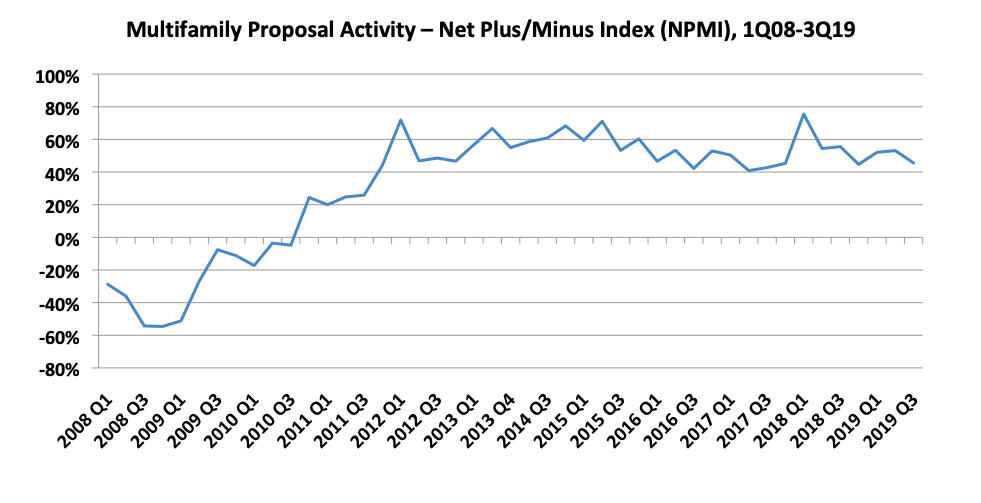

Multifamily housing will remain a robust market for A/E/C companies heading into 2020, according to the most recent results of PSMJ’s Quarterly Market Forecast (QMF) survey. For the third quarter of 2019, the survey found that less than 9% of the nearly 100 respondents doing multifamily work reported a decrease in proposal activity compared with the prior quarter, while more than 54% saw an increase.

The Multifamily market’s third quarter Net Plus/Minus Index (NPMI) of 46% marked the 31st consecutive quarter that the submarket exceeded an NPMI of 40%. The last time it was below that level was the third quarter of 2011.

PSMJ’s NPMI measures the difference between the percentage of firms reporting an increase in proposal activity and those reporting a decrease, quarter over quarter. PSMJ has been using the QMF as a predictor of the A/E/C industry’s health since 2003, tracking 12 major markets and 58 submarkets every three months. The company chose proposal activity to gauge the industry’s long-term outlook because it is among the earliest stages of the project lifecycle. Approximately 200 firms participate in the survey each quarter.

The Senior and Assisted Living submarket also performed well with a third-quarter NPMI of 49%. Only 4 of the 86 responding firms working in the senior care submarket reported declining proposal activity. The Senior/Assisted Living market has also been a consistently stellar performer in the QMF. Its NPMI hasn’t dipped below 50% since the fourth quarter of 2012.

“Multifamily and Senior/Assisted Living have been two of the hottest markets for proposal activity for quite some time, not only among the Housing submarkets, but throughout all 58 submarkets,” says PSMJ’s Greg Hart, a consultant who also oversees the QMF. “It is remarkable that both have seen such steady proposal growth for so long. Very few submarkets have been this consistently strong throughout the 16-year history of our survey.”

Housing (all submarkets) recorded an NPMI of 40% in the third quarter, a potentially noteworthy drop from the 59% recorded in the second quarter. After ranking the second-highest of the 12 major markets measured in the second quarter, Housing fell completely out of the top five in the third quarter. Transportation (49%) and Healthcare (46%) were tops among major markets.

Among the other Housing submarkets, Condominiums recorded a respectable NPMI of 24%, its sixth consecutive quarter in the mid-20% range. Individual single-family homes (15%) and subdivisions (8%) trailed the Housing field in the third quarter, falling markedly from 25% and 23%, respectively, in the second quarter. PSMJ Director and Senior Consultant Dave Burstein, PE, notes that the results are still positive, if potentially troubling in the longer term. He adds that lower mortgage interest rates on the horizon are likely to spur a rebound in the single-family and subdivision subsectors.

PSMJ Resources, Inc., based in Newton, Massachusetts, is a publishing, executive education, and advisory company dedicated to serving architecture, engineering and construction (A/E/C) organizations worldwide.

Related Stories

Multifamily Housing | Dec 20, 2022

Brooks + Scarpa-designed apartment provides affordable housing to young people aging out of support facilities

In Venice, Calif., the recently completed Rose Apartments provides affordable housing to young people who age out of youth facilities and often end up living on the street. Designed by Brooks + Scarpa, the four-story, 35-unit mixed-use apartment building will house transitional aged youths.

Coatings | Dec 20, 2022

The Pier Condominiums — What's old is new again!

When word was out that the condominium association was planning to carry out a refresh of the Pier Condominiums on Fort Norfolk, Hanbury jumped at the chance to remake what had become a tired, faded project.

Cladding and Facade Systems | Dec 20, 2022

Acoustic design considerations at the building envelope

Acentech's Ben Markham identifies the primary concerns with acoustic performance at the building envelope and offers proven solutions for mitigating acoustic issues.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Sponsored | Resiliency | Dec 14, 2022

Flood protection: What building owners need to know to protect their properties

This course from Walter P Moore examines numerous flood protection approaches and building owner needs before delving into the flood protection process. Determining the flood resilience of a property can provide a good understanding of risk associated costs.

Sponsored | Multifamily Housing | Dec 14, 2022

Urban housing revival: 3 creative multifamily housing renovations

This continuing education course from Bruner/Cott & Associates highlights three compelling projects that involve reimagining unlikely buildings for compelling multifamily housing developments.

Multifamily Housing | Dec 13, 2022

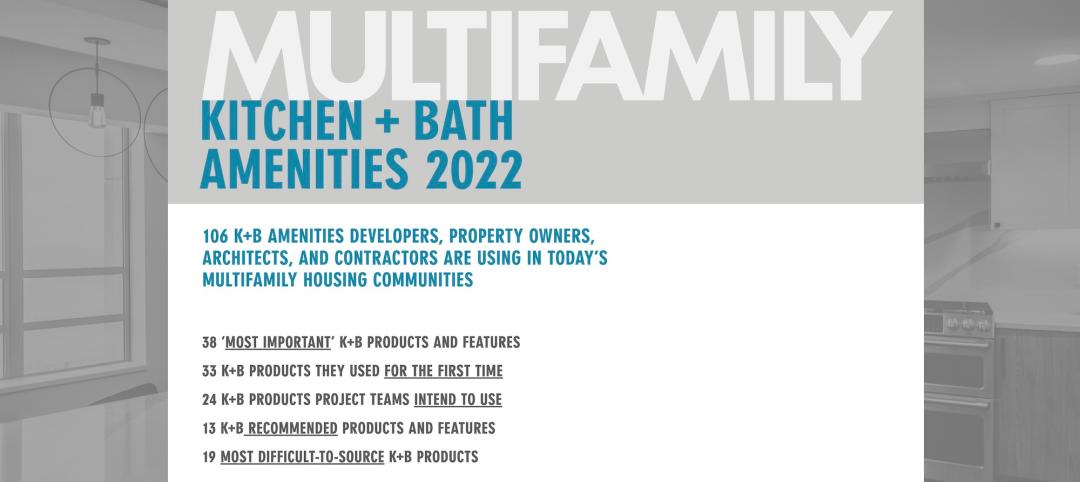

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Mixed-Use | Dec 7, 2022

Bjarke Ingels’ first design project in South America is poised to open next year in Ecuador

In 2013, Quito, Ecuador’s capital, opened its new airport, which had been relocated from the metro’s center to an agricultural site 12 miles northeast of the city. Since then, Quito’s skyline has been reshaped by new, vertical structures that include the 24-story mixed-use EPIQ Residences, designed in the shape of a quarter circle by Bjarke Ingels Group (BIG).

High-rise Construction | Dec 7, 2022

SOM reveals its design for Singapore’s tallest skyscraper

Skidmore, Owings & Merrill (SOM) has revealed its design for 8 Shenton Way—a mixed-use tower that will stand 63 stories and 305 meters (1,000 feet) high, becoming Singapore’s tallest skyscraper. The design team also plans to make the building one of Asia’s most sustainable skyscrapers. The tower incorporates post-pandemic design features.

Multifamily Housing | Dec 7, 2022

Canada’s largest net-zero carbon residential community to include affordable units

The newly unveiled design for Canada’s largest net-zero carbon residential community includes two towers that will create a new destination within Ottawa and form a striking gateway into LeBreton Flats. The development will be transit-oriented, mixed-income, mixed-use, and include unprecedented sustainability targets. Dream LeBreton is a partnership between real estate companies Dream Asset Management, Dream Impact, and local non-profit MultiFaith Housing Initiative.