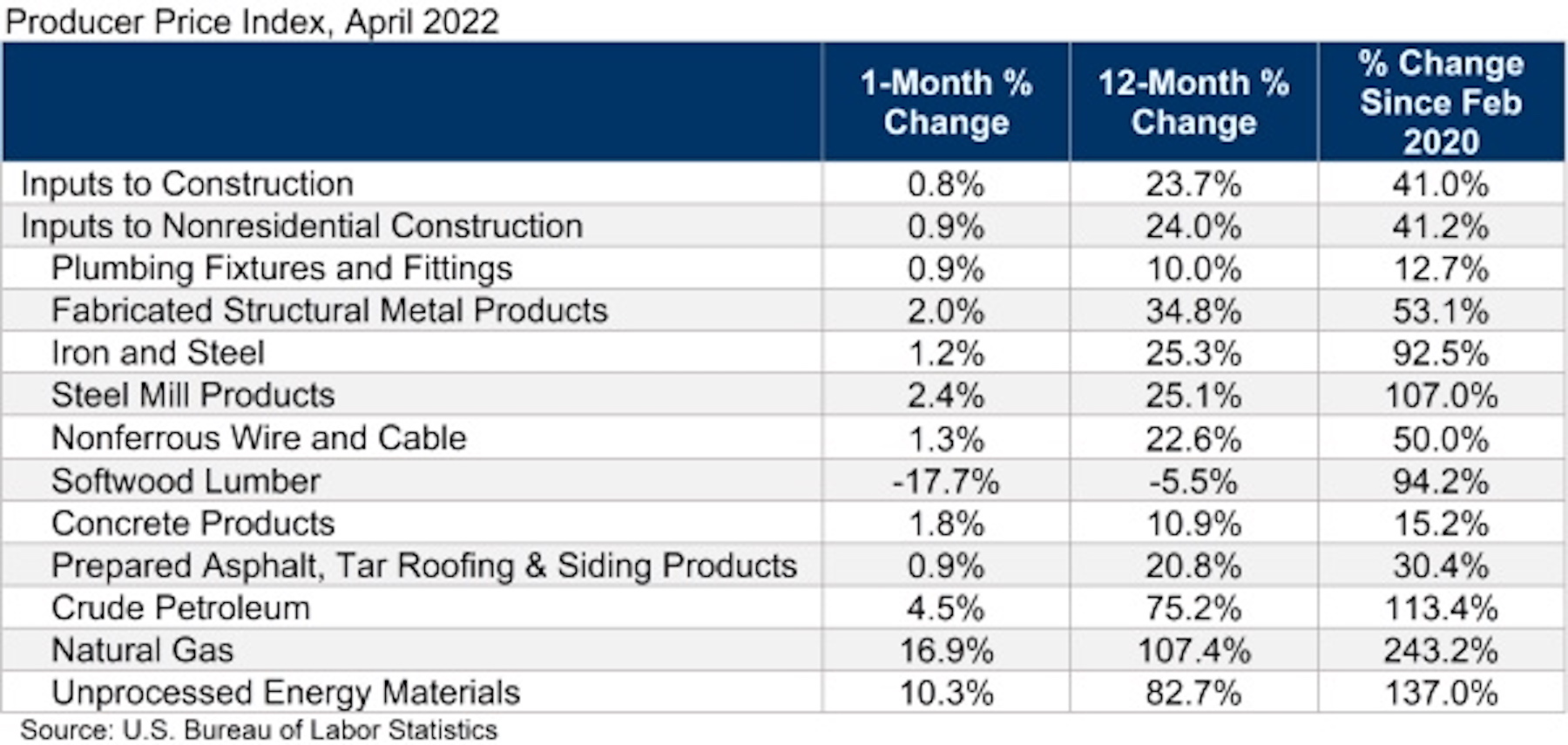

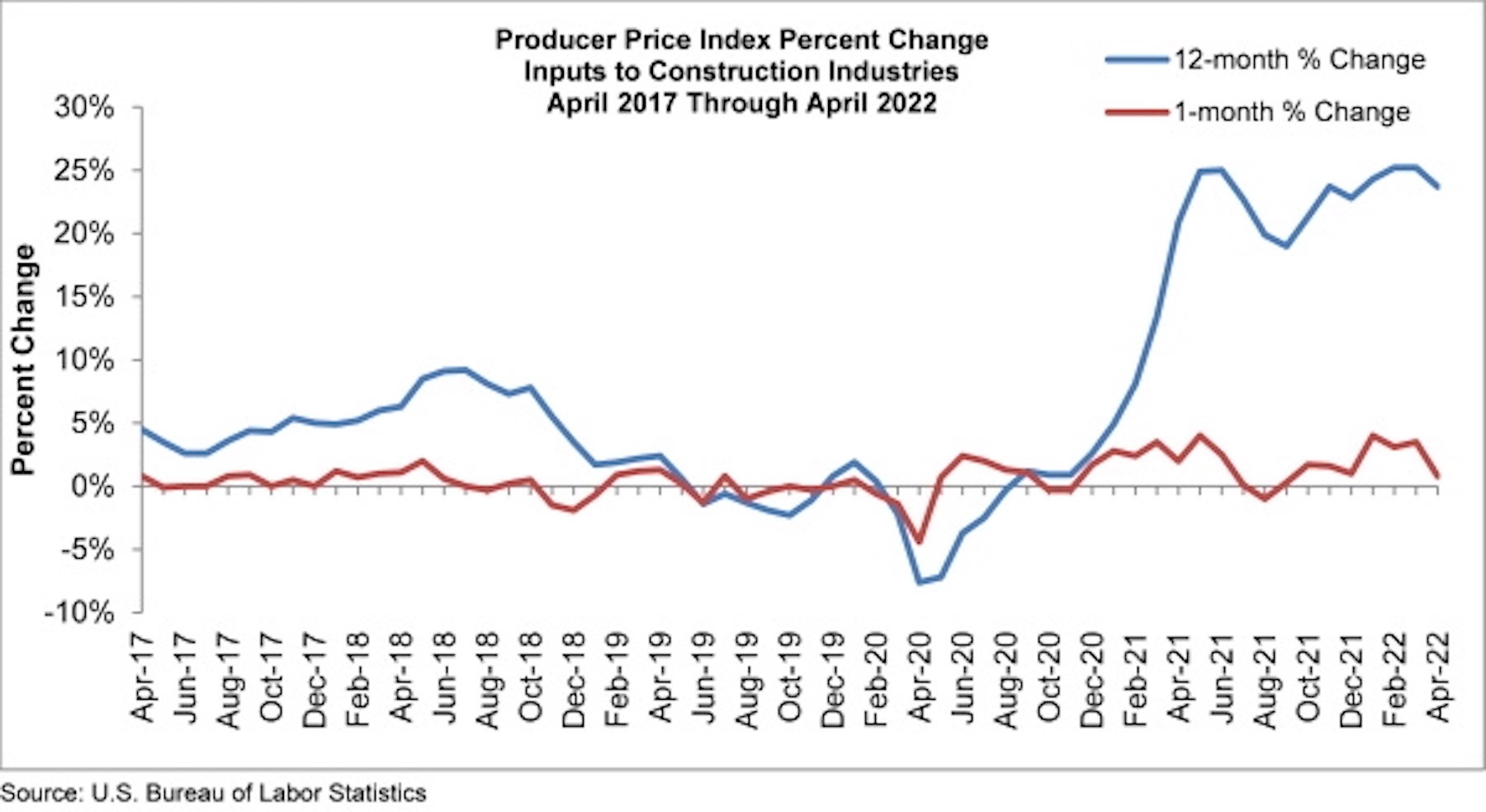

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 0.9% for the month.

Construction input prices are up 23.7% from a year ago, while nonresidential construction input prices are 24.0% higher. Input prices were up in 10 of 11 subcategories in April. Softwood lumber was the only category in which prices decreased, falling 17.7% for the month. The largest price increases were in natural gas (+16.9%) and unprocessed energy materials (+10.3%).

“There are some economists who believe that inflation has peaked,” said ABC Chief Economist Anirban Basu. “Even if that were true, stakeholders should not expect dramatic declines in inflation in the near term given an array of factors placing upward pressure on prices: the Russia-Ukraine war, COVID-19, a shrunken labor force, elevated transportation costs and abundant demand for goods. Today’s PPI release indicates that producers continue to ask for and receive elevated prices for their limited production. These high input prices will continue to circulate through the economy as production continues, whether in the form of manufactured goods, buildings or infrastructure.

“According to ABC’s Construction Confidence Index, many contractors report that demand for their services remains sufficiently robust for them to pass along the bulk of their cost increases to project owners,” said Basu. “But at some point, the economy could weaken to the point that purchasers of construction services become less willing to pay elevated prices.

“The Federal Reserve is now in the middle of what will likely prove a lengthy monetary tightening process, and higher borrowing costs are rendering project starts less likely, all things being equal. That said, certain segments are likely to power through this dynamic, should it happen. That includes public construction, given the recent passage and ongoing implementation of a large-scale American infrastructure package. It should be noted that recent inflation has reduced the return taxpayers will get per dollar spent on infrastructure.”

Related Stories

Multifamily Housing | Oct 30, 2020

The Weekly show: Multifamily security tips, the state of construction industry research, and AGC's market update

BD+C editors speak with experts from AGC, Charles Pankow Foundation, and Silva Consultants on the October 29 episode of "The Weekly." The episode is available for viewing on demand.

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

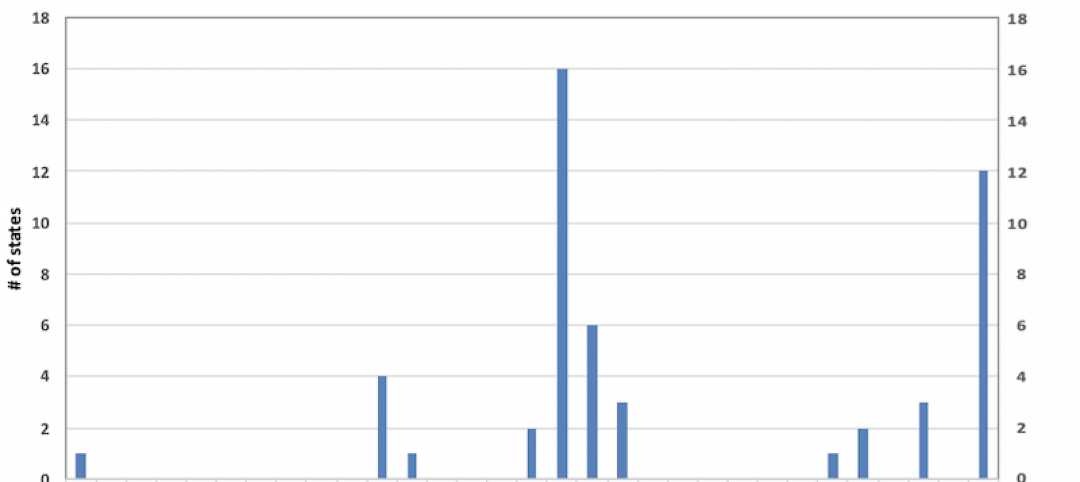

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.